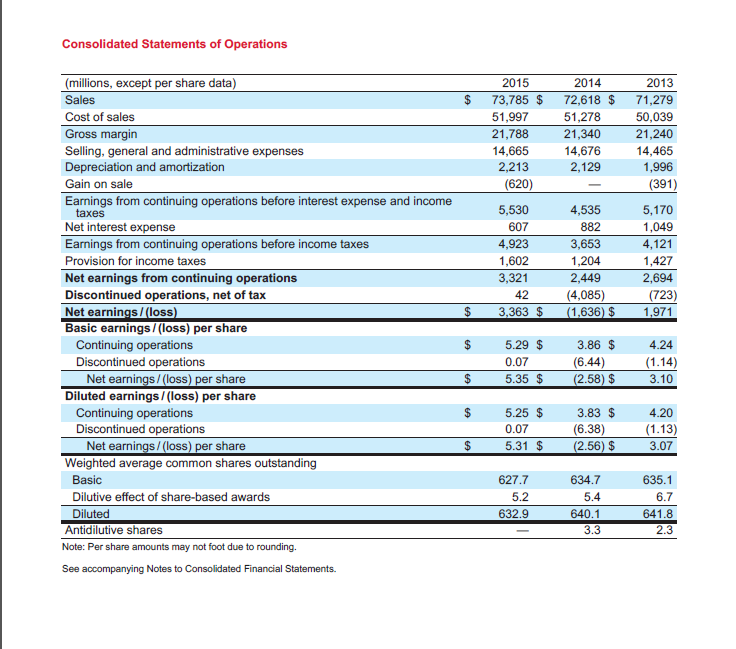

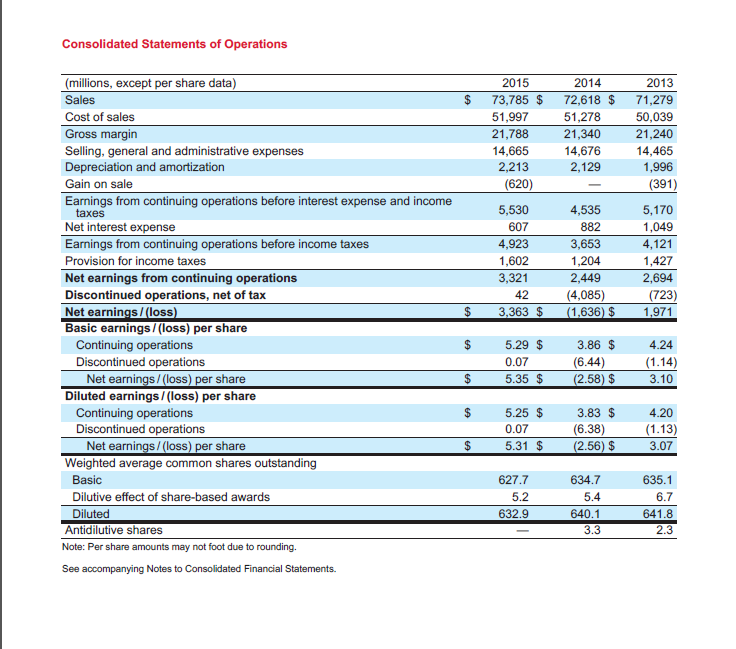

At the most recent strategic planning meeting, the board of directors of your company has voted to issue additional stock to raise capital for major

At the most recent strategic planning meeting, the board of directors of your company has voted to issue additional stock to raise capital for major expansions for the company in the next five years. The board is considering $5 million. Take the most recent financial statements and prepare a set of projected financial statements based on the given assumptions. The CEO requests that you prepare a written report (including the financial statements) for her.

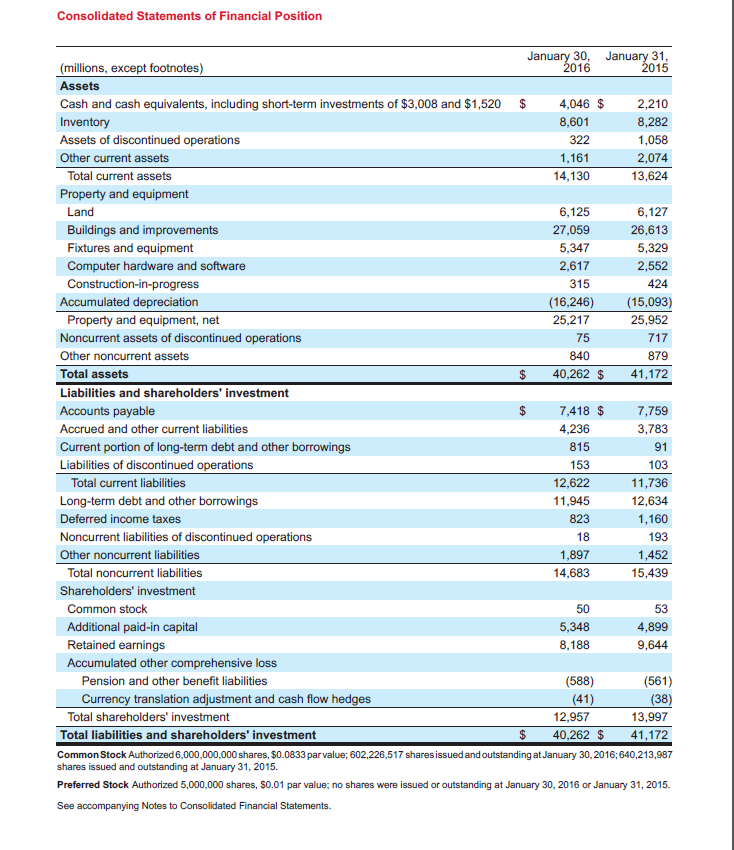

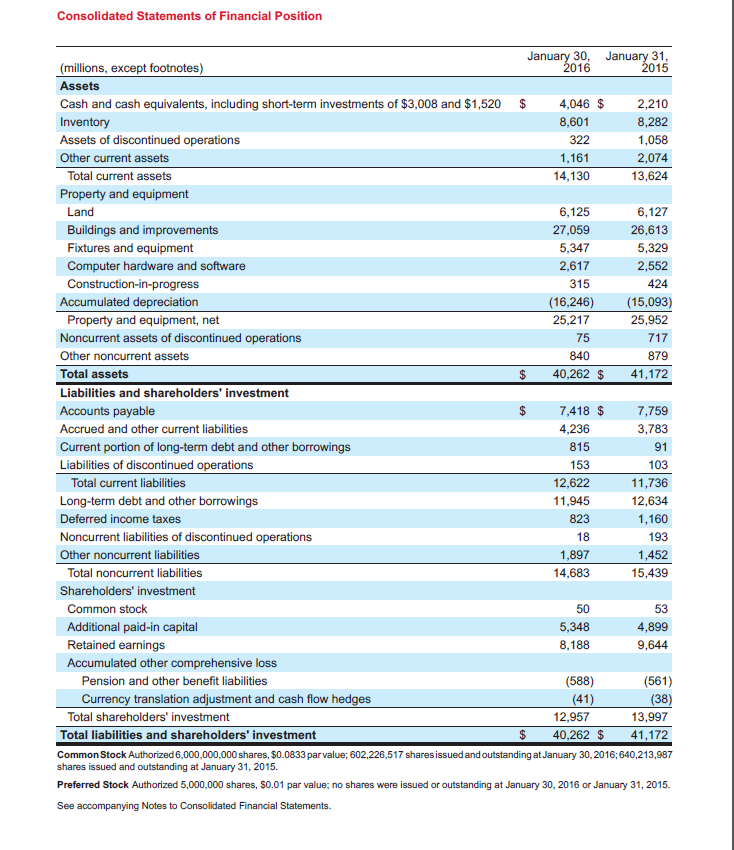

E. Generate a projected balance sheet based on the given scenario.

F. Analyze the impact on the balance sheet based on the given scenario.

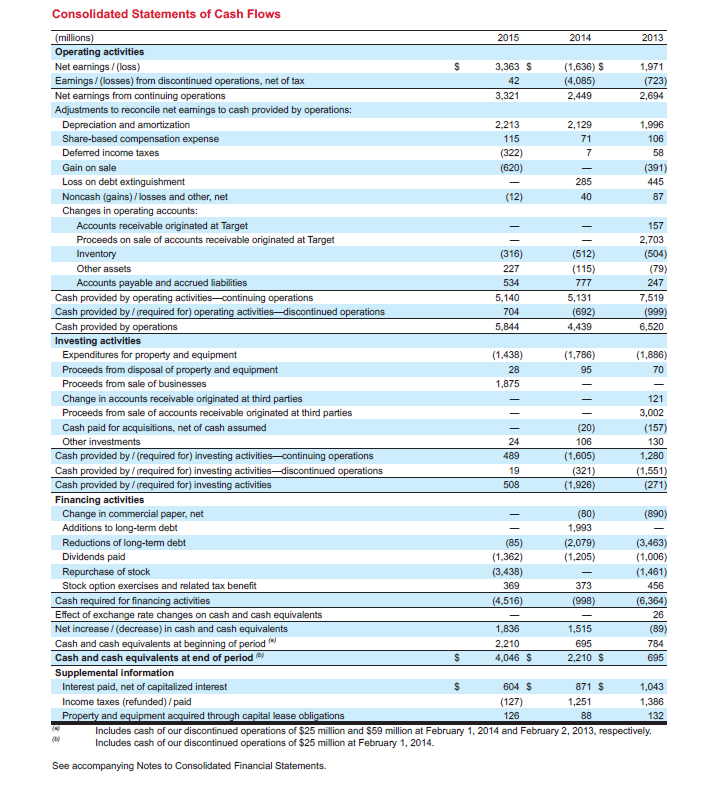

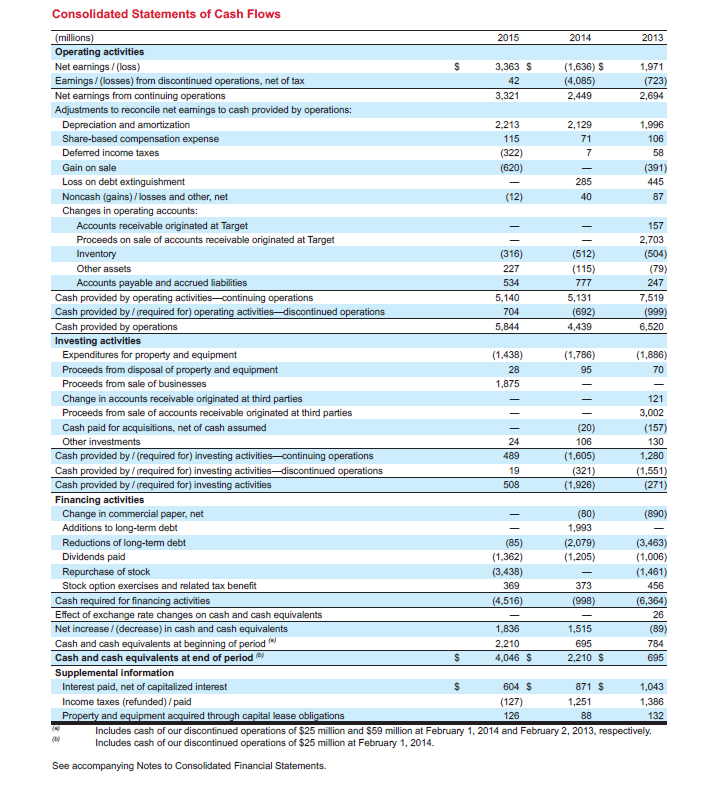

G. Generate a projected cash flow statement based on the given scenario.

H. Analyze the impact on the cash flow statement based on the given scenario.

Consolidated Statements of Cash Flows 2015 2014 2013 Operating activities 3,363 1,636) Net earnings (loss) 1,971 Earnings /(ost from discontinued operations, net of tax ses) 42 4,085) 723) Net earnings from continuing operations 3.321 2,449 2,694 Adjustments to reconcile net earnings to cash provided by operations: Depreciation and amortization 2,213 2,129 1,996 Share-based compensation expense 115 106 Deferred income taxes 322) Gain on sale 391 Loss on debt extinguishment 445 Noncash (gains) /losses and other, net 87 Changes in operating accounts: Accounts receivable originated at Target 157 Proceeds on sale of accounts receivable originated at Target 2,703 316) 512) 504) assets 115) Accounts payable and accrued liabilities 247 Cash provided by operating activities ontinuing operations 5,140 5,131 7,519 Cash provided by /(equired for) operating activities discontinued operations 692) 999) Cash provided by operations 5,844 4,439 6,520 Investing activities Expenditures for property and equipment 1.438) 786 1,8B6 Proceeds from disposal of property and equipment 70 Proceeds from sale of businesses 1.875 Change in accounts receivable originated at third parties 121 Proceeds from sale of accounts receivable originated at third parties 3,002 Cash paid for acquisitions, net of cash assumed (20) (157) Other investments 24 106 130 Cash provided by (required for) investing activities Continuing operations 489 (1,605) 1.280 Cash provided by/required for) nvesting activities-discontinued operations 321 551 Cash provided by Vrequired for) nvesting activities 1,926) 271 Financing activities Change in commercial paper, net (80) 890) Additions to long-term debt 1,993 (2,079) (3,463) Reductions of long-term debt (85) Dividends paid 1.362) 205) 1,006) Repurchase of stock 3,438) (1,461) Stock option exercises and related tax benefit 373 456 Cash required for financing activities 4.516) 998) 6,364) Effect of exchange rate changes on cash and cash equivalents 26 Net increase/(decrease) in cash and cash equivalents 1,836 1,515 (89) Cash and cash equivalents at beginning of period 2,210 695 784 4,046 2,210 Cash and cash equivalents at end of period 695 Supplemental information 604 s 871 s 1043 Interest paid, net of capitalized interest Income taxes (refunded) /paid 127) 251 1.3B6 acquired th h capital lease obligations 126 88 132 Includes cash of our d scontinued operations of $25 million and S59 million at February 1, 2014 and February 2, 2013, respectively. Includes cash of our discontinued operations of $25 million at February 1, 2014 See accompanying Notes to Consolidated Financial Statements