Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At time 0.5, the price of $1 par of a zero maturing at time 1 will be either $0.96 or $0.98. The current price

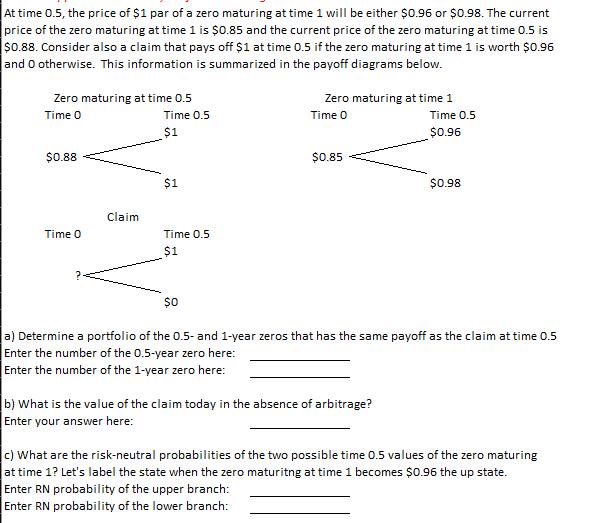

At time 0.5, the price of $1 par of a zero maturing at time 1 will be either $0.96 or $0.98. The current price of the zero maturing at time 1 is $0.85 and the current price of the zero maturing at time 0.5 is $0.88. Consider also a claim that pays off $1 at time 0.5 if the zero maturing at time 1 is worth $0.96 and O otherwise. This information is summarized in the payoff diagrams below. Zero maturing at time 0.5 Time 0 $0.88 Time 0 Claim Time 0.5 $1 $1 Time 0.5 $1 $0 Zero maturing at time 1 Time O $0.85 Time 0.5 $0.96 b) What is the value of the claim today in the absence of arbitrage? Enter your answer here: $0.98 a) Determine a portfolio of the 0.5- and 1-year zeros that has the same payoff as the claim at time 0.5 Enter the number of the 0.5-year zero here: Enter the number of the 1-year zero here: c) What are the risk-neutral probabilities of the two possible time 0.5 values of the zero maturing at time 1? Let's label the state when the zero maturitng at time 1 becomes $0.96 the up state. Enter RN probability of the upper branch: Enter RN probability of the lower branch:

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Enter the number of the 05year zero here 1 Enter the number of the 1year zero here 2 b What is the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started