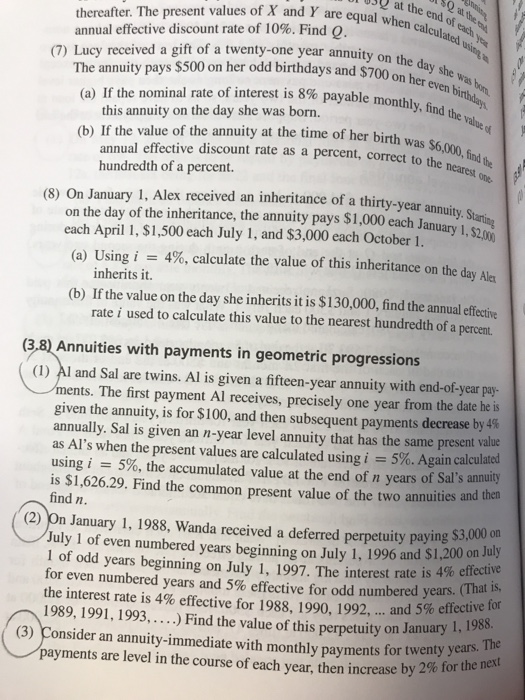

at the end of each and Y are equal when calculated thereafter. The present values of X and Y are equ annual effective discount rate of 10%. Find Q. the day she was (7) Lucy received a gift of a twenty-one year annuity o The annuity pays $500 on her odd birthdays and $700 (a) If the nominal rate of interest is 8% payable mon even monthly, find the this annuity on the day she was born. (b) If the value of the annuity at the time of her birth was s $6,000, find the annual effective discount rate as a percent, correct to the hundredth of a percent. on the day of the inheritance, the annuity pays $1,000 each January 1. 52 (a) Using 4%, calculate the value of this inheritance on the day Alex (8) On January 1, Alex received an inheritance of a thirty-year annuit each April 1, $1,500 each July 1, and $3,000 each October 1. inherits it (b) If the value on the day she inherits it is $130,000, find the annual effective rate i used to calculate this value to the nearest hundredth of a percent (38) Annuities with payments in geometric progressions (1) Al and Sal are twins. Al is given a fifteen-year annuity with end-of-year pay ents. The first payment Al receives, precisely one year from the date he given the annuity, is for $100, and then subsequent payments decrease annually. Sal is given an n-year level annuity that has the same present val as Al's when the present values are calculated using i = 5%. Again calcu using i = 5%, the accumulated value at the end of n years of Sal's an is $1,626.29. Find the common present value of the two annuities and find n. (2) On January 1, 1988, Wanda received a deferred perpetuity paying $3,000 July 1 of even numbered years beginning on July 1, 1996 and $1,200 on July 4% effective 1 of odd years beginning on July 1, 1997. The interest rate is for even numbered years and 5% effective for odd numbered years the interest rate is 4% effective for 1988, 1990, 1992, and 5% That effective 1989, 1991, 1993,.... Find the value of this perpetuity on January 1,195s (3) Consider an annuity-immediate with monthly payments for twenty years 2% for the The payments are level in the course of each year, then increase by