Answered step by step

Verified Expert Solution

Question

1 Approved Answer

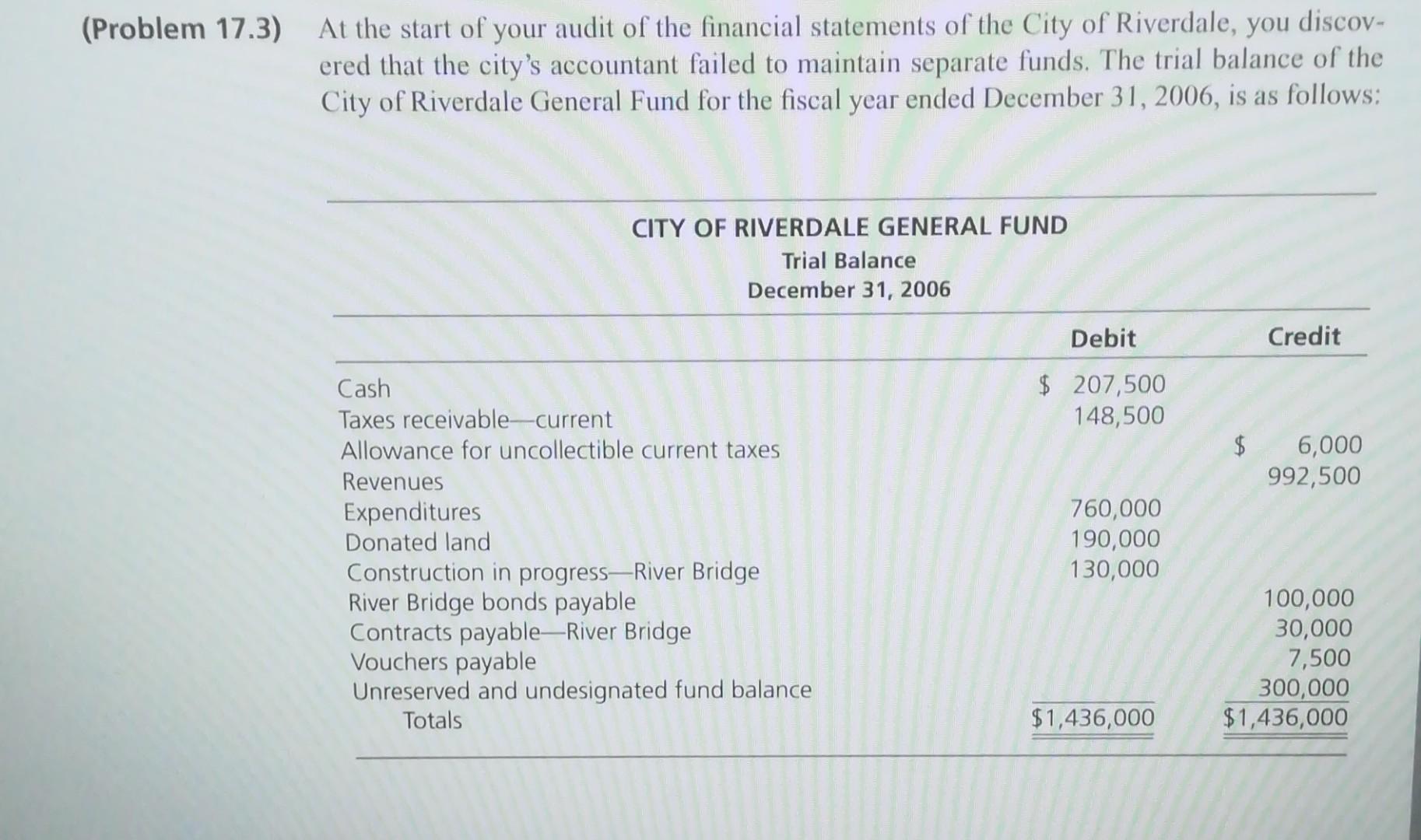

At the start of your audit of the financial statements of the City of Riverdale, you discovered that the city's accountant failed to maintain separate

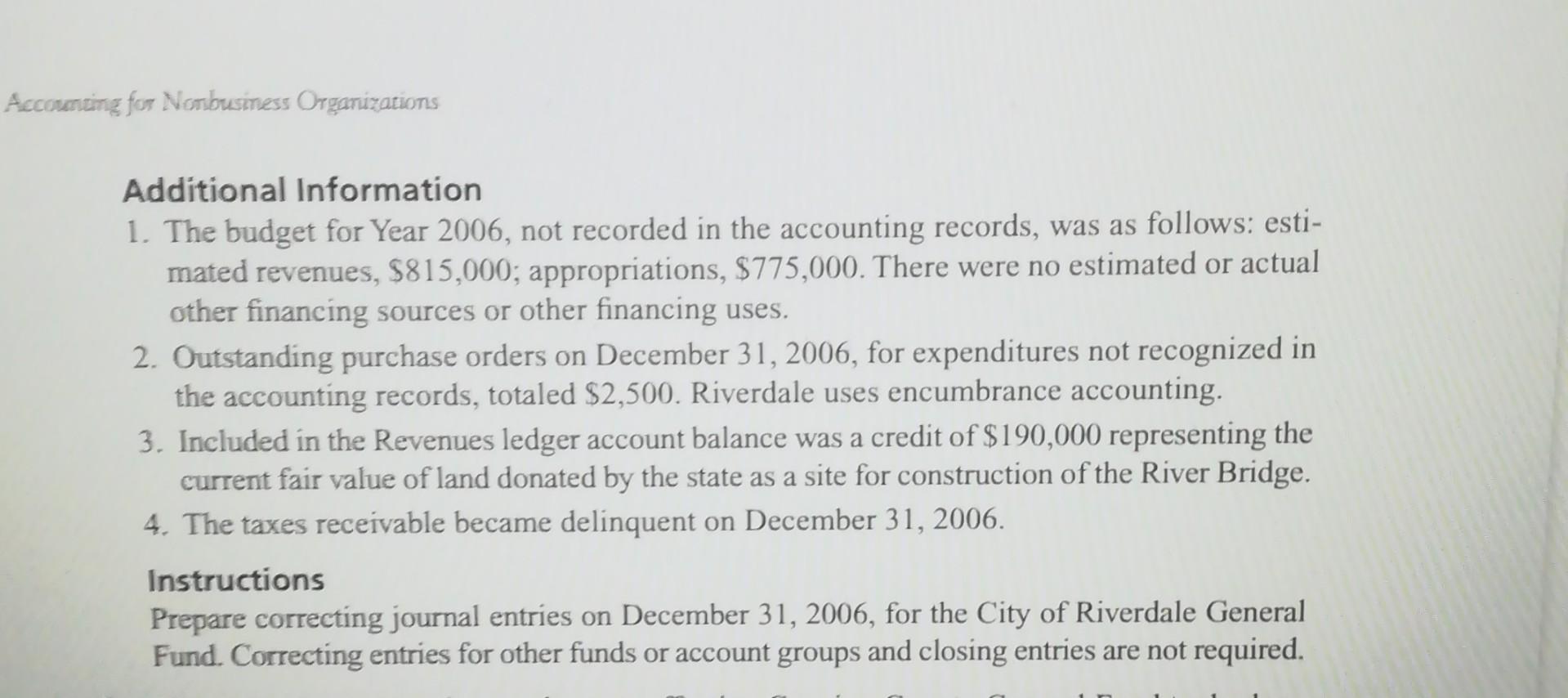

At the start of your audit of the financial statements of the City of Riverdale, you discovered that the city's accountant failed to maintain separate funds. The trial balance of the City of Riverdale General Fund for the fiscal year ended December 31, 2006, is as follows: Additional Information 1. The budget for Year 2006, not recorded in the accounting records, was as follows: estimated revenues, $815,000; appropriations, $775,000. There were no estimated or actual other financing sources or other financing uses. 2. Outstanding purchase orders on December 31, 2006, for expenditures not recognized in the accounting records, totaled $2,500. Riverdale uses encumbrance accounting. 3. Included in the Revenues ledger account balance was a credit of $190,000 representing the current fair value of land donated by the state as a site for construction of the River Bridge. 4. The taxes receivable became delinquent on December 31, 2006. Instructions Prepare correcting journal entries on December 31, 2006, for the City of Riverdale General Fund. Correcting entries for other funds or account groups and closing entries are not required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started