Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the Monsters Incorporated factory, skilled monsters employed as scarers venture into the human world to scare children and harvest their screams, through doors

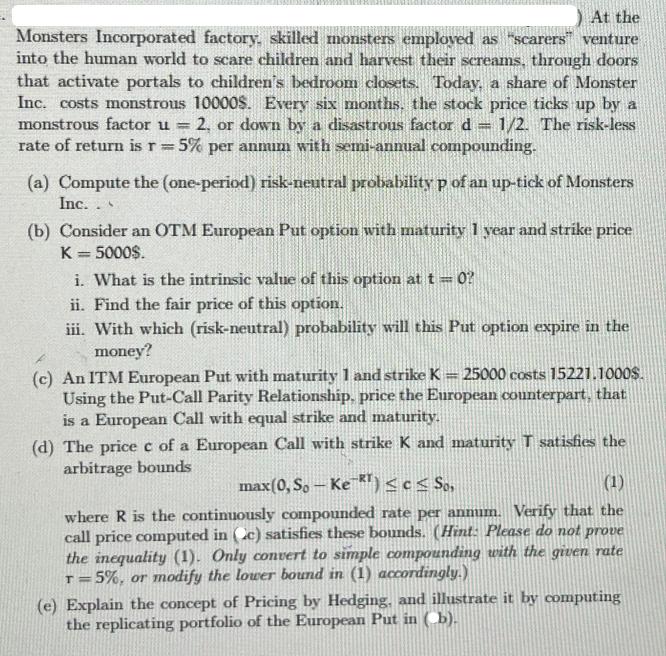

At the Monsters Incorporated factory, skilled monsters employed as "scarers" venture into the human world to scare children and harvest their screams, through doors that activate portals to children's bedroom closets. Today, a share of Monster Inc. costs monstrous 10000$. Every six months, the stock price ticks up by a monstrous factor u = 2, or down by a disastrous factor d 1/2. The risk-less rate of return is r = 5% per anmum with semi-annual compounding. B (a) Compute the (one-period) risk-neutral probability p of an up-tick of Monsters Inc. . (b) Consider an OTM European Put option with maturity 1 year and strike price K = 5000$. i. What is the intrinsic value of this option at t = 0? ii. Find the fair price of this option. iii. With which (risk-neutral) probability will this Put option expire in the money? (c) An ITM European Put with maturity 1 and strike K = 25000 costs 15221.1000$. Using the Put-Call Parity Relationship, price the European counterpart, that is a European Call with equal strike and maturity. (d) The price c of a European Call with strike K and maturity T satisfies the arbitrage bounds max(0, So-Ke-R) c So, (1) where R is the continuously compounded rate per annum. Verify that the call price computed in (c) satisfies these bounds. (Hint: Please do not prove the inequality (1). Only convert to simple compounding with the given rate -5%, or modify the lower bound in (1) accordingly.) T= (e) Explain the concept of Pricing by Hedging, and illustrate it by computing the replicating portfolio of the European Put in (b).

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the riskneutral probability p of an uptick we can use the riskneutral pricing formula p 1 r d u d where r is the riskfree rate u is the uptick factor and d is the downtick factor Substitu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started