Question

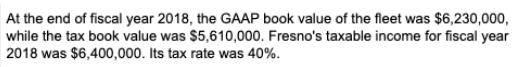

At the end of fiscal year 2018, the GAAP book value of the fleet was $6,230,000, while the tax book value was $5,610,000. Fresno's

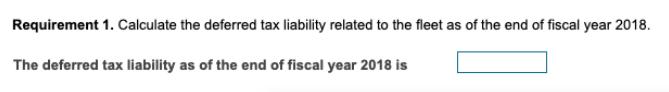

At the end of fiscal year 2018, the GAAP book value of the fleet was $6,230,000, while the tax book value was $5,610,000. Fresno's taxable income for fiscal year 2018 was $6,400,000. Its tax rate was 40%. Requirement 1. Calculate the deferred tax liability related to the fleet as of the end of fiscal year 2018. The deferred tax liability as of the end of fiscal year 2018 is

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the deferred tax liability at the end of the year 2018 we will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Management And Economics Abbreviated

Authors: Gerald Keller

10th Edition

978-1-305-0821, 1285869648, 1-305-08219-2, 978-1285869643

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App