A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $ 13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the current year 20,000

A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $ 13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the current year 20,000

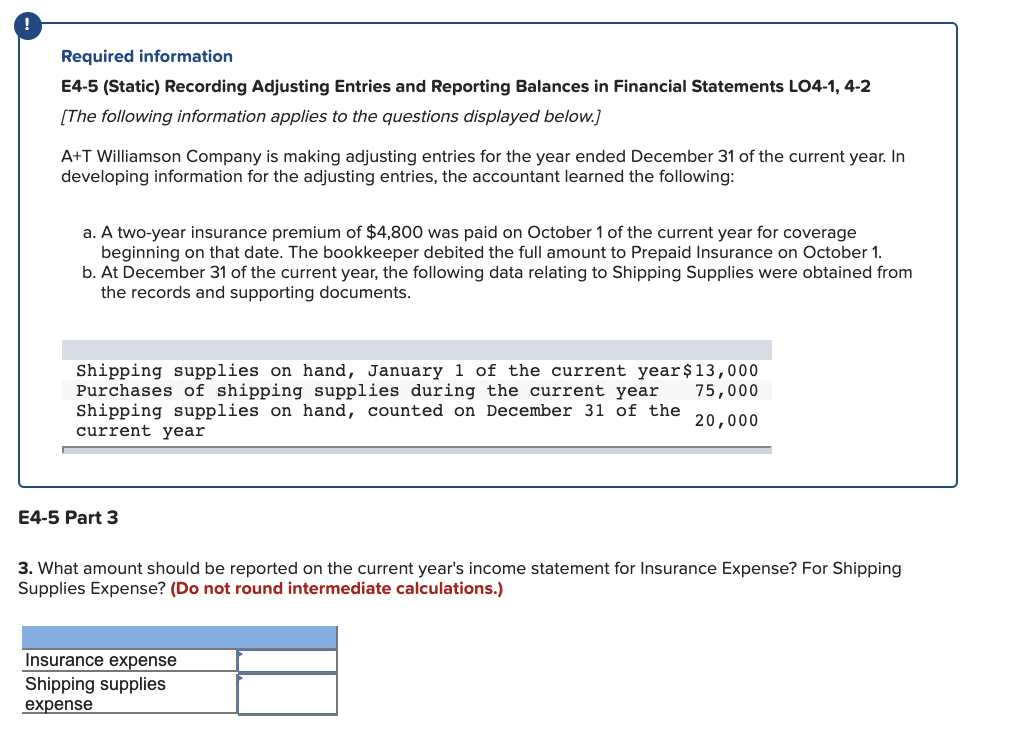

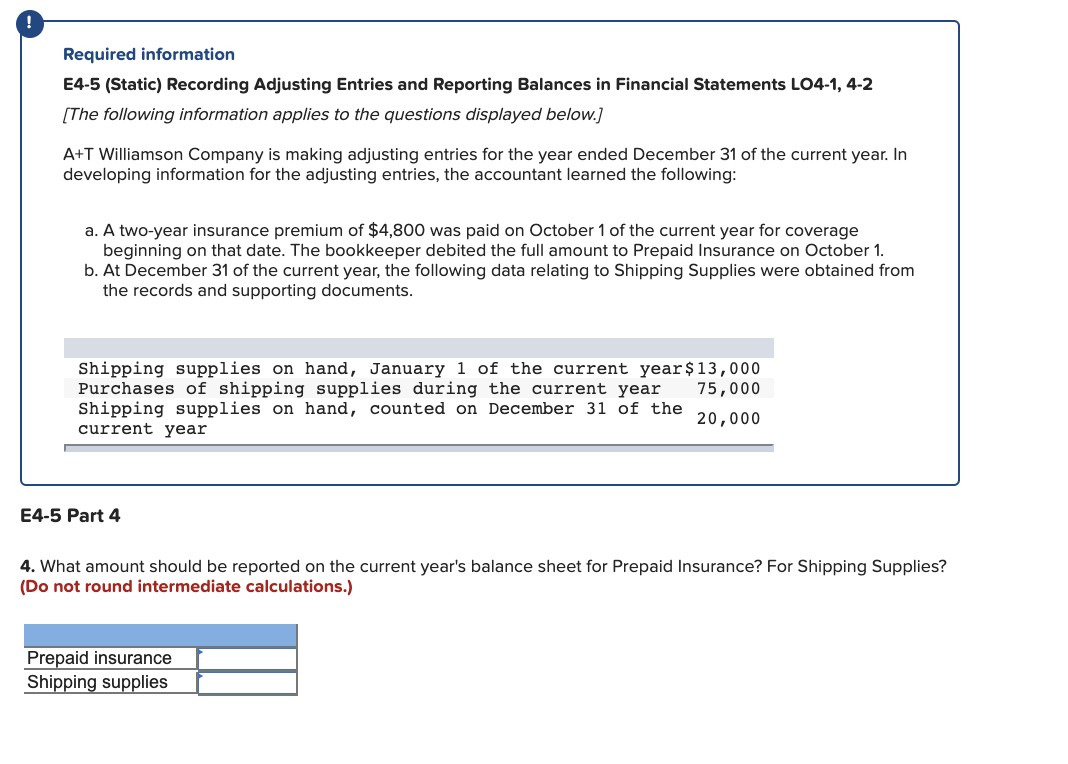

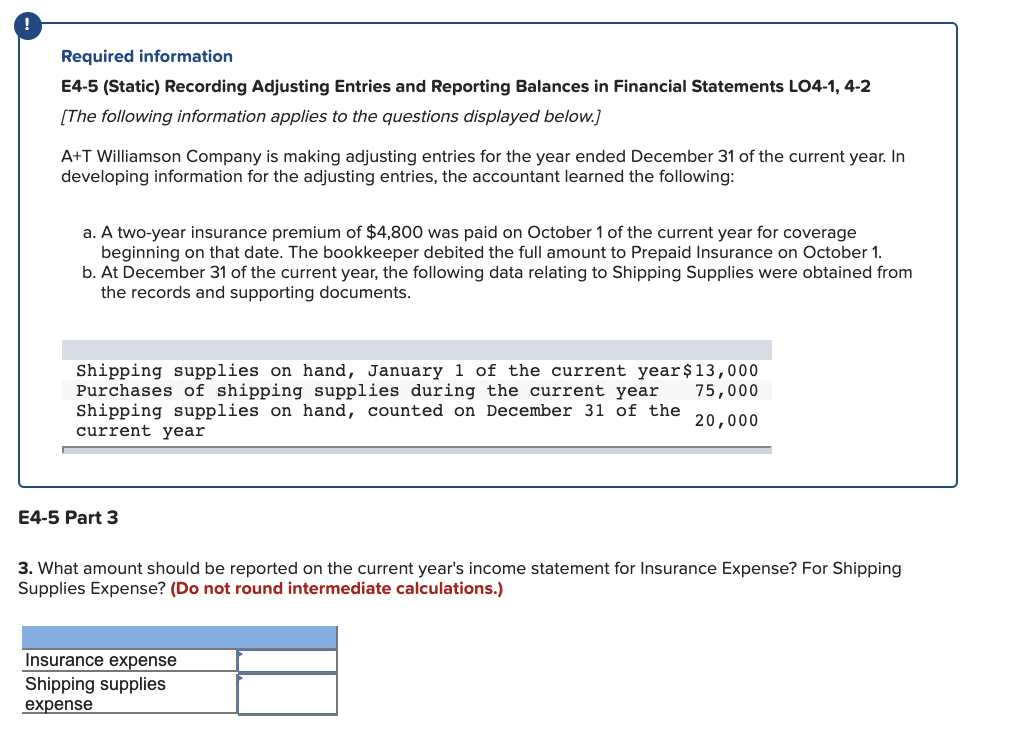

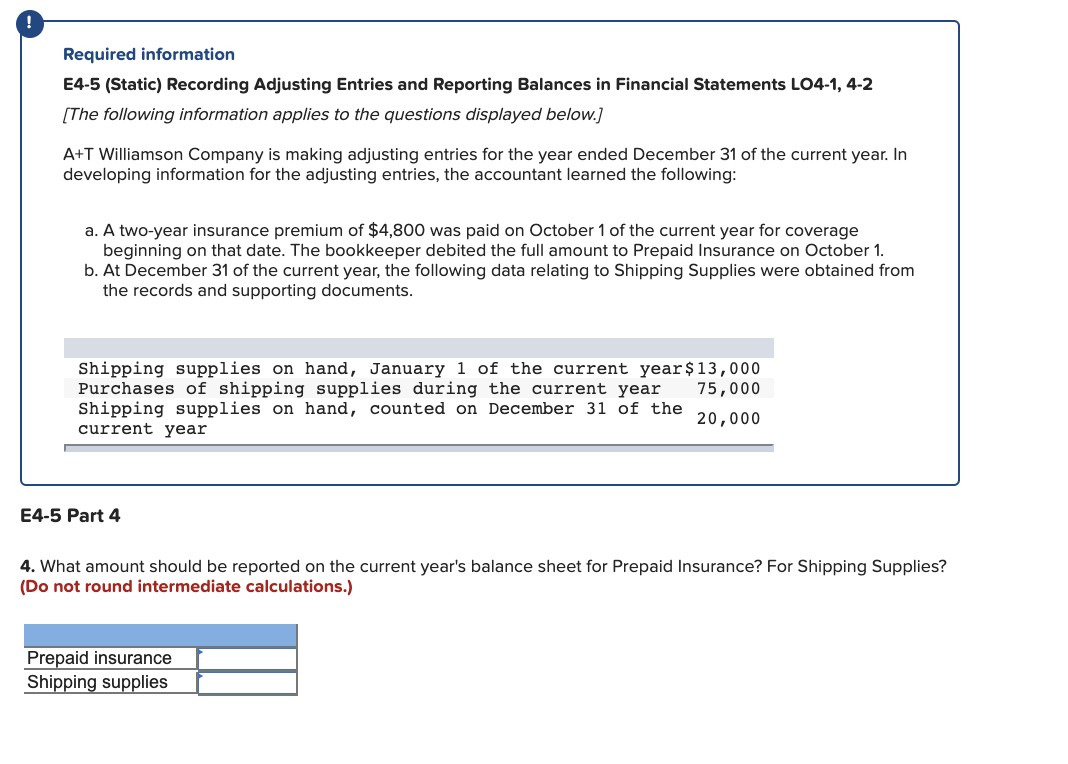

Required information E4-5 (Static) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2 [The following information applies to the questions displayed below.) A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. b. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the 20 000 current year E4-5 Part 3 3. What amount should be reported on the current year's income statement for Insurance Expense? For Shipping Supplies Expense? (Do not round intermediate calculations.) Insurance expense Shipping supplies expense Required information E4-5 (Static) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2 [The following information applies to the questions displayed below.) A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. b. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the 20.000 current year E4-5 Part 4 4. What amount should be reported on the current year's balance sheet for Prepaid Insurance? For Shipping Supplies? (Do not round intermediate calculations.) Prepaid insurance Shipping supplies

A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $ 13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the current year 20,000

A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents. Shipping supplies on hand, January 1 of the current year $ 13,000 Purchases of shipping supplies during the current year 75,000 Shipping supplies on hand, counted on December 31 of the current year 20,000