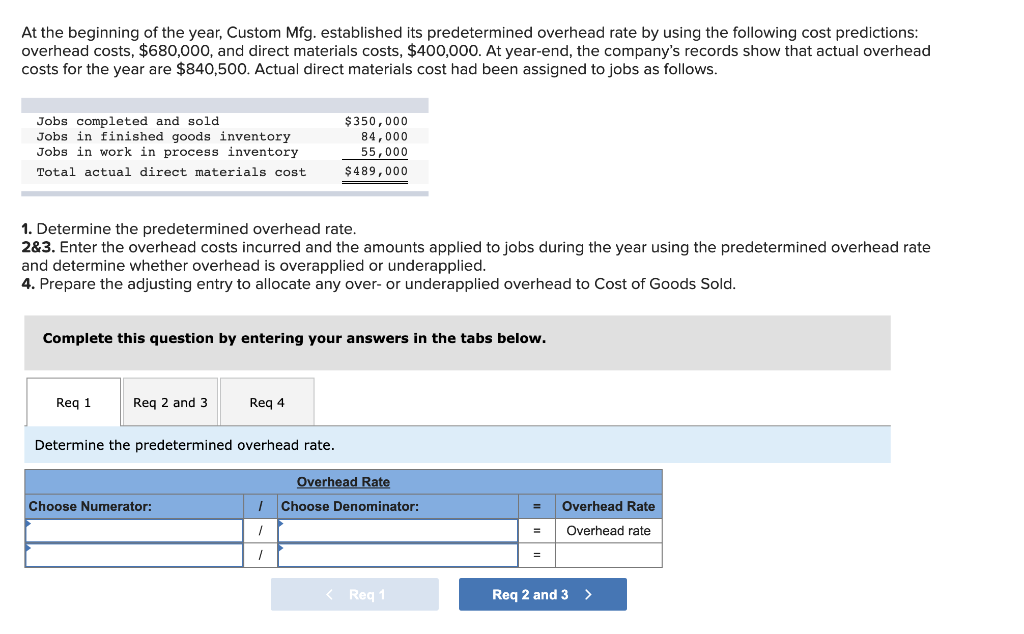

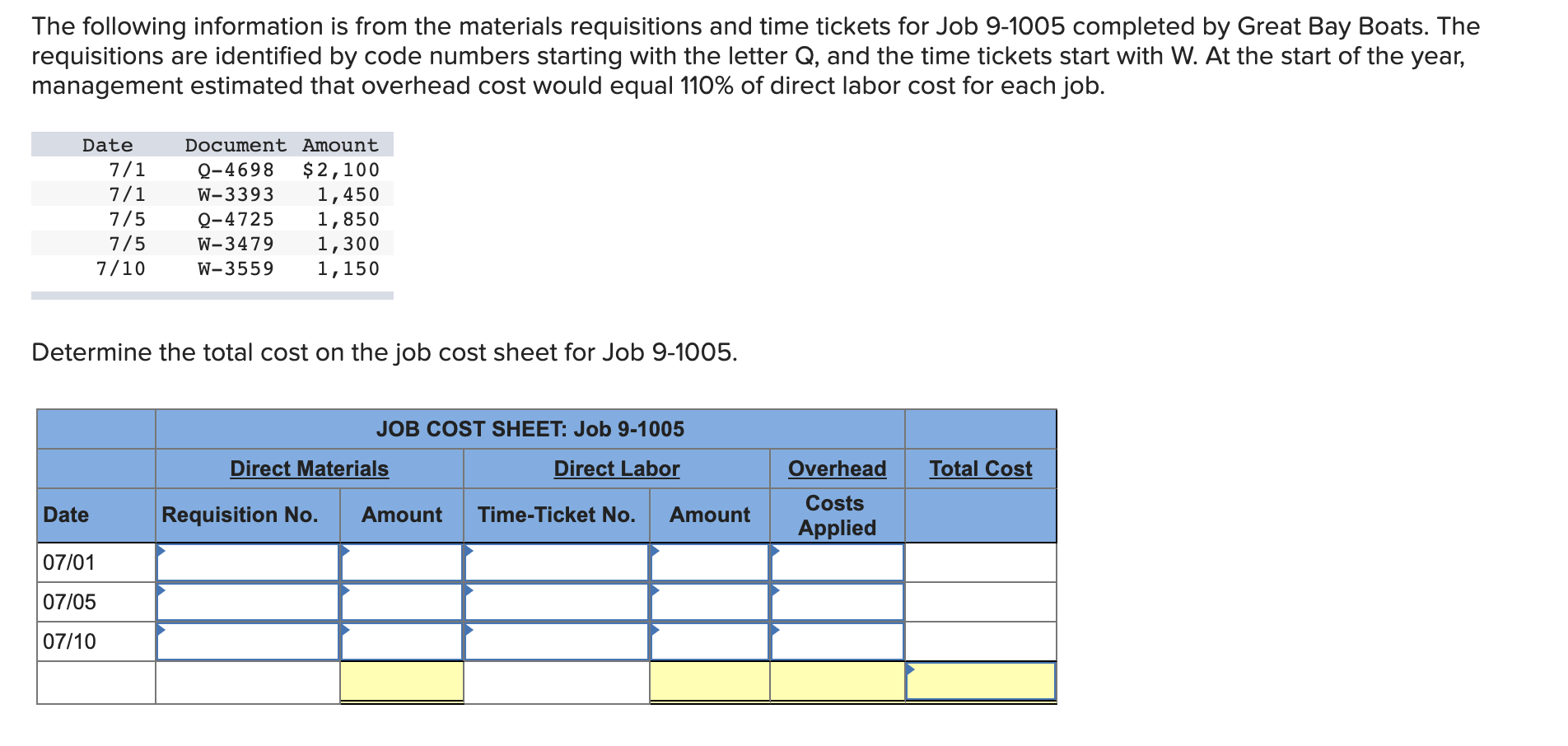

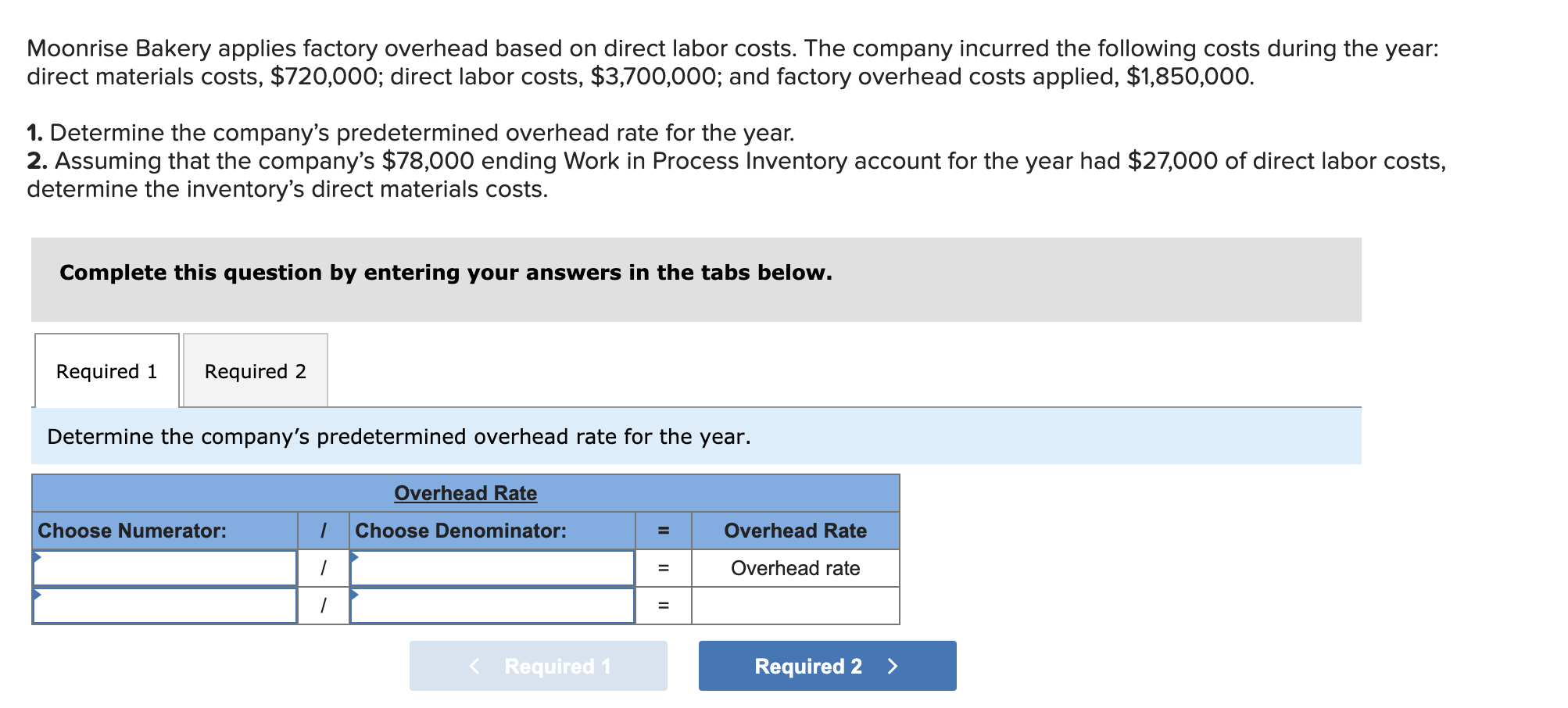

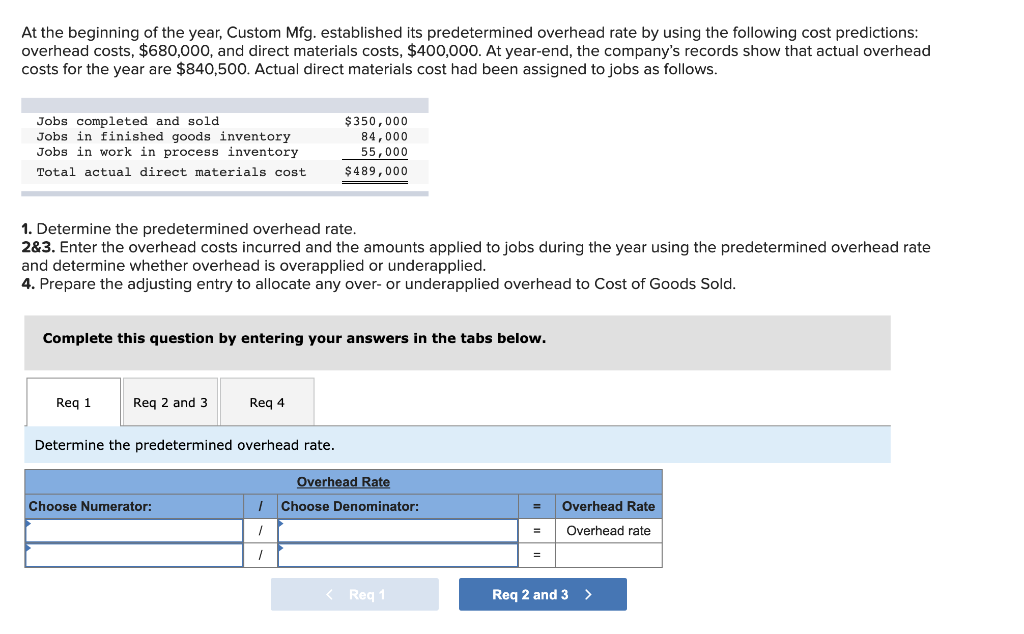

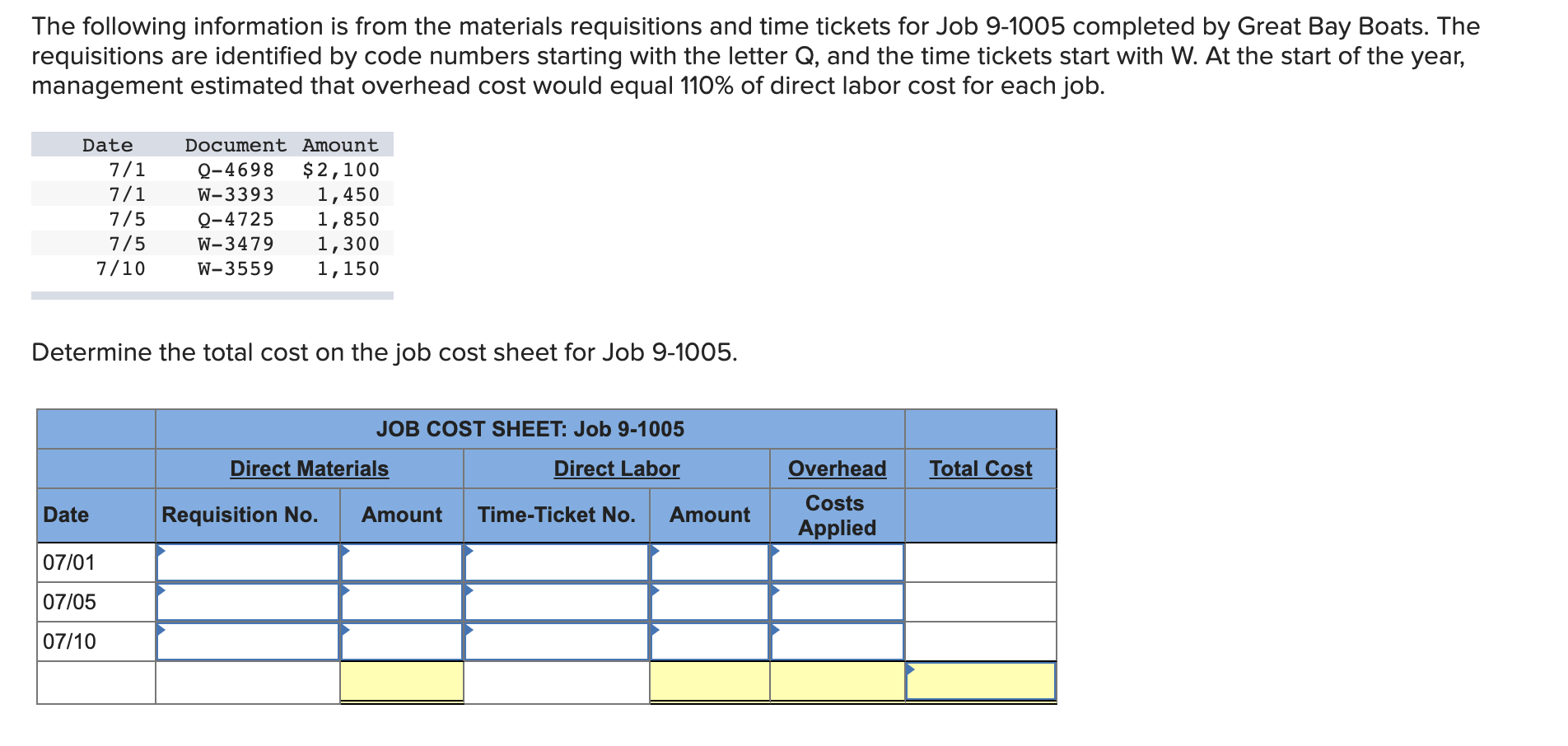

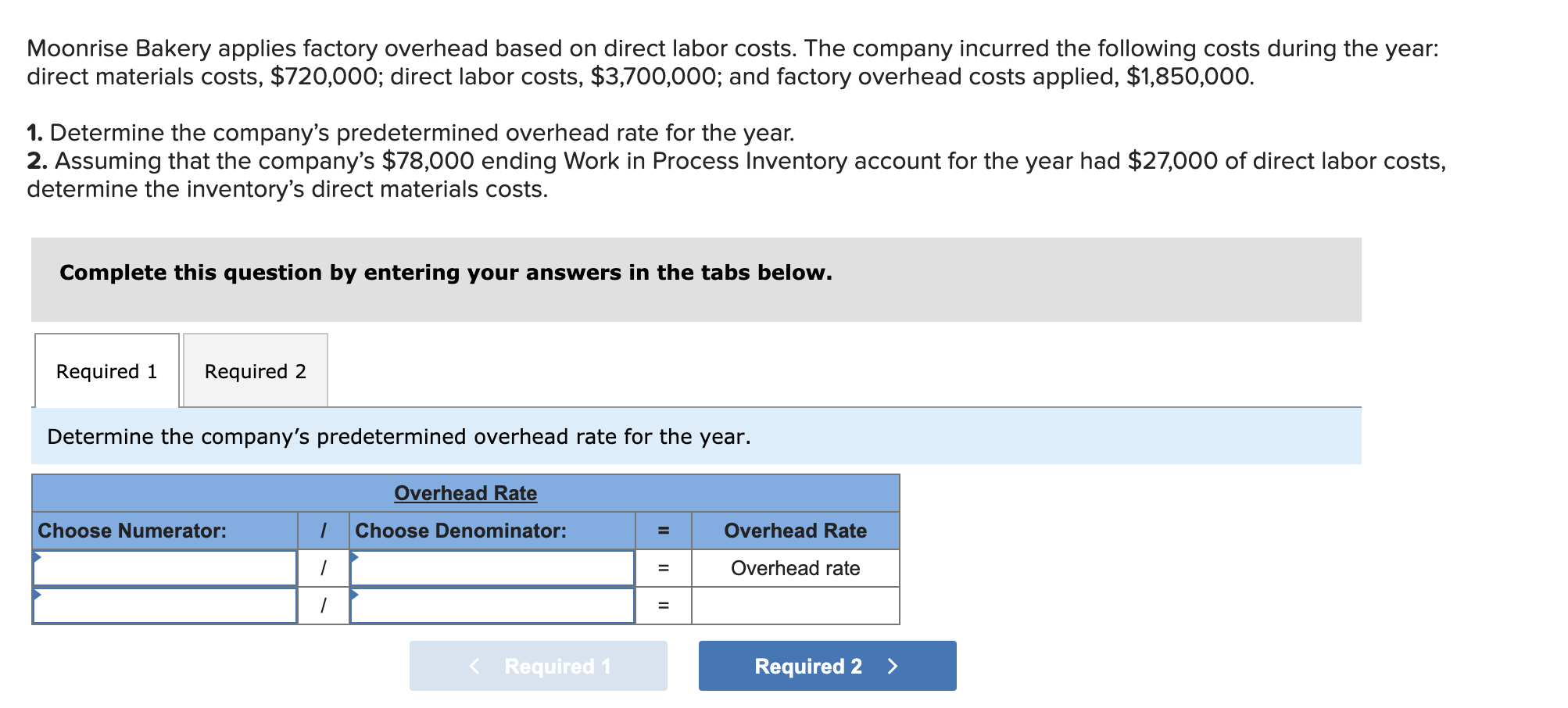

At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions: overhead costs, $680,000, and direct materials costs, $400,000. At year-end, the company's records show that actual overhead costs for the year are $840,500. Actual direct materials cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost $350,000 84,000 55,000 $ 489,000 1. Determine the predetermined overhead rate. 2&3. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Req 4 Determine the predetermined overhead rate. Overhead Rate Choose Denominator: Choose Numerator: 1 = Overhead Rate / = Overhead rate / Req 1 Req 2 and 3 > The following information is from the materials requisitions and time tickets for Job 9-1005 completed by Great Bay Boats. The requisitions are identified by code numbers starting with the letter Q, and the time tickets start with W. At the start of the year, management estimated that overhead cost would equal 110% of direct labor cost for each job. Date 7/1 7/1 7/5 7/5 7/10 Document Amount Q-4698 $2,100 W-3393 1,450 Q-4725 1,850 W-3479 1,300 W-3559 1,150 Determine the total cost on the job cost sheet for Job 9-1005. JOB COST SHEET: Job 9-1005 Direct Materials Direct Labor Overhead Total Cost Date Requisition No. Amount Time-Ticket No. Amount Costs Applied 07/01 07/05 07/10 Moonrise Bakery applies factory overhead based on direct labor costs. The company incurred the following costs during the year: direct materials costs, $720,000; direct labor costs, $3,700,000; and factory overhead costs applied, $1,850,000. 1. Determine the company's predetermined overhead rate for the year. 2. Assuming that the company's $78,000 ending Work in Process Inventory account for the year had $27,000 of direct labor costs, determine the inventory's direct materials costs. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the company's predetermined overhead rate for the year. Overhead Rate Choose Numerator: 1 Choose Denominator: Overhead Rate / II Overhead rate / II Required 1 Required 2 >