Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At time t=-1, a publicly listed firm owns some assets in place and a positive NPV project in which the firm could invest at

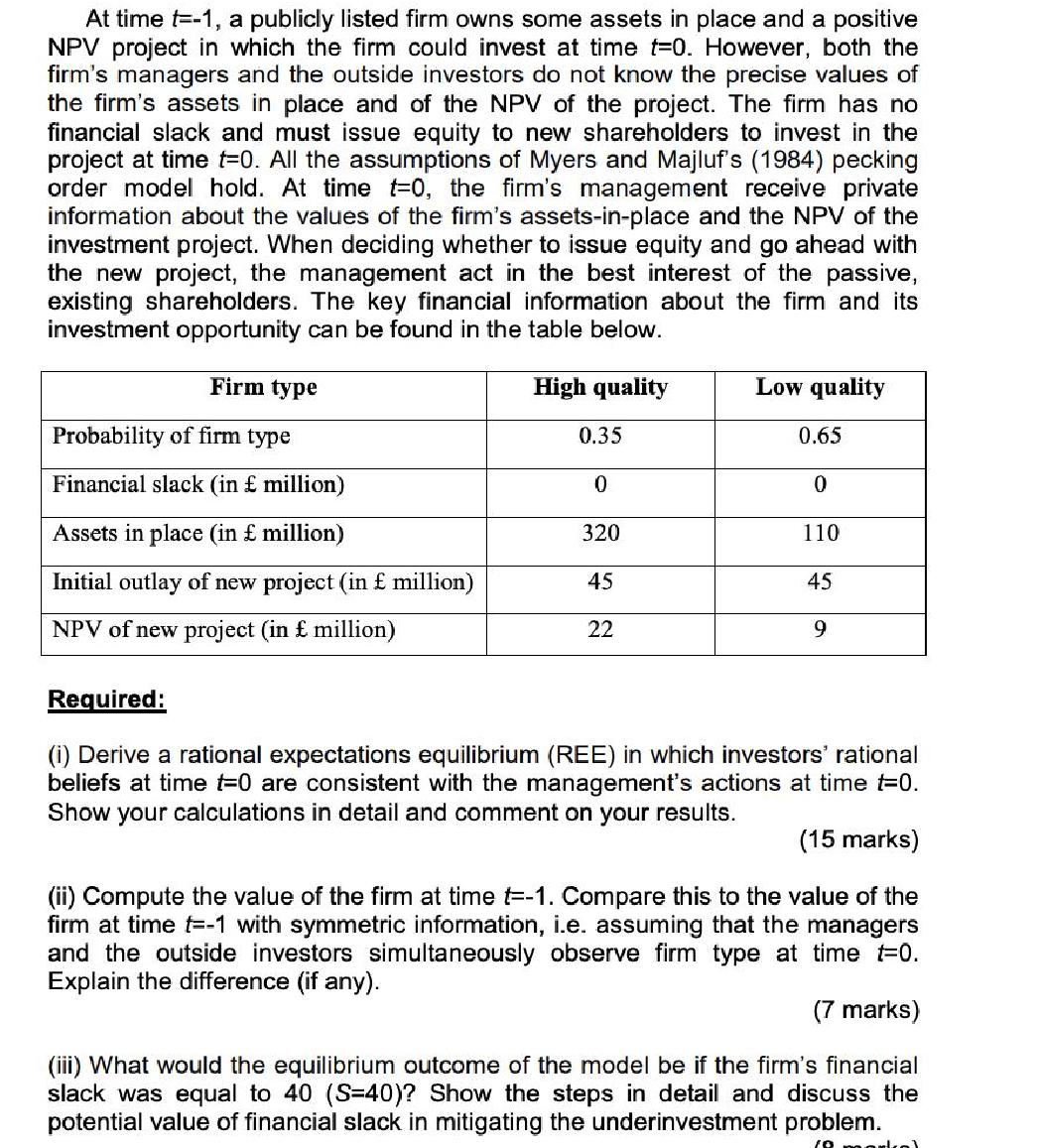

At time t=-1, a publicly listed firm owns some assets in place and a positive NPV project in which the firm could invest at time t-0. However, both the firm's managers and the outside investors do not know the precise values of the firm's assets in place and of the NPV of the project. The firm has no financial slack and must issue equity to new shareholders to invest in the project at time =0. All the assumptions of Myers and Majluf's (1984) pecking order model hold. At time =0, the firm's management receive private information about the values of the firm's assets-in-place and the NPV of the investment project. When deciding whether to issue equity and go ahead with the new project, the management act in the best interest of the passive, existing shareholders. The key financial information about the firm and its investment opportunity can be found in the table below. Firm type High quality Low quality Probability of firm type 0.35 0.65 Financial slack (in million) 0. Assets in place (in million) 320 110 Initial outlay of new project (in million) 45 45 NPV of new project (in million) 22 9 Required: (i) Derive a rational expectations equilibrium (REE) in which investors' rational beliefs at time t=0 are consistent with the management's actions at time t=0. Show your calculations in detail and comment on your results. (15 marks) (ii) Compute the value of the firm at time t=-1. Compare this to the value of the firm at time t=-1 with symmetric information, i.e. assuming that the managers and the outside investors simultaneously observe firm type at time t=0. Explain the difference (if any). (7 marks) (iii) What would the equilibrium outcome of the model be if the firm's financial slack was equal to 40 (S=40)? Show the steps in detail and discuss the potential value of financial slack in mitigating the underinvestment problem. arlco)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

i The rational expectations equilibrium REE in which investors rational beliefs at time t0 are consi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started