Question

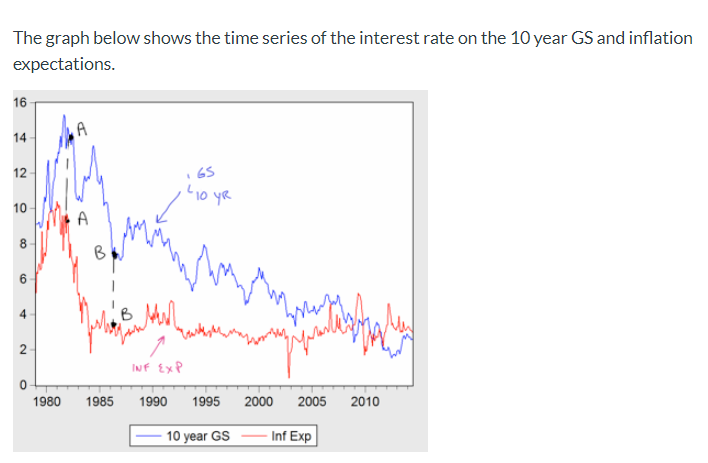

At the points A's, the interest rate on the 10 year GS is 14% andinflation expectations are 9%.At points B, the interest rate on the

At the points A's, the interest rate on the 10 year GS is 14% andinflation expectations are 9%.At points B, the interest rate on the 10 year GS is 7% andinflation expectations are 3%.

a) (10 points) Using a bond supply / bond demand diagram, locate points A and points B beingsure to label your diagram completely. Note, we are holding all other factors that effect bond supply and bond demand constant except for inflation expectations (note also that we do not know the actual bond prices at points A and B but we do know what happens to bond prices).

b) (10 points) Now explain the intuition as the why the conditions in the bond market changed.That is, why exactly did your diagram change the way it did and relate your answer to the graphic above.

c) (5 points) What has happened to the ex-ante real interest rate and would this change in the ex-ante real interest rate,cause you (and other consumers) to spend more or save more. Please explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started