Question

At the beginning of the year, Young Company bought machinery, shelving, and a forklift. The machinery initially cost $25,600 but had to be overhauled

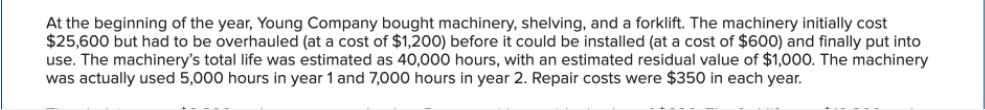

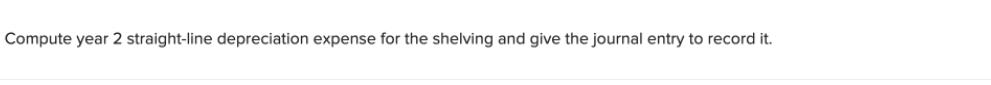

At the beginning of the year, Young Company bought machinery, shelving, and a forklift. The machinery initially cost $25,600 but had to be overhauled (at a cost of $1,200) before it could be installed (at a cost of $600) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $350 in each year. Compute year 2 straight-line depreciation expense for the shelving and give the journal entry to record it.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution Total cost of machinery Purchase price overhauling c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

5th edition

78025915, 978-1259115400, 1259115402, 978-0078025914

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App