Answered step by step

Verified Expert Solution

Question

1 Approved Answer

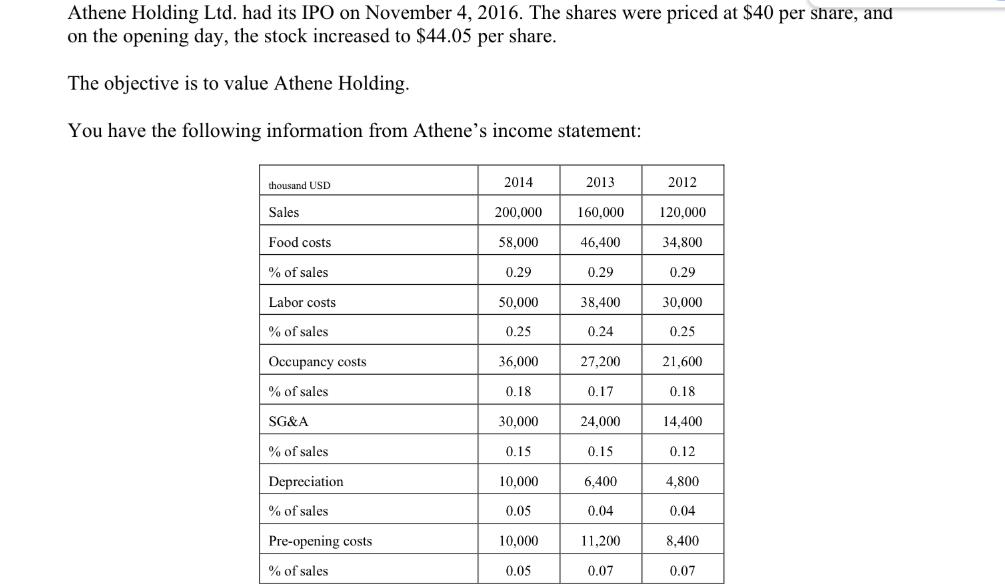

Athene Holding Ltd. had its IPO on November 4, 2016. The shares were priced at $40 per share, and on the opening day, the

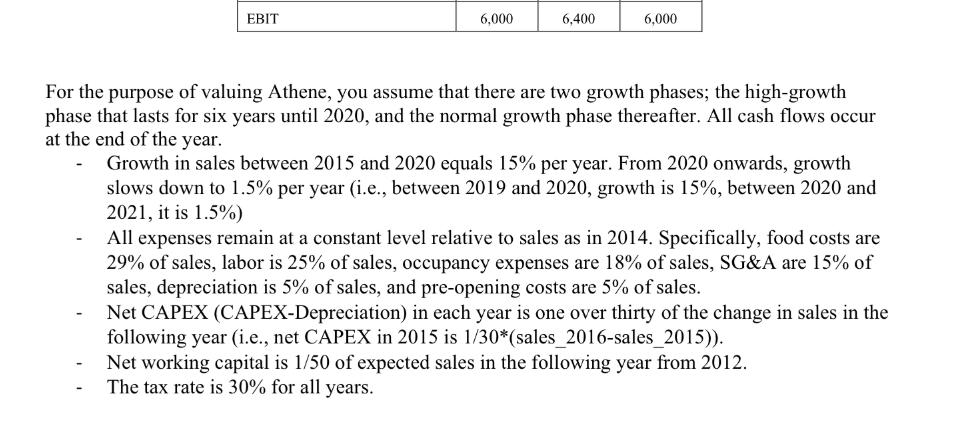

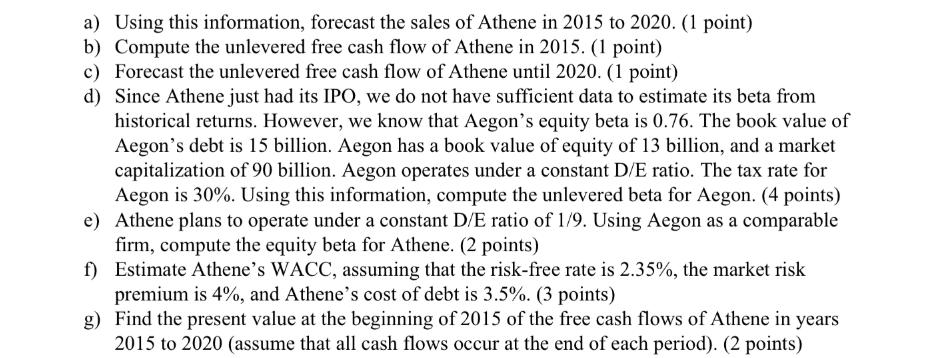

Athene Holding Ltd. had its IPO on November 4, 2016. The shares were priced at $40 per share, and on the opening day, the stock increased to $44.05 per share. The objective is to value Athene Holding. You have the following information from Athene's income statement: thousand USD Sales Food costs % of sales Labor costs % of sales Occupancy costs % of sales SG&A % of sales Depreciation % of sales Pre-opening costs % of sales 2014 200,000 58,000 0.29 50,000 0.25 36,000 0.18 30,000 0.15 10,000 0.05 10,000 0.05 2013 160,000 46,400 0.29 38,400 0.24 27,200 0.17 24,000 0.15 6,400 0.04 11,200 0.07 2012 120,000 34,800 0.29 30,000 0.25 21,600 0.18 14,400 0.12 4,800 0.04 8,400 0.07 EBIT 6,000 6.400 6,000 For the purpose of valuing Athene, you assume that there are two growth phases; the high-growth phase that lasts for six years until 2020, and the normal growth phase thereafter. All cash flows occur at the end of the year. Growth in sales between 2015 and 2020 equals 15% per year. From 2020 onwards, growth slows down to 1.5% per year (i.e., between 2019 and 2020, growth is 15%, between 2020 and 2021, it is 1.5%) All expenses remain at a constant level relative to sales as in 2014. Specifically, food costs are 29% of sales, labor is 25% of sales, occupancy expenses are 18% of sales, SG&A are 15% of sales, depreciation is 5% of sales, and pre-opening costs are 5% of sales. Net CAPEX (CAPEX-Depreciation) in each year is one over thirty of the change in sales in the following year (i.e., net CAPEX in 2015 is 1/30*(sales_2016-sales_2015)). Net working capital is 1/50 of expected sales in the following year from 2012. The tax rate is 30% for all years. a) Using this information, forecast the sales of Athene in 2015 to 2020. (1 point) b) Compute the unlevered free cash flow of Athene in 2015. (1 point) c) Forecast the unlevered free cash flow of Athene until 2020. (1 point) d) Since Athene just had its IPO, we do not have sufficient data to estimate its beta from historical returns. However, we know that Aegon's equity beta is 0.76. The book value of Aegon's debt is 15 billion. Aegon has a book value of equity of 13 billion, and a market capitalization of 90 billion. Aegon operates under a constant D/E ratio. The tax rate for Aegon is 30%. Using this information, compute the unlevered beta for Aegon. (4 points) Athene plans to operate under a constant D/E ratio of 1/9. Using Aegon as a comparable firm, compute the equity beta for Athene. (2 points) e) f) Estimate Athene's WACC, assuming that the risk-free rate is 2.35%, the market risk premium is 4%, and Athene's cost of debt is 3.5%. (3 points) g) Find the present value at the beginning of 2015 of the free cash flows of Athene in years 2015 to 2020 (assume that all cash flows occur at the end of each period). (2 points) h) Find the enterprise value for Athene. (4 points) You have the following balance sheet information (in thousand US dollars). Cash and Cash Equivalents Accounts Receivable Inventory Prepaid Expenses PP&E Other Assets Total Assets Accounts Payable Short-term Debt Accrued Expenses Long-term Debt Total Liabilities Stockholder Equity 5,400 6,600 1,200 2,800 140,000 10,000 166,000 13,000 64,000 11,000 52,000 140,000 26,000 i) Using the information, estimate the equity value for Athene. If there are 7 million shares outstanding, what is the fair value of the stock price? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTIONS IN DETAILS a Sales of Athene in 2015 to 2020 Year Sales 2015 160000 15 184400 2016 184400 15 213310 2017 213310 15 240945 2018 240945 15 273...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started