Answered step by step

Verified Expert Solution

Question

1 Approved Answer

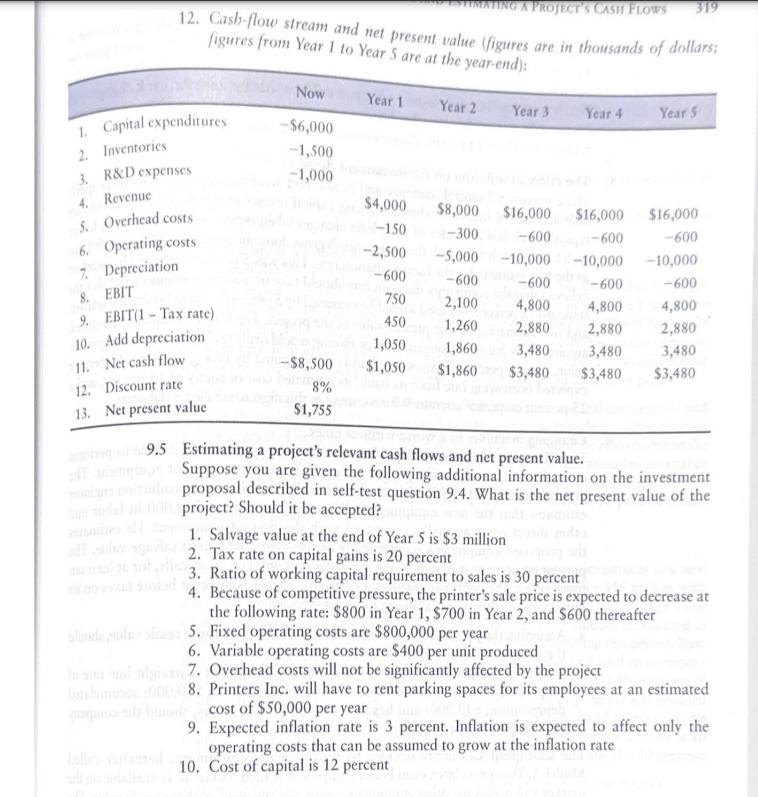

ATING A PROJECT'S CASH FLOWS 319 12. Cash-flow stream and net present value (figures are in thousands of dollars; figures from Year 1 to

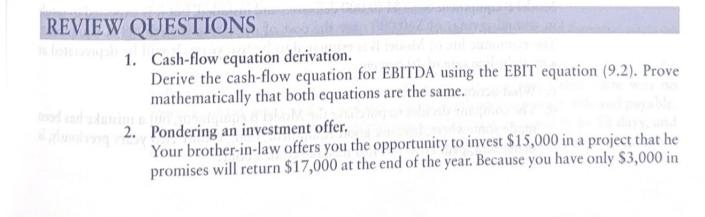

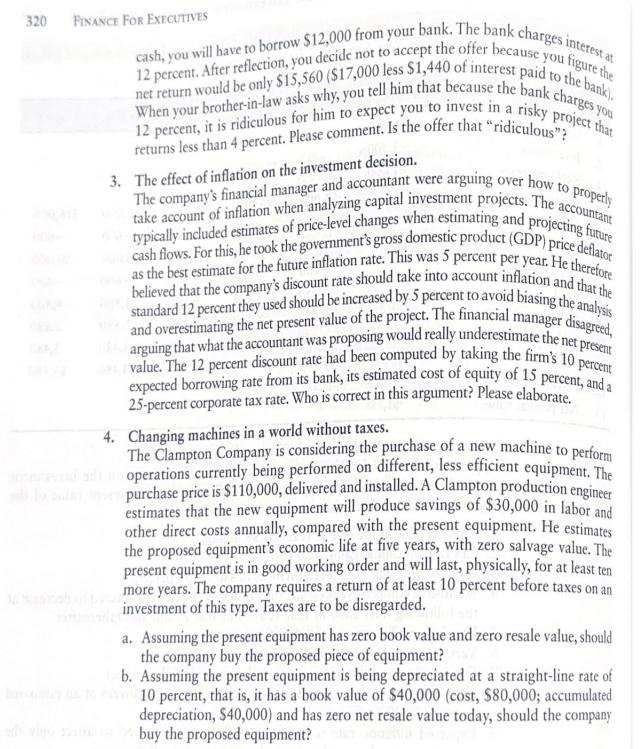

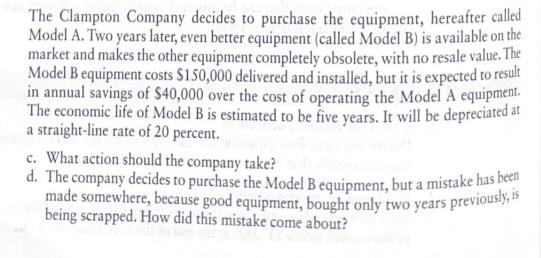

ATING A PROJECT'S CASH FLOWS 319 12. Cash-flow stream and net present value (figures are in thousands of dollars; figures from Year 1 to Year 5 are at the year-end): Now Year 1 Year 2 1. Capital expenditures Year 3 Year 4 Year 5 -$6,000 2. Inventories -1,500 3. R&D expenses -1,000 4. Revenue $4,000 $8,000 5. Overhead costs $16,000 $16,000 $16,000 -150 -300. 6. Operating costs -600 0-600 -600 -2,500 7. Depreciation 8. EBIT 9. EBIT(1 Tax rate) 10. Add depreciation 11. Net cash flow -5,000-10,000 -10,000 -10,000 -600 -600 -600 -600 -600 750 2,100 4,800 4,800 4,800 450 1,260 2,880 2,880 2,880 1,050 1,860 3,480 3,480 3,480 -$8,500 $1,050 $1,860 $3,480 $3,480 $3,480 12. Discount rate 8% 13. Net present value $1,755 9.5 Estimating a project's relevant cash flows and net present value. Suppose you are given the following additional information on the investment proposal described in self-test question 9.4. What is the net present value of the ham sorel ni 00 project? Should it be accepted? 1. Salvage value at the end of Year 5 is $3 million 2. Tax rate on capital gains is 20 percent 13. Ratio of working capital requirement to sales is 30 percent 4. Because of competitive pressure, the printer's sale price is expected to decrease at the following rate: $800 in Year 1, $700 in Year 2, and $600 thereafter blonde gullas S. Fixed operating costs are $800,000 per year 6. Variable operating costs are $400 per unit produced 7. Overhead costs will not be significantly affected by the project lam 00008. Printers Inc. will have to rent parking spaces for its employees at an estimated Lelles tasted cost of $50,000 per year 9. Expected inflation rate is 3 percent. Inflation is expected to affect only the operating costs that can be assumed to grow at the inflation rate 10. Cost of capital is 12 percent REVIEW QUESTIONS 1. Cash-flow equation derivation. Derive the cash-flow equation for EBITDA using the EBIT equation (9.2). Prove mathematically that both equations are the same. 2. Pondering an investment offer. Your brother-in-law offers you the opportunity to invest $15,000 in a project that he promises will return $17,000 at the end of the year. Because you have only $3,000 in 320 FINANCE FOR EXECUTIVES cash, you will have to borrow $12,000 from your bank. The bank charges interest at net return would be only $15,560 ($17,000 less $1,440 of interest paid to the bank). When your brother-in-law asks why, you tell him that because the bank charges you 12 percent. After reflection, you decide not to accept the offer because you figure the 12 percent, it is ridiculous for him to expect you to invest in a risky project that returns less than 4 percent. Please comment. Is the offer that "ridiculous"? 3. The effect of inflation on the investment decision. The company's financial manager and accountant were arguing over how to properly typically included estimates of price-level changes when estimating and projecting future take account of inflation when analyzing capital investment projects. The accountant cash flows. For this, he took the government's gross domestic product (GDP) price deflator as the best estimate for the future inflation rate. This was 5 percent per year. He therefore believed that the company's discount rate should take into account inflation and that the standard 12 percent they used should be increased by 5 percent to avoid biasing the analysis arguing that what the accountant was proposing would really underestimate the net present and overestimating the net present value of the project. The financial manager disagreed, expected borrowing rate from its bank, its estimated cost of equity of 15 percent, and a value. The 12 percent discount rate had been computed by taking the firm's 10 percent 25-percent corporate tax rate. Who is correct in this argument? Please elaborate. 4. Changing machines in a world without taxes. The Clampton Company is considering the purchase of a new machine to perform operations currently being performed on different, less efficient equipment. The purchase price is $110,000, delivered and installed. A Clampton production engineer estimates that the new equipment will produce savings of $30,000 in labor and other direct costs annually, compared with the present equipment. He estimates the proposed equipment's economic life at five years, with zero salvage value. The present equipment is in good working order and will last, physically, for at least ten more years. The company requires a return of at least 10 percent before taxes on an investment of this type. Taxes are to be disregarded. a. Assuming the present equipment has zero book value and zero resale value, should the company buy the proposed piece of equipment? b. Assuming the present equipment is being depreciated at a straight-line rate of 10 percent, that is, it has a book value of $40,000 (cost, $80,000; accumulated depreciation, $40,000) and has zero net resale value today, should the company avo buy the proposed equipment? The Clampton Company decides to purchase the equipment, hereafter called Model A. Two years later, even better equipment (called Model B) is available on the market and makes the other equipment completely obsolete, with no resale value. The Model B equipment costs $150,000 delivered and installed, but it is expected to result in annual savings of $40,000 over the cost of operating the Model A equipment. The economic life of Model B is estimated to be five years. It will be depreciated at a straight-line rate of 20 percent. c. What action should the company take? d. The company decides to purchase the Model B equipment, but a mistake has been made somewhere, because good equipment, bought only two years previously, is being scrapped. How did this mistake come about?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started