Answered step by step

Verified Expert Solution

Question

1 Approved Answer

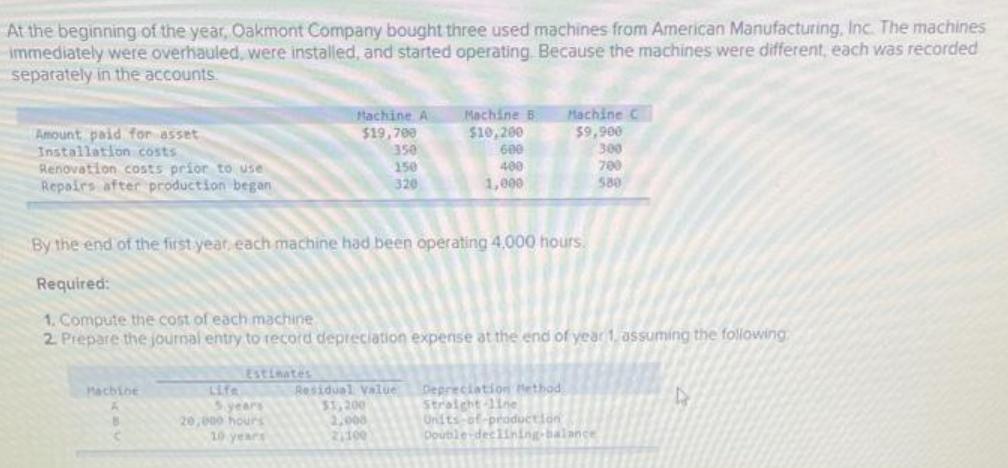

At the beginning of the year, Oakmont Company bought three used machines from American Manufacturing, Inc. The machines immediately were overhauled, were installed, and

At the beginning of the year, Oakmont Company bought three used machines from American Manufacturing, Inc. The machines immediately were overhauled, were installed, and started operating Because the machines were different, each was recorded separately in the accounts. Machine B Machine Machine A $19,700 $9,900 Amount paid for asset Installation costs $10,200 600 350 300 Renovation costs prior to use 150 400 700 Repairs after production began 320 1,000 580 By the end of the first year each machine had been operating 4.000 hours. Required: 1. Compute the cost of each machine 2. Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following Estimates Machine Residual value Life 5 years 20,000 hours Depreciation Method Straight-line 4 $1,200 B 2,000 Onits of production Double-declining-balance 10 years 2,100

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 The cost of each machine is calculated below Machine A Machine B Mac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started