Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Dalal and John, the partners of D&J Partnership, have beginning balances of $60,000 and $50,000 respectively. The partnership has a

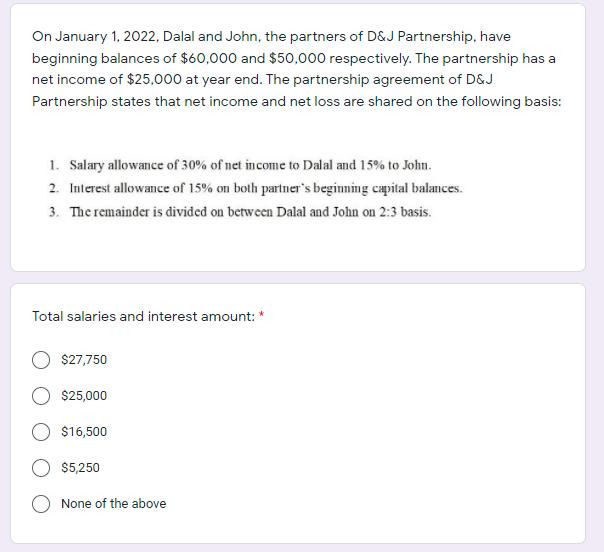

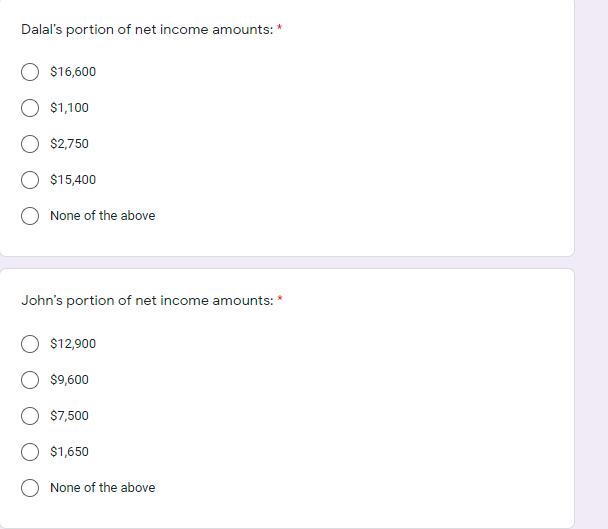

On January 1, 2022, Dalal and John, the partners of D&J Partnership, have beginning balances of $60,000 and $50,000 respectively. The partnership has a net income of $25,000 at year end. The partnership agreement of D&J Partnership states that net income and net loss are shared on the following basis: 1. Salary allowance of 30% of net income to Dalal and 15% to John. 2. Interest allowance of 15% on both partner's beginning capital balances. 3. The remainder is divided on between Dalal and John on 2:3 basis. Total salaries and interest amount: * $27,750 $25,000 $16,500 $5,250 None of the above Dalal's portion of net income amounts: * $16,600 $1,100 $2,750 $15,400 None of the above John's portion of net income amounts: * $12,900 $9,600 $7,500 $1,650 None of the above

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

E 1 Working note Statement showing Calculation of attribution of profit 2 A 3 Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started