Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of year 1, P Ltd acquired all the assets and liabilities of S Ltd on a cumulative dividend basis when S

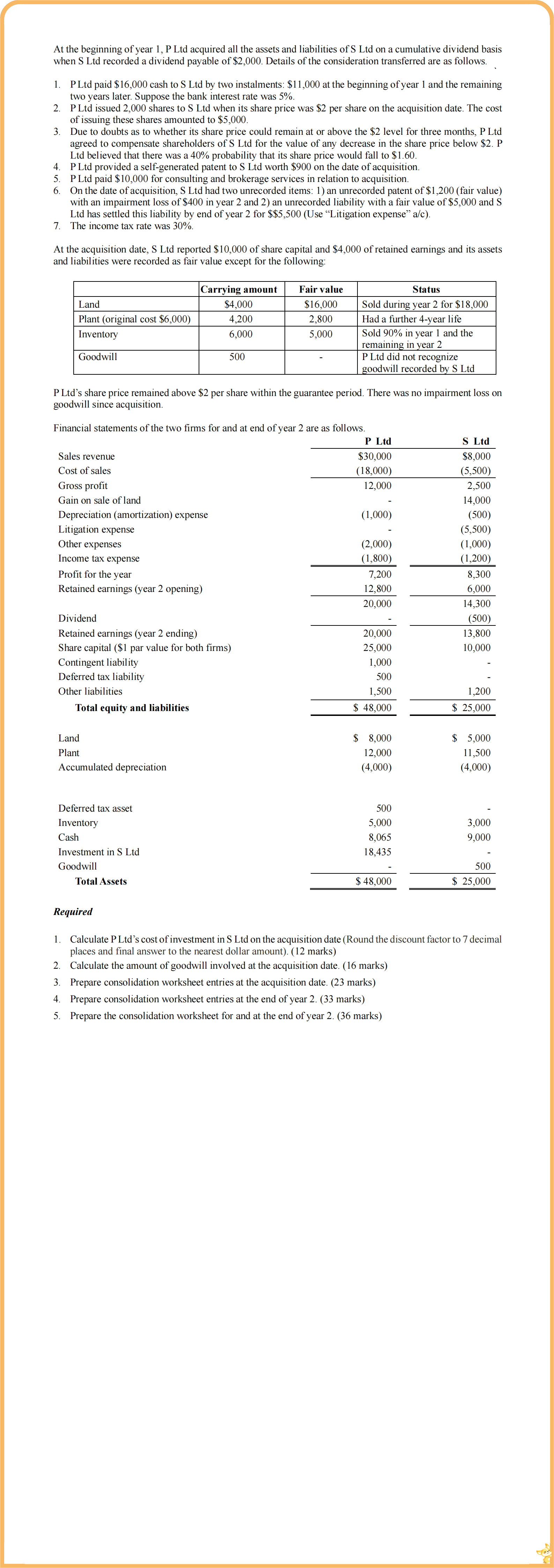

At the beginning of year 1, P Ltd acquired all the assets and liabilities of S Ltd on a cumulative dividend basis when S Ltd recorded a dividend payable of $2,000. Details of the consideration transferred are as follows. 1. PLtd paid $16,000 cash to S Ltd by two instalments: $11,000 at the beginning of year 1 and the remaining two years later. Suppose the bank interest rate was 5%. 2. P Ltd issued 2,000 shares to S Ltd when its share price was $2 per share on the acquisition date. The cost of issuing these shares amounted to $5,000. 3. Due to doubts as to whether its share price could remain at or above the $2 level for three months, P Ltd agreed to compensate shareholders of S Ltd for the value of any decrease in the share price below $2. P Ltd believed that there was a 40% probability that its share price would fall to $1.60. 4. P Ltd provided a self-generated patent to S Ltd worth $900 on the date of acquisition. 5. P Ltd paid $10,000 for consulting and brokerage services in relation to acquisition. 6. On the date of acquisition, S Ltd had two unrecorded items: 1) an unrecorded patent of $1,200 (fair value) with an impairment loss of $400 in year 2 and 2) an unrecorded liability with a fair value of $5,000 and S Ltd has settled this liability by end of year 2 for $$5,500 (Use Litigation expense a/c). 7. The income tax rate was 30%. At the acquisition date, S Ltd reported $10,000 of share capital and $4,000 of retained earnings and its assets and liabilities were recorded as fair value except for the following: Carrying amount Fair value Land $4,000 $16,000 Status Sold during year 2 for $18,000 Plant (original cost $6,000) 4,200 2,800 Had a further 4-year life Inventory 6,000 5,000 Sold 90% in year 1 and the remaining in year 2 Goodwill 500 P Ltd did not recognize goodwill recorded by S Ltd P Ltd's share price remained above $2 per share within the guarantee period. There was no impairment loss on goodwill since acquisition. Financial statements of the two firms for and at end of year 2 are as follows. P Ltd S Ltd Sales revenue $30,000 $8,000 Cost of sales (18,000) (5,500) Gross profit 12,000 2,500 Gain on sale of land 14,000 Depreciation (amortization) expense (1,000) (500) Litigation expense (5,500) Other expenses (2,000) (1,000) Income tax expense (1,800) (1,200) Profit for the year 7,200 8,300 Retained earnings (year 2 opening) 12,800 6,000 20,000 14,300 Dividend (500) Retained earnings (year 2 ending) 20,000 13,800 Share capital ($1 par value for both firms) 25,000 10,000 Contingent liability 1,000 Deferred tax liability 500 Other liabilities 1,500 1,200 Total equity and liabilities $ 48,000 $ 25,000 Land Plant Accumulated depreciation $ 8,000 12,000 (4,000) $ 5,000 11,500 (4,000) Deferred tax asset Inventory Cash Investment in S Ltd Goodwill Total Assets Required 500 5,000 3,000 8,065 9,000 18,435 500 $ 48,000 $ 25,000 1. Calculate P Ltd's cost of investment in S Ltd on the acquisition date (Round the discount factor to 7 decimal places and final answer to the nearest dollar amount). (12 marks) 2. Calculate the amount of goodwill involved at the acquisition date. (16 marks) 3. Prepare consolidation worksheet entries at the acquisition date. (23 marks) 4. Prepare consolidation worksheet entries at the end of year 2. (33 marks) 5. Prepare the consolidation worksheet for and at the end of year 2. (36 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started