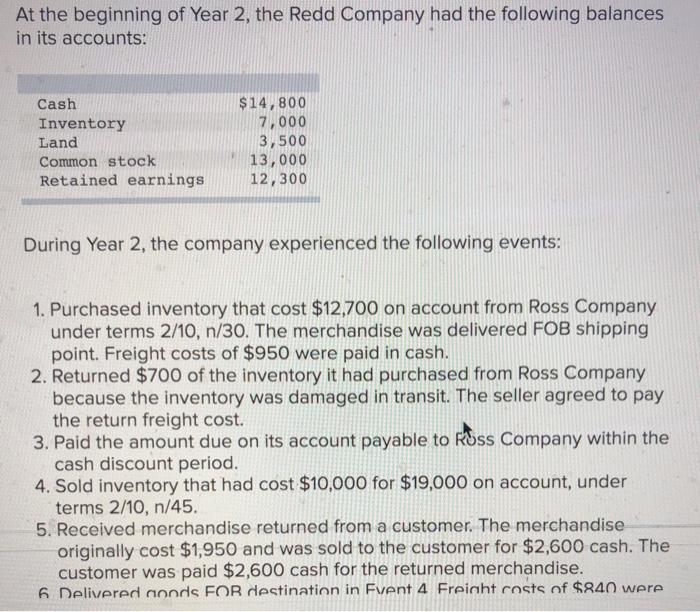

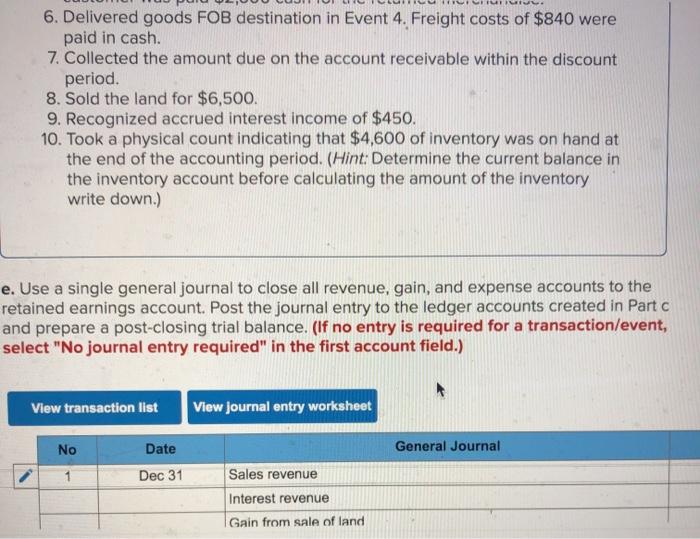

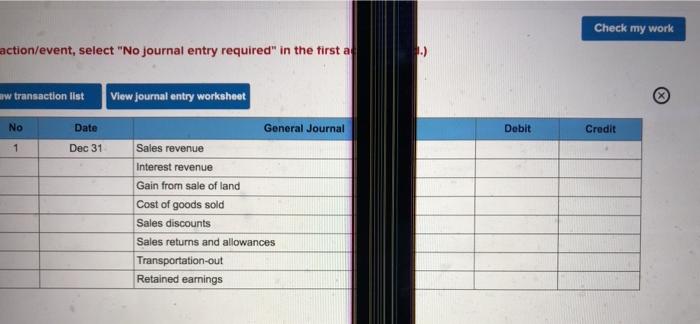

At the beginning of Year 2, the Redd Company had the following balances in its accounts: Cash Inventory Land Common stock Retained earnings $14,800 7,000 3,500 13,000 12,300 During Year 2, the company experienced the following events: 1. Purchased inventory that cost $12,700 on account from Ross Company under terms 2/10, n/30. The merchandise was delivered FOB shipping point. Freight costs of $950 were paid in cash. 2. Returned $700 of the inventory it had purchased from Ross Company because the inventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period. 4. Sold inventory that had cost $10,000 for $19,000 on account, under terms 2/10, n/45. 5. Received merchandise returned from a customer. The merchandise originally cost $1,950 and was sold to the customer for $2,600 cash. The customer was paid $2,600 cash for the returned merchandise. 6 Delivered aoods FOR destination in Event 4 Freight costs of $840 were 6. Delivered goods FOB destination in Event 4. Freight costs of $840 were paid in cash. 7. Collected the amount due on the account receivable within the discount period. 8. Sold the land for $6,500. 9. Recognized accrued interest income of $450. 10. Took a physical count indicating that $4,600 of inventory was on hand at the end of the accounting period. (Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down.) e. Use a single general journal to close all revenue, gain, and expense accounts to the retained earnings account. Post the journal entry to the ledger accounts created in Part and prepare a post-closing trial balance. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Dec 31 Sales revenue Interest revenue Gain from sale of land Check my work action/event, select "No journal entry required" in the first a w transaction ist View journal entry worksheet No Date General Journal Debit Credit 1 Dec 31 Sales revenue Interest revenue Gain from sale of land Cost of goods sold Sales discounts Sales returns and allowances Transportation-out Retained earnings