Question

At the investment committee meeting to discuss the proposed investment, one of your partners points out that in one of your potential scenarios, the company

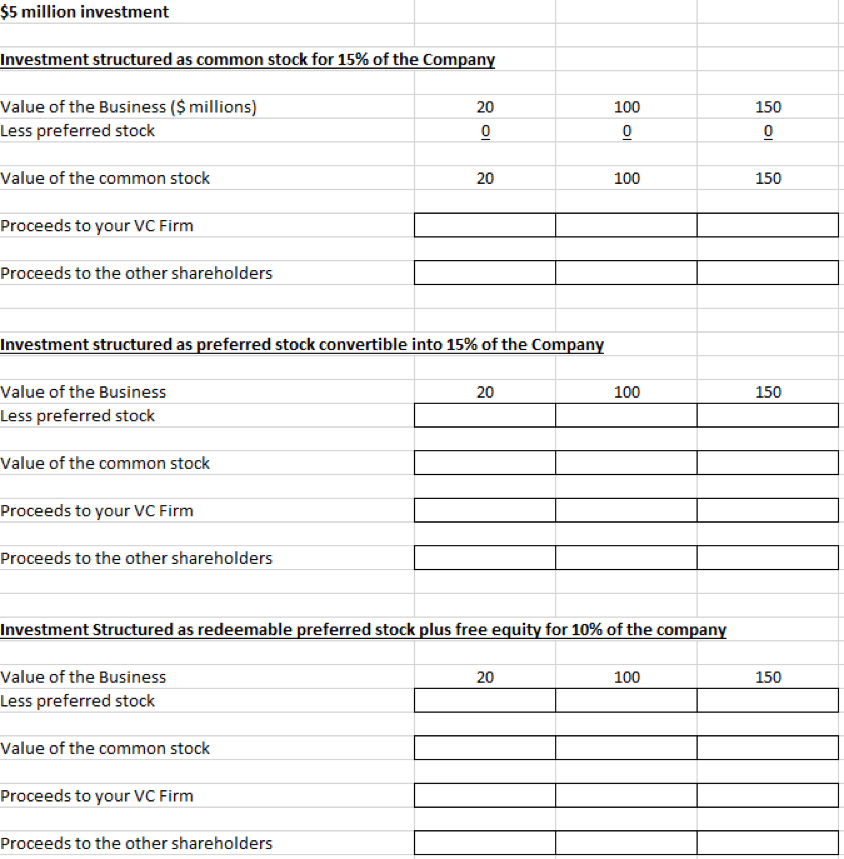

At the investment committee meeting to discuss the proposed investment, one of your partners points out that in one of your potential scenarios, the company could be sold within one year of the investment for a value of $20 million. Given that could be an attractive outcome for the existing shareholders, but not for your firm, you consider structuring the investment as a $5 million non-dividend paying convertible preferred stock, convertible at your option into 15% of the common stock of the company. Also, the CEO has come back to you and believes that her company has much more upside than you are projecting. (She thinks the company could be worth $150 million in four years.) As a result, she believes that your requirement for 15% of the company is too high. As a result of that feedback, you also consider a structure consisting of preferred stock and free equity as a way to bridge the value gap. You look at an investment structure that would consist of $5 million of non-dividend paying redeemable preferred stock and free equity representing 10% of the company (rather than 15%). Please fill in the following table to analyze the various alternatives, and then answer the question that follows.

If the VC firm is most concerned with the downside scenario, then which of the various investment structures do you think seems to address the concerns of both the CEO and the VC investor and why ?

$5 million investment Investment structured as common stock for 15% of the Company 100 Value of the Business ($ millions) Less preferred stock Value of the common stock 100 Proceeds to your VC Firm Proceeds to the other shareholders Investment structured as preferred stock convertible into 15% of the Company 20 100 150 Value of the Business Less preferred stock Value of the common stock Proceeds to your VC Firm Proceeds to the other shareholders Investment Structured as redeemable preferred stock plus free equity for 10% of the company 20 100 150 Value of the Business Less preferred stock Value of the common stock Proceeds to your VC Firm Proceeds to the other shareholdersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started