Answered step by step

Verified Expert Solution

Question

1 Approved Answer

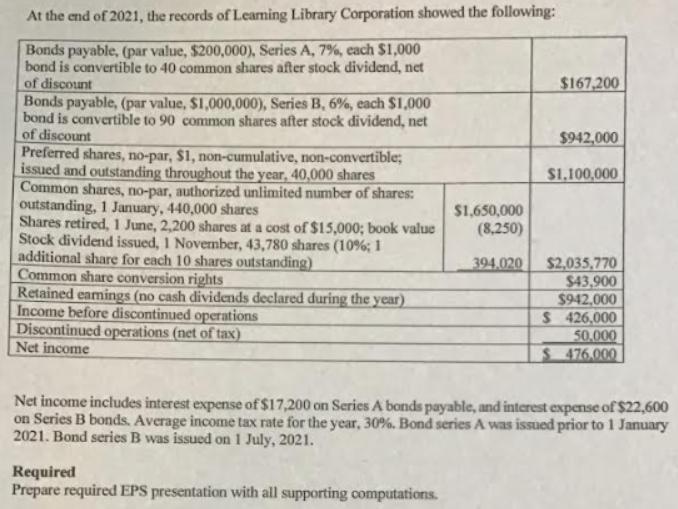

At the end of 2021, the records of Learning Library Corporation showed the following: Bonds payable, (par value, $200,000), Series A, 7%, each $1,000

At the end of 2021, the records of Learning Library Corporation showed the following: Bonds payable, (par value, $200,000), Series A, 7%, each $1,000 bond is convertible to 40 common shares after stock dividend, net of discount Bonds payable, (par value, $1,000,000), Series B, 6%, each $1,000 bond is convertible to 90 common shares after stock dividend, net of discount Preferred shares, no-par, $1, non-cumulative, non-convertible; issued and outstanding throughout the year, 40,000 shares Common shares, no-par, authorized unlimited number of shares: outstanding, 1 January, 440,000 shares Shares retired, 1 June, 2,200 shares at a cost of $15,000; book value Stock dividend issued, 1 November, 43,780 shares (10%; 1 additional share for each 10 shares outstanding) Common share conversion rights Retained earnings (no cash dividends declared during the year) Income before discontinued operations Discontinued operations (net of tax) Net income $1,650,000 (8,250) 394,020 Required Prepare required EPS presentation with all supporting computations. $167,200 $942,000 $1,100,000 $2,035,770 $43,900 $942,000 $426,000 50.000 $ 476.000 Net income includes interest expense of $17,200 on Series A bonds payable, and interest expense of $22,600 on Series B bonds. Average income tax rate for the year, 30%. Bond series A was issued prior to 1 January 2021. Bond series B was issued on 1 July, 2021.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Earnings Per Share Presentation Net Income 2035770 Income before discontinued operations 2035770 Dis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started