Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of the fiscal year, Palm City was trying to determine which of its funds would be required to be reported as

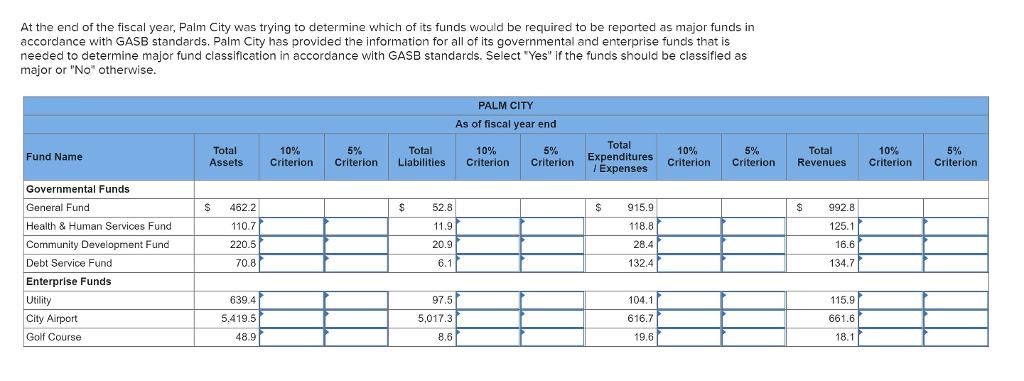

At the end of the fiscal year, Palm City was trying to determine which of its funds would be required to be reported as major funds in accordance with GASB standards. Palm City has provided the information for all of its governmental and enterprise funds that is needed to determine major fund classification in accordance with GASB standards. Select "Yes" if the funds should be classified as major or "No" otherwise. PALM CITY As of fiscal year end Total Assets Total Liabilities Total Expenditures I Expenses 10% 10% Criterion 5% Criterion 5% Criterion 10% Criterion 5% Criterion Total Revenues 10% Criterion 5% Criterion Fund Name Criterion Governmental Funds General Fund 462.2 $4 52.8 24 915.9 24 992.8 Health & Human Services Fund 110.7 11.9 118.8 125.1 Community Development Fund 220.5 20.9 28.4 16.6 Debt Service Fund 70.8 6.1 132.4 134.7 Enterprise Funds Utility 639.4 97.5 104.1 115.9 City Airport 5,419.5 5,017.3 616.7 661.6 Golf Course 48.9 8.6 19.6 18.1

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started