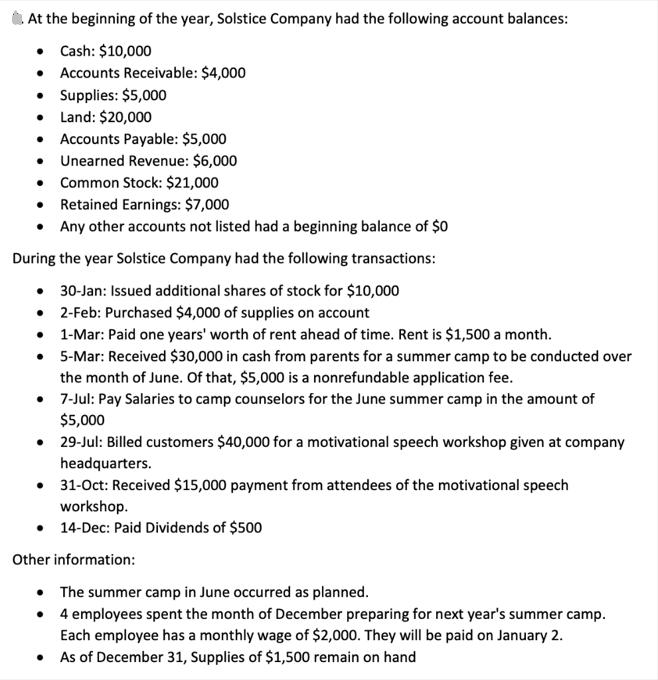

At the beginning of the year, Solstice Company had the following account balances: Cash: $10,000 Accounts Receivable: $4,000 Supplies: $5,000 Land: $20,000 Accounts Payable:

At the beginning of the year, Solstice Company had the following account balances: Cash: $10,000 Accounts Receivable: $4,000 Supplies: $5,000 Land: $20,000 Accounts Payable: $5,000 . Unearned Revenue: $6,000 Common Stock: $21,000 Retained Earnings: $7,000 Any other accounts not listed had a beginning balance of $0 During the year Solstice Company had the following transactions: 30-Jan: Issued additional shares of stock for $10,000 2-Feb: Purchased $4,000 of supplies on account 1-Mar: Paid one years' worth of rent ahead of time. Rent is $1,500 a month. 5-Mar: Received $30,000 in cash from parents for a summer camp to be conducted over the month of June. Of that, $5,000 is a nonrefundable application fee. 7-Jul: Pay Salaries to camp counselors for the June summer camp in the amount of $5,000 29-Jul: Billed customers $40,000 for a motivational speech workshop given at company headquarters. 31-Oct: Received $15,000 payment from attendees of the motivational speech workshop. 14-Dec: Paid Dividends of $500 Other information: The summer camp in June occurred as planned. 4 employees spent the month of December preparing for next year's summer camp. Each employee has a monthly wage of $2,000. They will be paid on January 2. As of December 31, Supplies of $1,500 remain on hand a. Record journal entries for the transactions that occurred over the year b. Record the necessary adjusting entries as of December 31 c. Prepare an income statement, statement of retained earnings, and balance sheet. d. Prepare closing entries.

Step by Step Solution

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

a Record journal entries for the transactions that occurred over the year 1 January 30 Debit Cash 10...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started