Answered step by step

Verified Expert Solution

Question

1 Approved Answer

+ . . . . . . At the present time, the beginning of year 1, the Barney-Jones Investment Corporation has $100,000 to invest

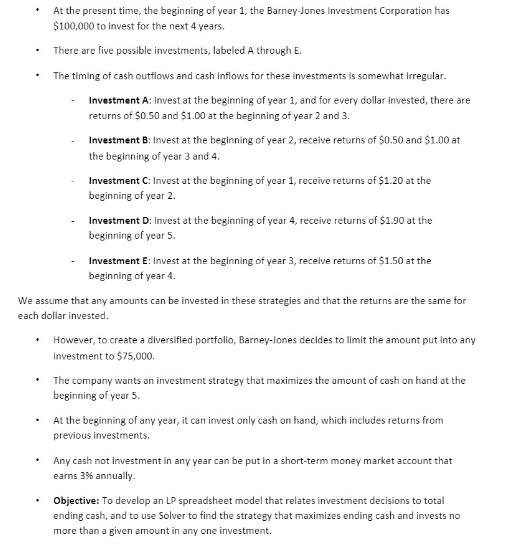

+ . . . . . . At the present time, the beginning of year 1, the Barney-Jones Investment Corporation has $100,000 to invest for the next 4 years. There are five possible investments, labeled A through E. The timing of cash outflows and cash inflows for these investments is somewhat Irregular. - Investment A: Invest at the beginning of year 1, and for every dollar invested, there are returns of $0.50 and $1.00 at the beginning of year 2 and 3. . - We assume that any amounts can be invested in these strategies and that the returns are the same for each dollar invested. Investment B: Invest at the beginning of year 2, receive returns of $0.50 and $1.00 at the beginning of year 3 and 4. Investment C: Invest at the beginning of year 1, receive returns of $1.20 at the beginning of year 2. Investment D: Invest at the beginning of year 4, receive returns of $1.90 at the beginning of year 5. Investment E: Invest at the beginning of year 3, receive returns of $1.50 at the beginning of year 4. However, to create a diversifled portfolio, Barney-Jones decides to limit the amount put into any Investment to $75,000. The company wants an investment strategy that maximizes the amount of cash on hand at the beginning of year 5. At the beginning of any year, it can invest only cash on hand, which includes returns from previous investments. Any cash not investment in any year can be put in a short-term money market account that earns 3% annually. Objective: To develop an LP spreadsheet model that relates investment decisions to total ending cash, and to use Solver to find the strategy that maximizes ending cash and invests no more than a given amount in any one investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To develop an LP spreadsheet model that relates investment decisions to total ending cash we can set ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started