Answered step by step

Verified Expert Solution

Question

1 Approved Answer

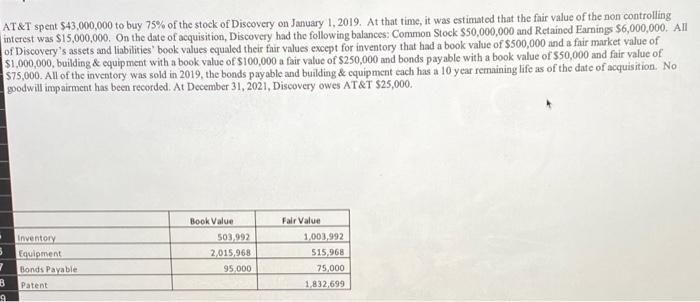

AT&T spent $43,000,000 to buy 75% of the stock of Discovery on January 1, 2019. At that time, it was estimated that the fair

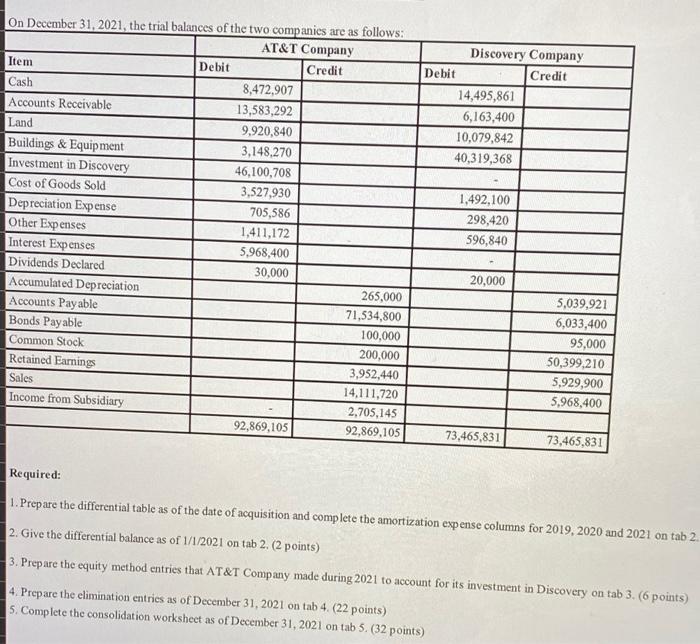

AT&T spent $43,000,000 to buy 75% of the stock of Discovery on January 1, 2019. At that time, it was estimated that the fair value of the non controlling interest was $15,000,000. On the date of acquisition, Discovery had the following balances: Common Stock $50,000,000 and Retained Earnings $6,000,000. All of Discovery's assets and liabilities' book values equaled their fair values except for inventory that had a book value of $500,000 and a fair market value of $1,000,000, building & equipment with a book value of $100,000 a fair value of $250,000 and bonds payable with a book value of $50,000 and fair value of $75,000. All of the inventory was sold in 2019, the bonds payable and building & equipment each has a 10 year remaining life as of the date of acquisition. No goodwill impairment has been recorded. At December 31, 2021, Discovery owes AT&T $25,000. . Inventory 3 Equipment 7 B 9 Bonds Payable Patent Book Value 503,992 2,015,968 95,000 Fair Value 1,003,992 $15,968 75,000 1,832,699 On December 31, 2021, the trial balances of the two companies are as follows: AT&T Company Credit Item Cash Accounts Receivable Land Buildings & Equipment Investment in Discovery Cost of Goods Sold Depreciation Expense Other Expenses Interest Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Subsidiary Debit 8,472,907 13,583,292 9,920,840 3,148,270 46,100,708 3,527,930 705,586 1,411,172 5,968,400 30,000 92,869,105 265,000 71,534,800 100,000 200,000 3,952,440 14,111,720 2,705,145 92,869,105 Debit Discovery Company Credit 14,495,861 6,163,400 10,079,842 40,319,368 1,492,100 298,420 596,840 20,000 73,465,831 5,039,921 6,033,400 95,000 50,399,210 5,929,900 5,968,400 73,465,831 Required: 1. Prepare the differential table as of the date of acquisition and complete the amortization expense columns for 2019, 2020 and 2021 on tab 2. 2. Give the differential balance as of 1/1/2021 on tab 2. (2 points) 3. Prepare the equity method entries that AT&T Company made during 2021 to account for its investment in Discovery on tab 3. (6 points) 4. Prepare the elimination entries as of December 31, 2021 on tab 4. (22 points) 5. Complete the consolidation worksheet as of December 31, 2021 on tab 5. (32 points)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the consolidated balance sheet for ATT and Discovery after the acquisition we need to consider the following information ATT purchased 75 of Discoverys stock for 43000000 on January 1 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started