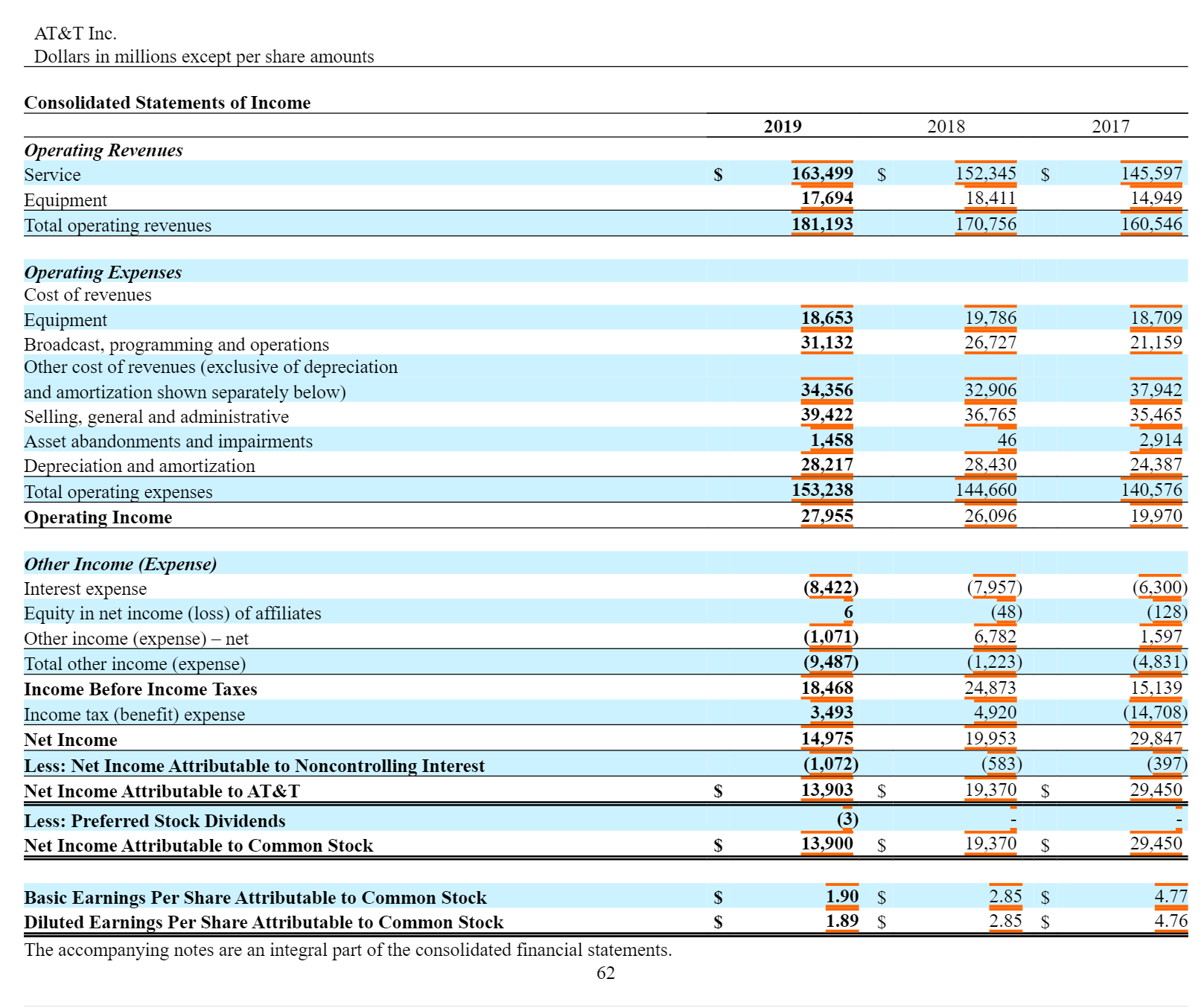

AT&T Inc. Dollars in millions except per share amounts Operating revenues increased in 2019, primarily due to including a full year's worth of Time Warner results, which was acquired in June 2018. Partially oifsetting the increase were declines in the Communications segment driven by continued pressure in legacy and video services and lower wireless equipment upgrades that were offset by growth in advanced data and wireless services. Operations and support expenses increased in 2019, primarily due to our 2018 acquisition of Time Warner and the abandonment of certain copper assets that will not be necessary to support future network activity (see Note 7). The increase was partially offset by lower costs in our Communications segment, specically fewer subscribers contributing to lower content costs, lower upgrades driving a decline in wireless equipment costs and our continued focus on cost management. Depreciation and amortization expense decreased in 2019. Amortization expense decreased $415, or 5.0%, in 2019 primarily due to the amortization of intangibles associated with WarnerMedia. We expect continued declines in amortization expense, reecting the accelerated method of amortization applied to certain of the WamerMedia intangibles. Depreciation expense increased $202, or 1.0%, in 2019 primarily due to the Time Warner acquisition. Operating income increased in 2019 and 2018. Our operating margin was 15.4% in 2019, compared to 15.3% in 2018 and 12.4% in 2017. Interest expense increased in 2019, primarily due to lower capitalized interest associated with putting spectrum into network service. Equity in net income (loss) of affiliates increased in 2019, primarily due to the sale of Hulu, which had losses of $44 in 2019 and $105 in 2018. (See Note 6) Other income (expense) net decreased in 2019 primarily due to the recognition of $5,171 in actuarial losses, compared to gains of $3,412 in 2018. Also contributing to the decline were higher debt redemption costs, partially offset by increased income from Rabbi trusts and other investments and gains from the sales of nonstrategic assets. Income tax expense decreased in 2019, primarily driven by a decrease in income before income taxes. Our effective tax rate was 18.9% in 2019, 19.8% in 2018, and (97.2)% in 2017. All years were impacted by The Tax Cuts and Jobs Act, which was enacted in 2017. Segment Results Our segments are strategic business units that offer different products and services over various technology platforms and/or in different geographies that are managed accordingly. Our segment results presented below follow our internal management reporting. In addition to segment operating contribution, we also evaluate segment performance based on EBITDA and/or EBITDA margin. EBITDA is dened as segment operating contribution, excluding equity in net income (loss) of affiliates and depreciation and amortization. We believe EBITDA to be a relevant and useful measurement to our investors as it is part of our internal management reporting and planning processes and it is an important metric that management uses to evaluate operating performance. EBITDA does not give effect to cash used for debt service requirements and thus does not reect available funds for distributions, reinvestment or other discretionary uses. EBITDA margin is EBITDA divided by total revenues. 29 AT&T Inc. Dollars in millions except per share amounts Consolidated Statements of Income 2019 2018 2017 Operating Revenues Service 163,499 152,345 145,597 Equipment 17,694 18,411 14.949 Total operating revenues 181,193 170,756 60,546 Operating Expenses Cost of revenues Equipment 18,653 19,786 18,709 Broadcast, programming and operations 31,132 26,727 21,159 Other cost of revenues (exclusive of depreciation and amortization shown separately below) 34.356 32,906 37,942 Selling, general and administrative 39.422 36.765 35,465 Asset abandonments and impairments 1,458 46 2,914 Depreciation and amortization 28,217 28,430 24,387 Total operating expenses 153,238 144,660 140,576 Operating Income 27,955 26,096 19,970 Other Income (Expense) Interest expense (8,422) 7,957 6,300) Equity in net income (loss) of affiliates 6 48 (128) Other income (expense) - net (1,071) 5,782 1.597 Total other income (expense) 9,487) 1,223 4,831 Income Before Income Taxes 18,468 24,873 15,139 Income tax (benefit) expense 3.493 4,920 14,708 Net Income 14,975 19.953 29,847 Less: Net Income Attributable to Noncontrolling Interest 1,072 583 397 Net Income Attributable to AT&T $ 13,903 $ 19,370 $ 29,450 Less: Preferred Stock Dividends (3) Net Income Attributable to Common Stock 13.900 S 19,370 $ 29,450 Basic Earnings Per Share Attributable to Common Stock 1.90 2.85 4.7 A tA Diluted Earnings Per Share Attributable to Common Stock 1.89 S 2.85 4.76 The accompanying notes are an integral part of the consolidated financial statements. 62