Answered step by step

Verified Expert Solution

Question

1 Approved Answer

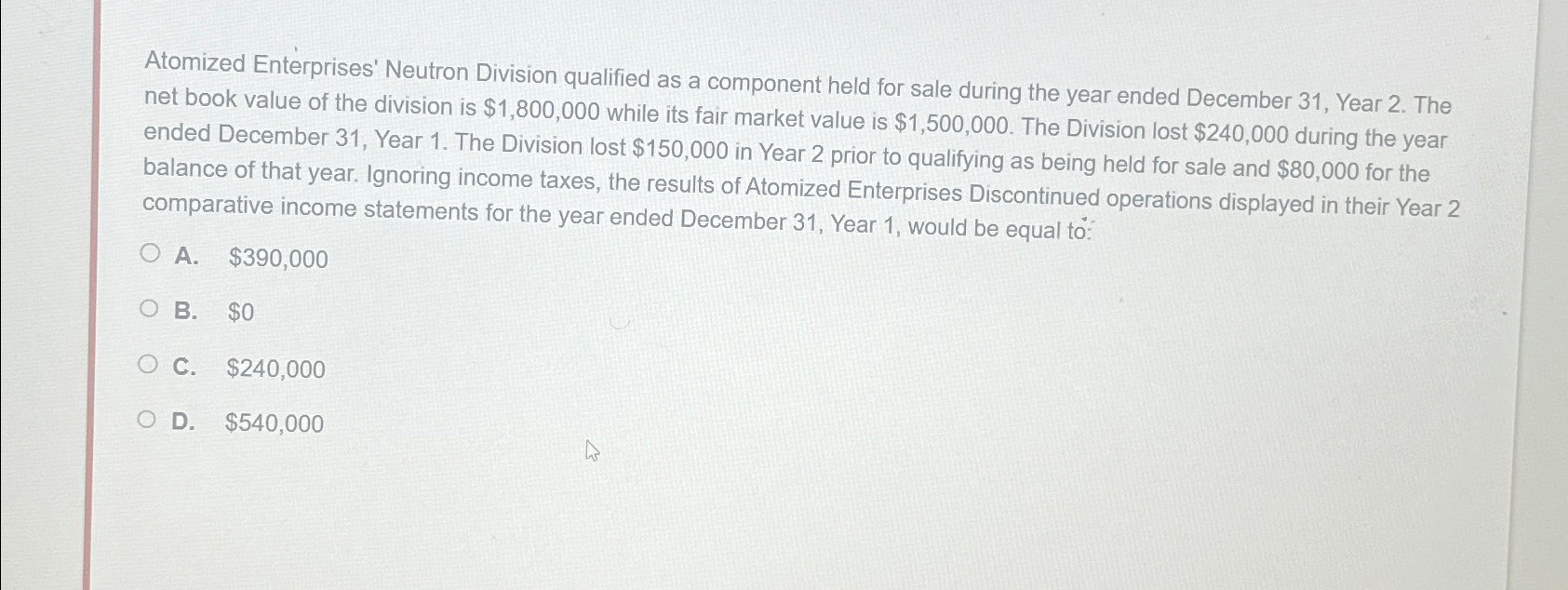

Atomized Enterprises' Neutron Division qualified as a component held for sale during the year ended December 3 1 , Year 2 . The net book

Atomized Enterprises' Neutron Division qualified as a component held for sale during the year ended December Year The net book value of the division is $ while its fair market value is $ The Division lost $ during the year ended December Year The Division lost $ in Year prior to qualifying as being held for sale and $ for the balance of that year. Ignoring income taxes, the results of Atomized Enterprises Discontinued operations displayed in their Year comparative income statements for the year ended December Year would be equal to:

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started