Question

Attached are financial statements for Attila Ltd. for the year that just ended. The company is considering a new strategy for the upcoming year with

Attached are financial statements for Attila Ltd. for the year that just ended. The company is considering a new strategy for the upcoming year with the following elements:

The new marketing manager has convinced the owners to boost the marketing budget. The company will now spend 20% more than last year on advertising and promotion, and as a result expects sales to increase by 25% in the coming year.

The cost of goods sold is expected to be lower, dropping by 5 percentage points relative to sales.

They also plan keep the same closing inventory level as in the previous year, even though their sales are expected to be higher. They will achieve this by buying $55,000 of new equipment that will make the company's manufacturing operations more efficient. The new equipment is expected to be delivered on June 30th, and will be financed entirely by an equipment lease. It will and will be depreciated over 10 years (all capital assets are depreciated on a straight-line basis). This new equipment will add $15,000 to current annual maintenance costs.

All other accounts will maintain their current proportion to sales revenues, except as follows:

Salaries are expected to go up by 3.5%

The income tax rate will remain the same.

No new shares will be issued. But the paid dividends will increase by 50%.

Annual depreciation amounts for the existing assets will stay the same.

Existing long-term liabilities and capital assets will be unchanged.

A regularly scheduled rent increase of 15% is scheduled for July 1st.

Based on the above information, create a proforma income statement, balance sheet, cashflow, and statement of retained earnings for Attila Ltd. for the upcoming year.

Use Cash as the "plug" number on the balance sheet.

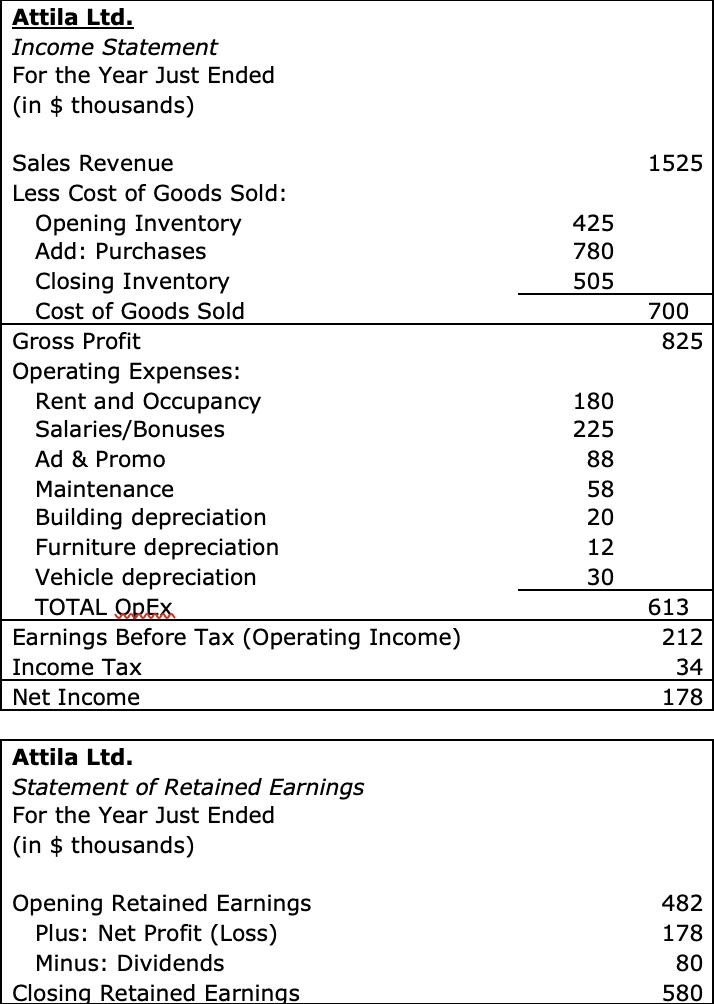

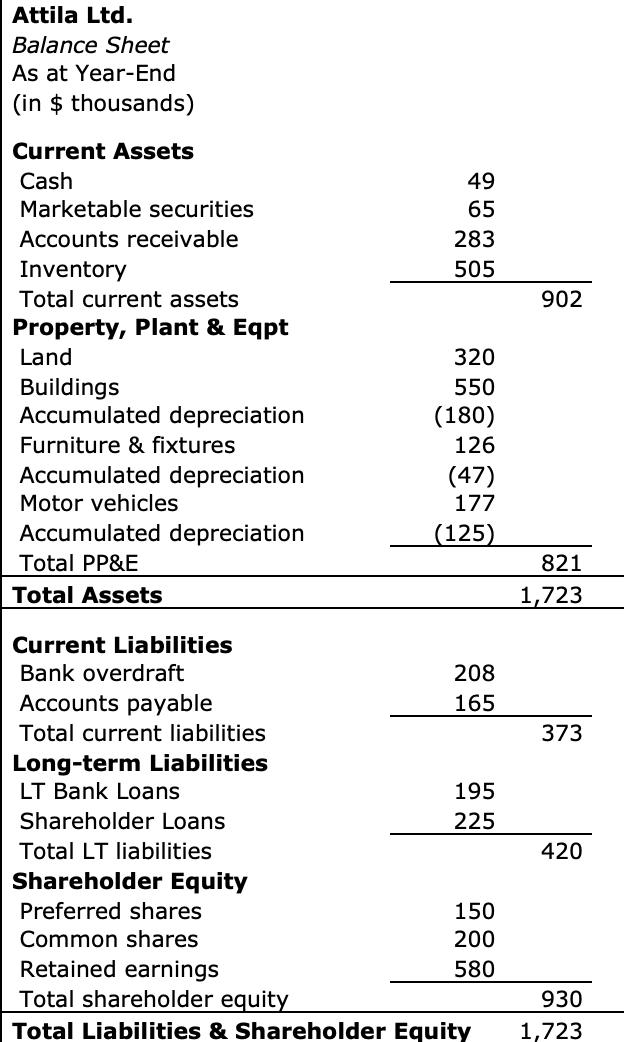

Attila Ltd. Income Statement For the Year Just Ended (in $ thousands) Sales Revenue Less Cost of Goods Sold: Opening Inventory Add: Purchases Closing Inventory Cost of Goods Sold Gross Profit Operating Expenses: Rent and Occupancy Salaries/Bonuses Ad & Promo Maintenance Building depreciation Furniture depreciation Vehicle depreciation TOTAL ODEX Earnings Before Tax (Operating Income) Income Tax Net Income Attila Ltd. Statement of Retained Earnings For the Year Just Ended (in $ thousands) Opening Retained Earnings Plus: Net Profit (Loss) Minus: Dividends Closing Retained Earnings 425 780 505 180 225 88 58 20 12 30 1525 700 825 613 212 34 178 482 178 80 580

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started