Question

Atlas Bolt and Lotto company began the year with Total Assets = $100,000 (all cash); Total Liabilities equal to $70,000 (all bank borrowings) and

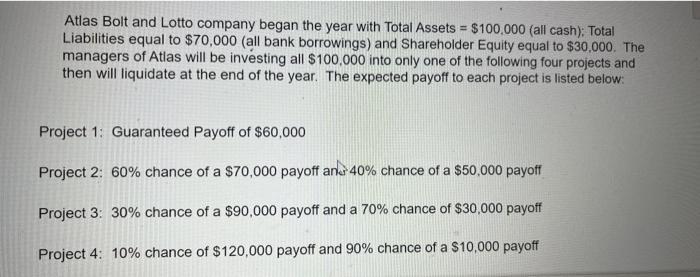

Atlas Bolt and Lotto company began the year with Total Assets = $100,000 (all cash); Total Liabilities equal to $70,000 (all bank borrowings) and Shareholder Equity equal to $30,000. The managers of Atlas will be investing all $100,000 into only one of the following four projects and then will liquidate at the end of the year. The expected payoff to each project is listed below: Project 1: Guaranteed Payoff of $60,000 Project 2: 60% chance of a $70,000 payoff an 40% chance of a $50,000 payoff Project 3: 30% chance of a $90,000 payoff and a 70% chance of $30,000 payoff Project 4: 10% chance of $120,000 payoff and 90% chance of a $10,000 payoff

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the expected payoff for each project we multip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Accounting

Authors: Belverd Needles, Marian Powers, Susan Crosson

10th edition

618736611, 978-1111809508, 111180950X, 978-0618736614

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App