Answered step by step

Verified Expert Solution

Question

1 Approved Answer

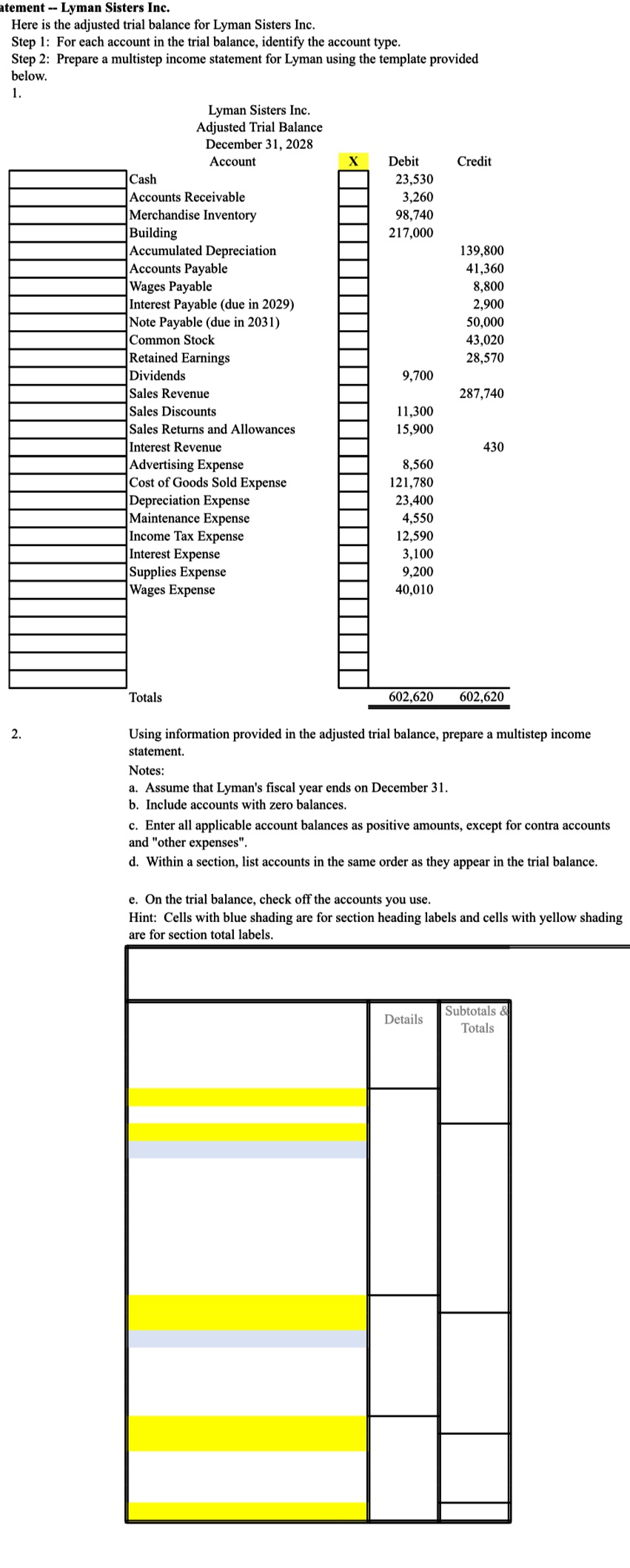

atement - Lyman Sisters Inc. Here is the adjusted trial balance for Lyman Sisters Inc. Step 1: For each account in the trial balance,

atement - Lyman Sisters Inc. Here is the adjusted trial balance for Lyman Sisters Inc. Step 1: For each account in the trial balance, identify the account type. Step 2: Prepare a multistep income statement for Lyman using the template provided below. 1. Lyman Sisters Inc. Adjusted Trial Balance December 31, 2028 Account X Debit Credit Cash 23,530 Accounts Receivable 3,260 Merchandise Inventory Building Accumulated Depreciation Accounts Payable Wages Payable 98,740 217,000 139,800 41,360 8,800 Interest Payable (due in 2029) 2,900 Note Payable (due in 2031) Common Stock 50,000 43,020 Retained Earnings Dividends 28,570 9,700 Sales Revenue 287,740 Sales Discounts 11,300 Sales Returns and Allowances 15,900 Interest Revenue 430 Advertising Expense 8,560 Cost of Goods Sold Expense 121,780 Depreciation Expense 23,400 Maintenance Expense 4,550 Income Tax Expense Interest Expense Supplies Expense 12,590 3,100 9,200 Wages Expense 40,010 Totals 602,620 602,620 2. Using information provided in the adjusted trial balance, prepare a multistep income statement. Notes: a. Assume that Lyman's fiscal year ends on December 31. b. Include accounts with zero balances. c. Enter all applicable account balances as positive amounts, except for contra accounts and "other expenses". d. Within a section, list accounts in the same order as they appear in the trial balance. e. On the trial balance, check off the accounts you use. Hint: Cells with blue shading are for section heading labels and cells with yellow shading are for section total labels. Details Subtotals & Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the adjusted trial balance provided we can prepare a multistep income statement for Lyman S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started