Question

At the end of this document, you will find six corporate bonds that will be available for you to purchase on January 1, 2024. You

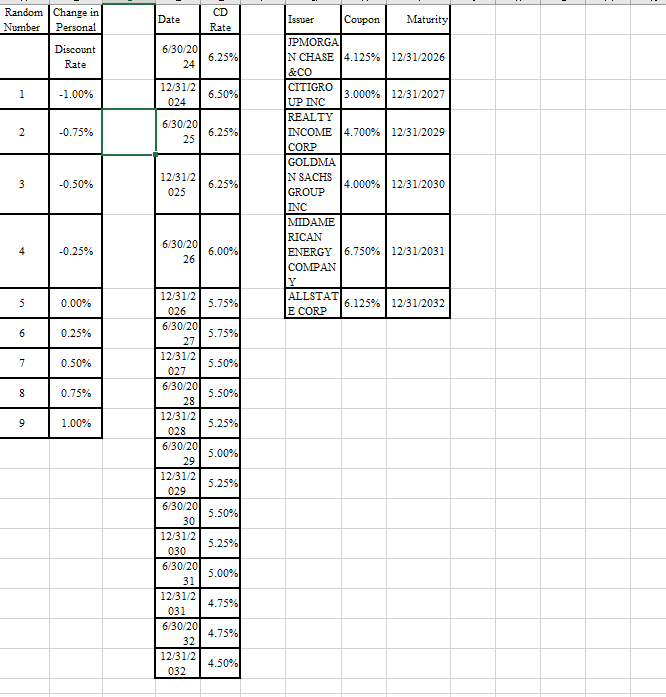

At the end of this document, you will find six corporate bonds that will be available for you to purchase on January 1, 2024. You have $60,000 to spend and will purchase six bonds of approximately $10,000 each on that date. Assume that they pay coupons semi-annually. Please do the following: 1 In Excel, use a random generator function to come up with your personal discount rate. It should be a number ranging from 5-8%. You should generate a random integer between 500 and 800 and convert that into a percent. For example, if you randomly get 652, then your discount rate would be 6.52%. 2 Price each of the six bonds, calculating the present value of the coupons and the principal. You should use the pricing methods that we used in the class. 3 Your portfolio will now return cash every six months, as you receive coupons and return of principal. You will reinvest those proceeds in six month CDs, whose rates are below. For example, you may receive money on June 30, 2027. You will then invest that money for the next six months at 5.75%. Naturally, as the CDs mature, you will invest that cash again in a CD at the new rate. 4 Every year, your personal discount rate will change. Generate a second random integer between 1 and 9. Use the table below to determine your change in discount rate for the year. For example, suppose your personal rate is initally 8%. If you generate a 4, then your new rate will be 7.75% 5 Construct a spreadsheet showing: (1) the purchase prices of the bonds in your portfolio; (2) the value of your portfolio, every six months, beginning June 30, 2024, accounting for the change in your personal discount rate; (3) the value of your invested cash. Please put a step by step on how to do this in excel thanks.

Please put a step by step on how to do this in excel thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started