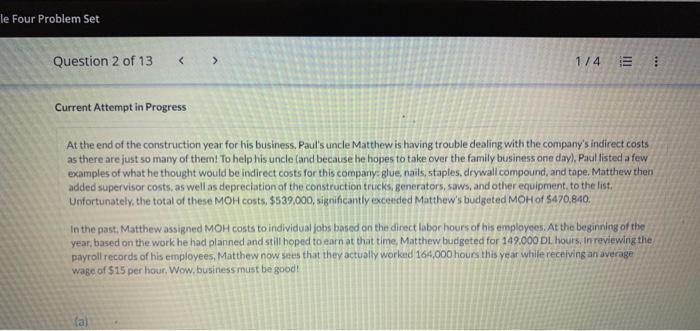

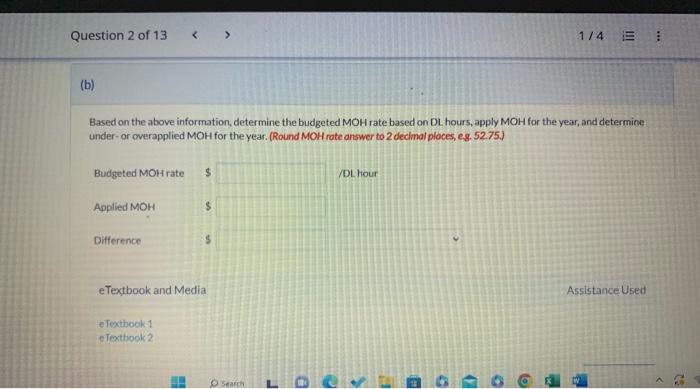

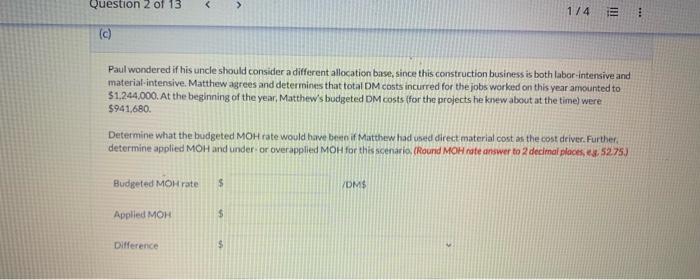

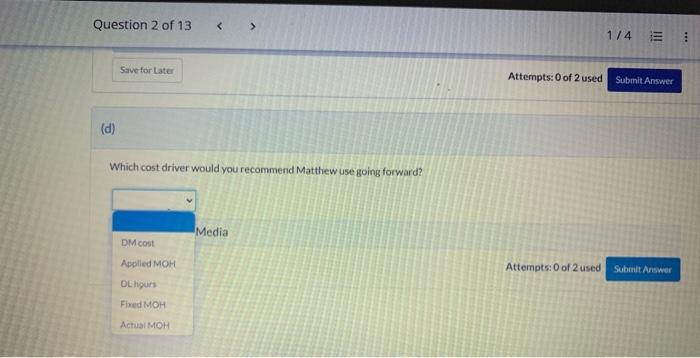

At the end of the construction year for his business. Paul's uncle Matthew is having trouble dealing with the company's indirect costs as there are just so many of them! To help his uncle (and because he hopes to take over the family business one day). Paul listed a few examples of what he thought would be indirect costs for this company: glue, nails, staples, drywall compound, and tape. Matthew then added supervisor costs, as well as depreciation of the construction trucks, generators, saws, and other equipment, to the list. Unfortunately, the total of these MOH costs, $539,000, significantly excended Matthew's budgeted MOH of $470,840. In the past, Matthew assigned MOH costs to individual jobs based on the direct labor hours of his employees. At the beginning of the year, based on the work he had planned and still hoped to earn at that time. Matthew budgeted for 149.000 DI. hours. in reviewing the payroll records of his employees, Matthew now sees that they actually worked 164,000 hours this year while receiving an average wabe of $15 per hour. Wow, bustness must be good! Based on the above information, determine the budgeted MOH rate based on DL hours, apply MOH for the year, and determioe under-or cverapplied MOH for the year. (Round MOH rate answer to 2 declmal ploces, es. 52.75.) Budgeted MOH rate /DLhour Applied MOH Paul wondered if his uncle should consider a different allocation base, since this construction business is both labor-intensive and material intensive. Matthew agrees and determines that total DM costs incurred for the jobs worked on this year amounted to \$1,244,000. At the beginning of the year, Matthew's budgeted DM costs (for the projects he knew about at the time) were 5941,680 Determine what the budgeted MOH rate would have been if Matthew had used direct material cost as the cost deiver. Further. determine applied MOH and under-or overapplied MOH for this scenario. (Round MOH rate answer to 2 decimal dlaces, es. 52.75.) Budgeted MOHrate rDM\$ Applied MOH Difference Which cost driver would you recommend Matthew use going forward