Answered step by step

Verified Expert Solution

Question

1 Approved Answer

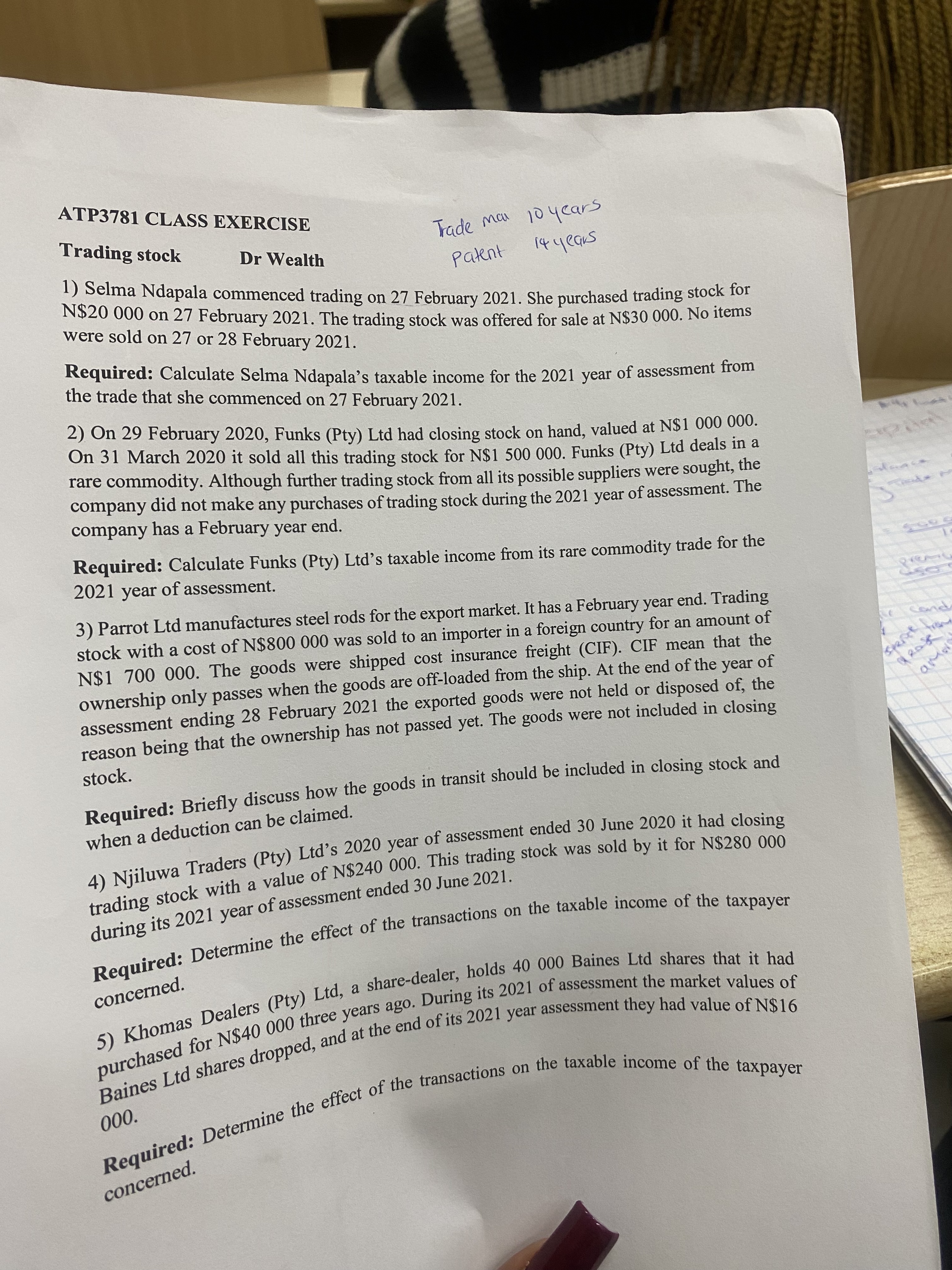

ATP 3 7 8 1 CLASS EXERCISE Trading stock Dr Wealth Trade mai 1 0 years patent 1 4 years Selma Ndapala commenced trading on

ATP CLASS EXERCISE

Trading stock

Dr Wealth

Trade mai years

patent years

Selma Ndapala commenced trading on February She purchased trading stock for N$ on February The trading stock was offered for sale at N$ No items were sold on or February

Required: Calculate Selma Ndapala's taxable income for the year of assessment from the trade that she commenced on February

On February Funks Pty Ltd had closing stock on hand, valued at N$ On March it sold all this trading stock for N$ Funks Pty Ltd deals in a rare commodity. Although further trading stock from all its possible suppliers were sought, the company did not make any purchases of trading stock during the year of assessment. The company has a February year end.

Required: Calculate Funks Pty Ltds taxable income from its rare commodity trade for the year of assessment.

Parrot Ltd manufactures steel rods for the export market. It has a February year end. Trading stock with a cost of $ was sold to an importer in a foreign country for an amount of N$ The goods were shipped cost insurance freight CIF CIF mean that the ownership only passes when the goods are offloaded from the ship. At the end of the year of assessment ending February the exported goods were not held or disposed of the reason being that the ownership has not passed yet. The goods were not included in closing stock.

Required: Briefly discuss how the goods in transit should be included in closing stock and when a deduction can be claimed.

Njiluwa Traders Pty Ltds year of assessment ended June it had closing trading stock with a value of $ This trading stock was sold by it for $ during its year of assessment ended June

Required: Determine the effect of the transactions on the taxable income of the taxpayer concerned.

Khomas Dealers Pty Ltd a sharedealer, holds Baines Ltd shares that it had purchased for $ three years ago. During its of assessment the market values of

Required: Determine the effect of the transactions on the taxable income of the tax concerned.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started