Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At week 0, the cash balance of Golden Sock is P1.2M and outflows exceed inflows by P600,000 every week. At the end of the

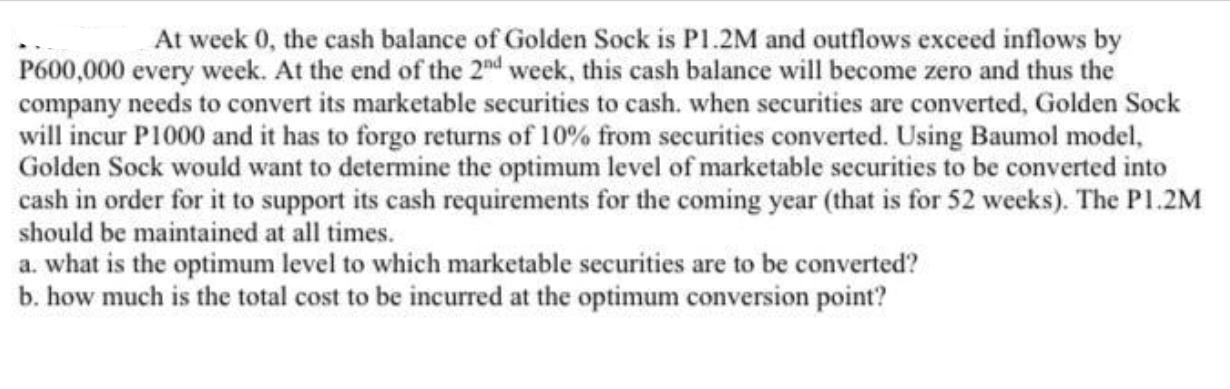

At week 0, the cash balance of Golden Sock is P1.2M and outflows exceed inflows by P600,000 every week. At the end of the 2nd week, this cash balance will become zero and thus the company needs to convert its marketable securities to cash. when securities are converted, Golden Sock will incur P1000 and it has to forgo returns of 10% from securities converted. Using Baumol model, Golden Sock would want to determine the optimum level of marketable securities to be converted into cash in order for it to support its cash requirements for the coming year (that is for 52 weeks). The P1.2M should be maintained at all times. a. what is the optimum level to which marketable securities are to be converted? b. how much is the total cost to be incurred at the optimum conversion point?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the optimum level of marketable securities to be converted into cash using the Baumol m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started