Answered step by step

Verified Expert Solution

Question

1 Approved Answer

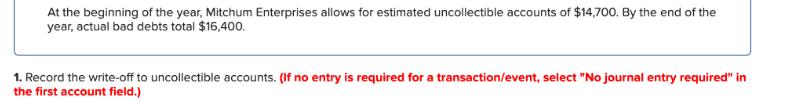

At the beginning of the year, Mitchum Enterprises allows for estimated uncollectible accounts of $14,700. By the end of the year, actual bad debts

![Required information [The following information applies to the questions displayed below.] At the beginning of the year, Mitc](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/05/6280ffce47584_1652621259200.png)

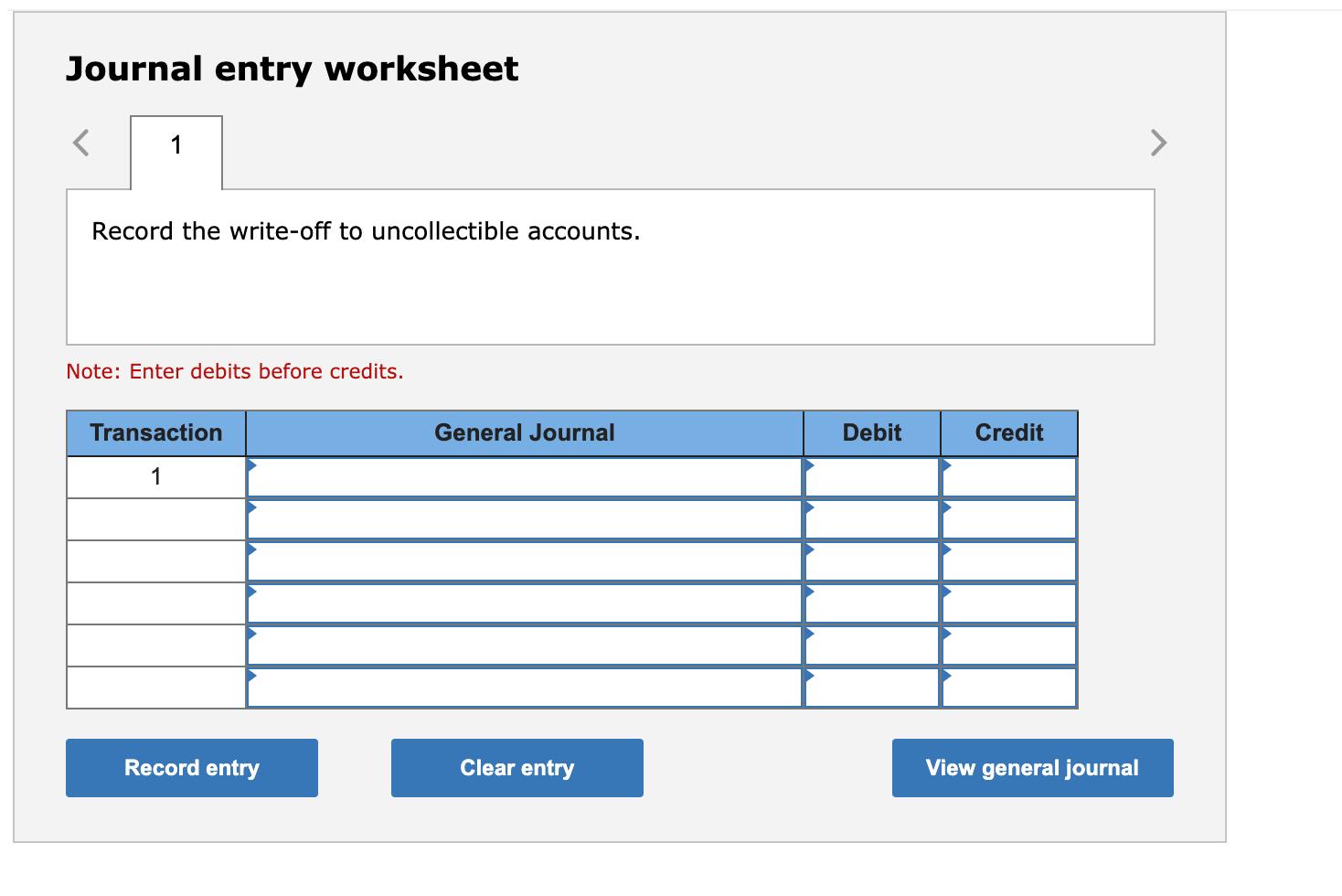

At the beginning of the year, Mitchum Enterprises allows for estimated uncollectible accounts of $14,700. By the end of the year, actual bad debts total $16,400. 1. Record the write-off to uncollectible accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 > Record the write-off to uncollectible accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal Required information (The following information applies to the questions displayed below.] At the beginning of the year, Mitchum Enterprises allows for estimated uncollectible accounts of $14,700. By the end of the year, actual bad debts total $16,400. 2. Following the write-off, what is the balance of Allowance for Uncollectible Accounts? (Enter the amount as a positive value.) Allowance for uncollectible accounts

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

General journal Debit Credit 1 Allowance for u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started