Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ATG 201, Class 04: Accruals and Deferrals, Page 7 Homework - To be reviewed in Class 05. This exercise has a combination of normal

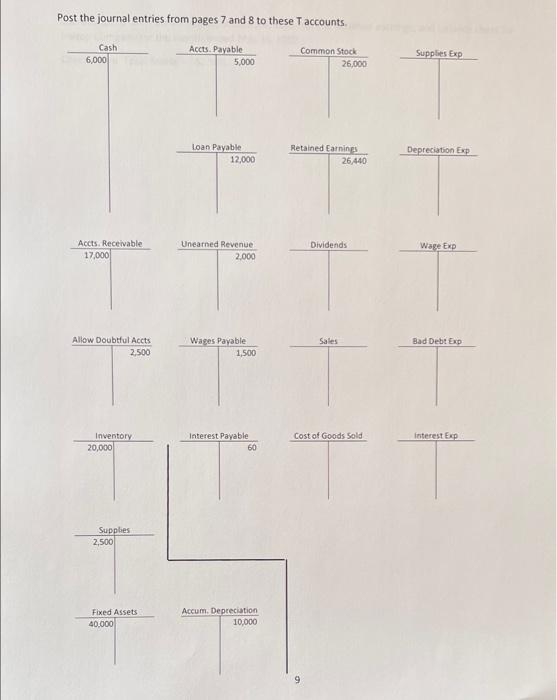

ATG 201, Class 04: Accruals and Deferrals, Page 7 Homework - To be reviewed in Class 05. This exercise has a combination of normal monthly transactions and adjusting transactions. We will start these in Class 04 if time permits. 1. Purchased inventory on credit for $38,000. 2. Had cash sales of $25,000. 3. Had credit sales of $30,000. 4. Cost of goods sold for sales was $40,000. 5. Collected $34,000 from customers on previous credit sales. 6. Sent $3,000 quote to a customer for possible job. 7. Made a loan payment of $2,000 plus the prior month s interest. 8. Paid $4,500 in wages. ($1,500 from prior month and $3,000 for the current month.) 9. Received payment in advance of completing services for $3,000. 10. Paid down accounts payable by $36,000. 11. Paid a cash dividend of $1,500. End of month adjustments 12. Accrue one month of interest payable. Use loan balance after the $2,000 payment for calculation of interest. Remember: annual interest rate is 6%. 13. Supplies on hand are $2,000. 14. Depreciation on fixed assets for the month was $1,000. 15. Wages earned but not paid are $1,000. 16. The balance in the allowance for doubtful accounts should be $3,000. 17. Completed work of $500 for previously unearned revenue. Use the space below and on the next page to record the journal entries. Post the journal entries from pages 7 and 8 to these T accounts. Cash 6,000 Accts. Receivable 17,000 Allow Doubtful Accts 2,500 Inventory 20,000 Supplies 2,500 Fixed Assets 40,000 Accts. Payable 5,000 Loan Payable 12,000 Unearned Revenue 2,000 Wages Payable 1,500 Interest Payable 60 Accum. Depreciation 10,000 Common Stock 26,000 Retained Earnings 26,440 Dividends Sales Cost of Goods Sold Supplies Exp Depreciation Exp Wage Exp Bad Debt Exp Interest Exp ATG 201, Class 04: Accruals and Deferrals, Page 10 Use this space to create an income statement, statement of retained earnings, and balance sheet for Hilltop Company for the month ended May 31, 2022. Check figure: Total Assets = $82,940.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

SNo Particulars Debit Credit 1 Inventory Account 38000 To Accounts Payable 38000 2 Cash 25000 To Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started