Question

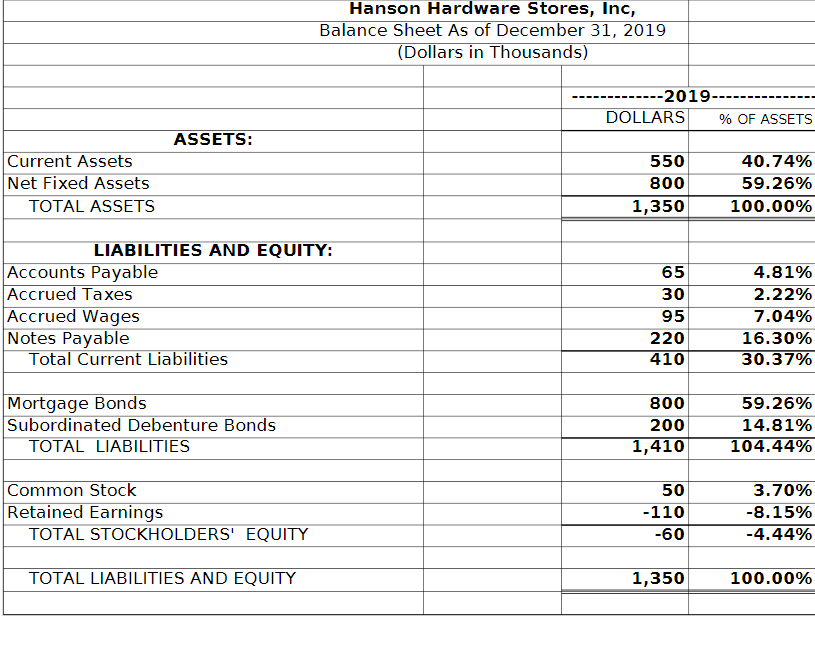

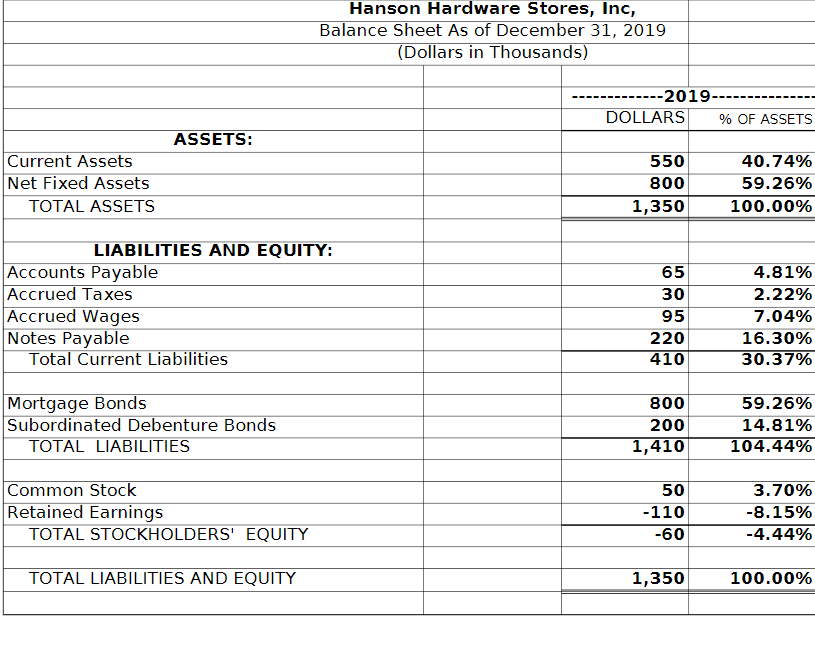

At the time it defaulted on its interest payments and filed for bankruptcy, Hanson Hardware Stores, Inc. had the balance sheet shown on the attachment

At the time it defaulted on its interest payments and filed for bankruptcy, Hanson Hardware Stores, Inc. had the balance sheet shown on the attachment (in thousands of dollars).The court, after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation.Sale of the "Fixed Assets," which were pledged as collateral to the mortgage bondholders, were expected to bring in 45% of their book value.the "Current Assets" were expected to sell for 70% of their book value.Trustee's costs totaled $50 (in thousands).

a.After the assets are liquidated, what is the total dollar amount available for distribution to all claimants?

b.What is the total of all creditor and trustee claims?

c.Will the preferred and common stockholders receive any distributions from the liquidation of the assets?Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started