Answered step by step

Verified Expert Solution

Question

1 Approved Answer

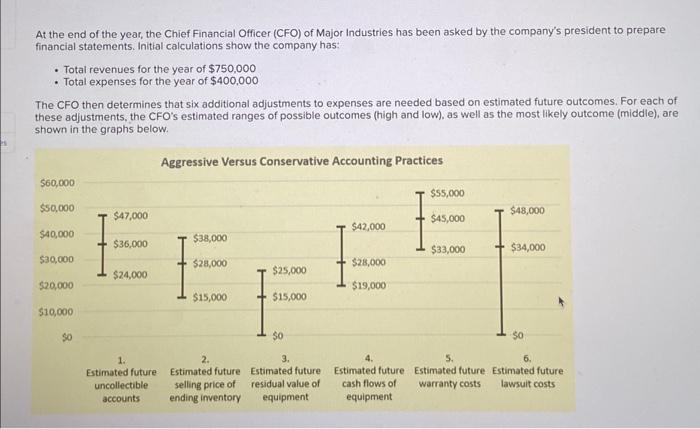

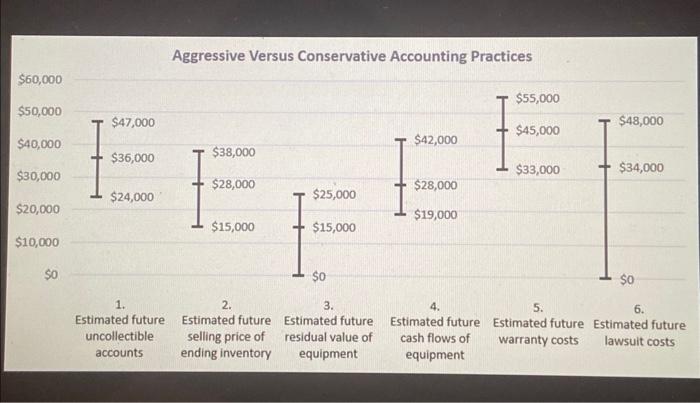

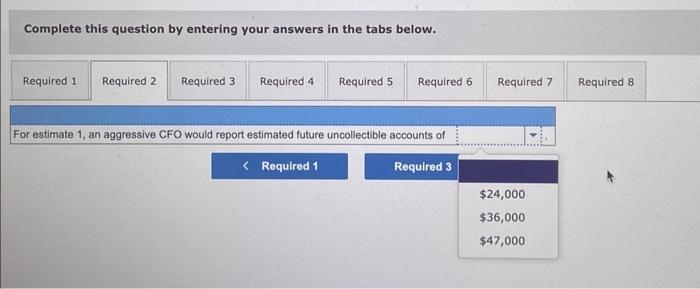

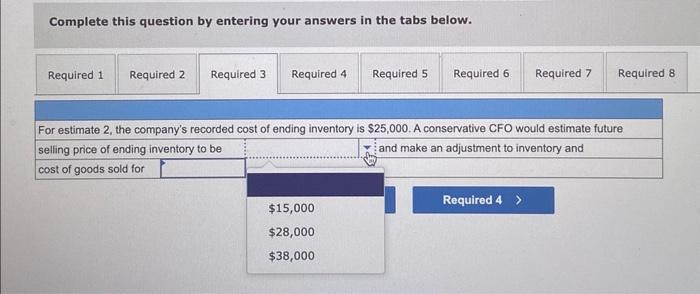

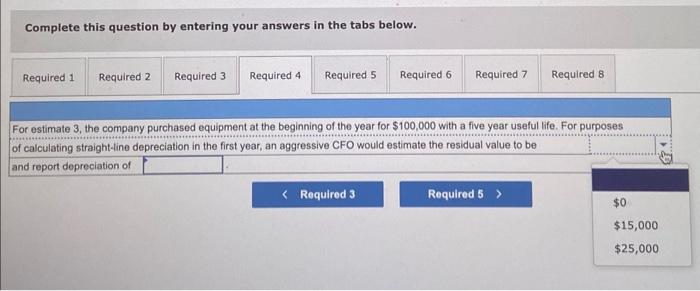

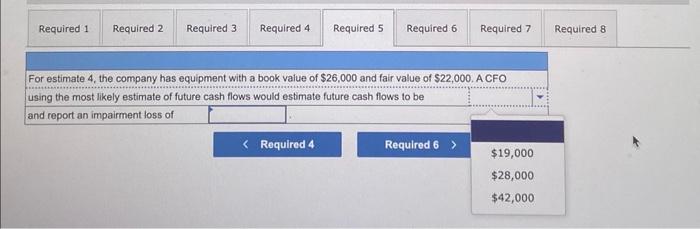

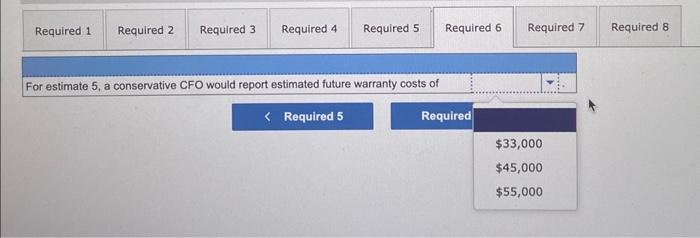

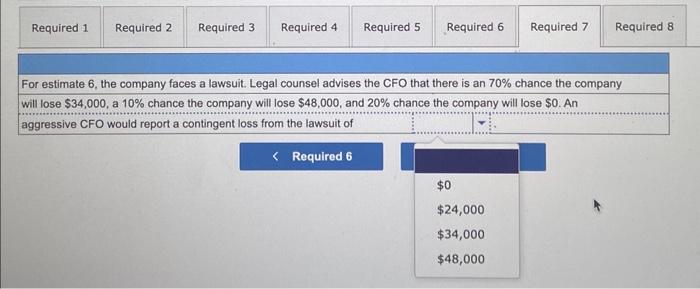

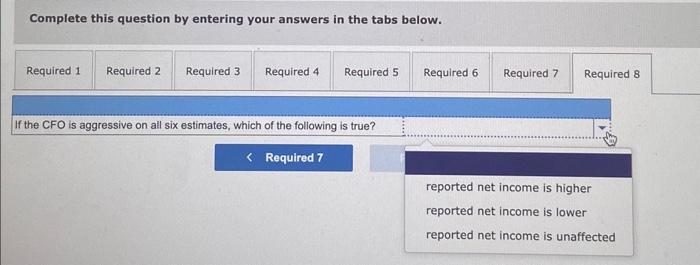

At the end of the year, the Chief Financial Officer (CFO) of Major Industries has been asked by the company's president to prepare financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started