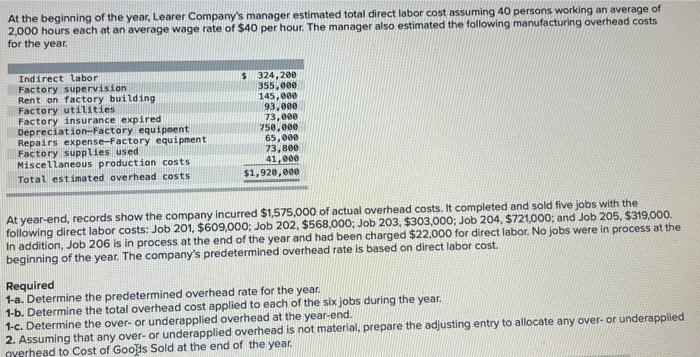

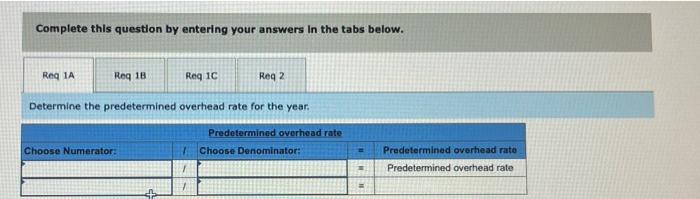

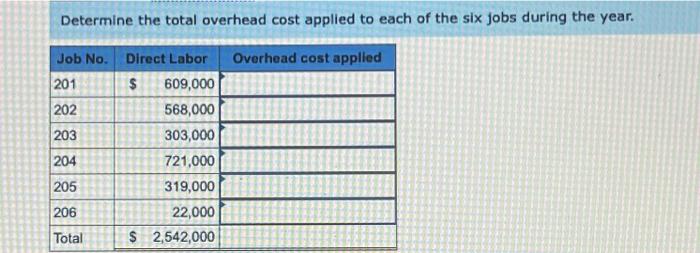

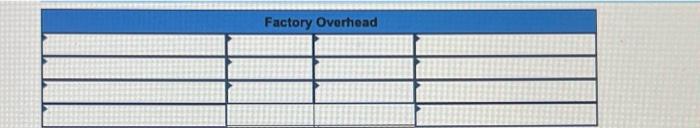

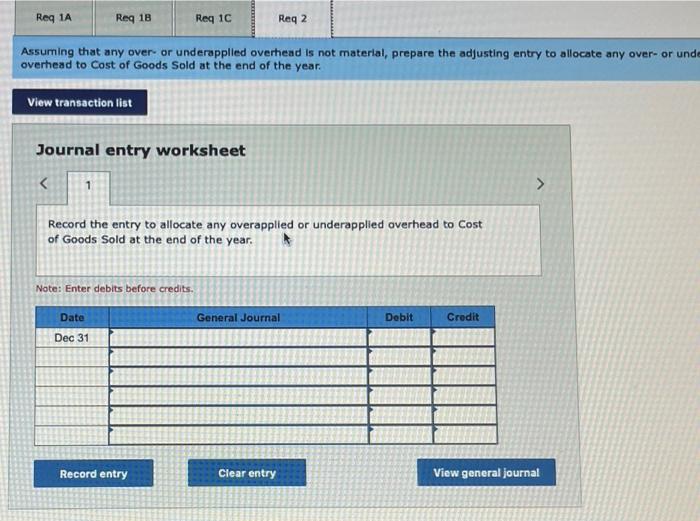

At the beginning of the year, Learer Company's manager estimated total direct labor cost assuming 40 persons working an average of 2,000 hours each at an average wage rate of $40 per hour. The manager also estimated the following manufacturing overhead costs for the year Indirect labor Factory supervision Rent on factory building Factory utilities Factory insurance expired Depreciation-Factory equipment Repairs expense-Factory equipment Factory supplies used Miscellaneous production costs Total estimated overhead costs $ 324,200 355,000 145,000 93,00 73,000 750,000 65,000 73,800 41,000 $1,920,000 At year-end, records show the company incurred $1,575,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $609,000: Job 202, $568,000, Job 203. $303,000; Job 204. $721,000; and Job 205, $319,000. In addition, Job 206 is in process at the end of the year and had been charged $22,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the total overhead cost applied to each of the six jobs during the year. 1-c. Determine the over- or underapplied overhead at the year-end. 2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied gyerhead to Cost of Goods Sold at the end of the year. Complete this question by entering your answers in the tabs below. Req 1A Reg 18 Req 1C Reg 2 Determine the predetermined overhead rate for the year. Predetermined overhead rate 1 Choose Denominator: Choose Numerator: Predetermined overhead rate Predetermined overhead rate Determine the total overhead cost applied to each of the six jobs during the year. Overhead cost applied Job No. Direct Labor 201 $ 609,000 202 568,000 203 303,000 204 721,000 205 319,000 206 22,000 $ 2,542,000 Total Factory Overhead Reg 1A Reg 18 Reg 1C Req2 Assuming that any over or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or unde overhead to Cost of Goods Sold at the end of the year. View transaction list Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal