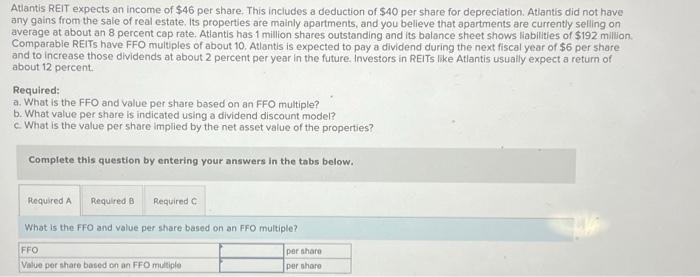

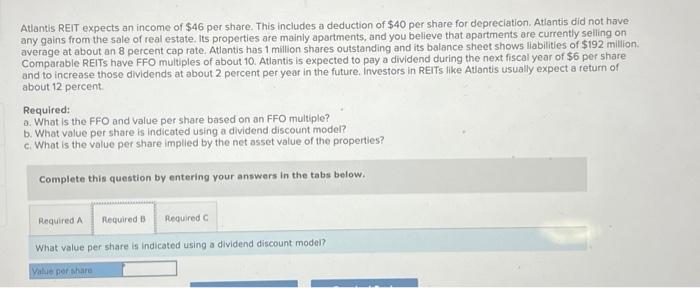

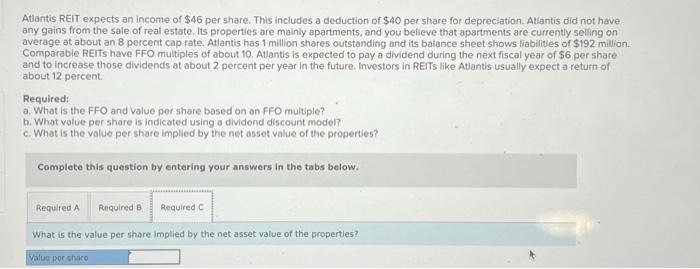

Atlantis REIT expects an income of $46 per share. This includes a deduction of $40 per share for depreciation. Atlantis did not have any gains from the sale of real estate. its properties are malnly apartments, and you belleve that apartments are currently selting on average at about an 8 percent cap rate. Atlantis has 1 million shares outstanding and its balance sheet shows liabilities of $192 million. Comparable REITs have FFO multiples of about 10, Atlontis is expected to pay a dividend during the next fiscal year of $6 per share and to increase those dividends at about 2 percent per year in the future. Investors in REITs like Atlantis usually expect a return of about 12 percent. Required: a. What is the FFO and value per share based on an FFO multiple? b. What value per share is indicated using a dividend discount model? c. What is the value per share implied by the net asset value of the properties? Complete this question by entering your answers in the tabs below. What is the FFO and value per share based on an FFO multiple? Atlantis REIT expects an income of $46 per share. This includes a deduction of $40 per share for depreciation. Atlantis did not have any gains from the sale of real estate. Its properties are mainly apartments, and you believe that apartments are currently selling on average at about an 8 percent cap rate. Atlantis has 1 milion shares outstanding and its balance sheet shows liabilities of $192 million. Comparable REITs have FFO multiples of about 10. Atlantis is expected to pay a dividend during the next fiscal year of $6 per share and to increase those dividends at about 2 percent per year in the future. Investors in REITs like Atiantis usually expect a return of about 12 percent. Required: a. What is the FFO and value per share based on an FFO multiple? b. What value per share is indicated using a dividend discount model? c. What is the value per share implied by the net asset value of the properties? Complete this question by entering your answars in the tabs below. What value per share is indicated using a dividend discount model? Atlantis REIT expects an income of $46 per share. This includes a deduction of $40 per share for depreciation. Attantis did not have any gains from the sale of real estate. its properties are mainly apartments, and you believe that apartments are eurrently selling on average at about an 8 percent cap rate. Atlantis has 1 million shares outstanding and its balance sheet shows liabilities of $192 million. Comparable REITs have FFO multiples of about 10. Atlantis is expected to pay a dividend during the next fiscal year of $6 per share and to increase those dividends at about 2 percent per year in the future. Investors in REITs like Atiantis usually expect a return of about 12 percent. Required: a. What is the FFO and value per share based on an FFO multiple? b. What value per share is indicated using o dividend discount model? c. What is the value per share implied by the net asset value of the properties? Complete this question by entering your answers in the tabs below. What is the value per share implied by the net asset value of the properties