Question

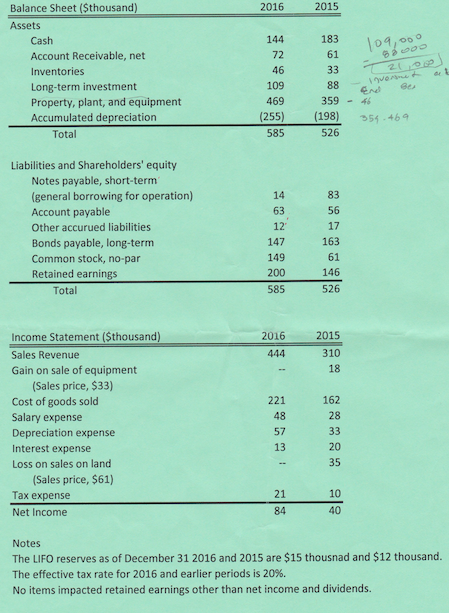

Attached are the condensed balance sheet, income statement and notes for CDX Company, COX prepares it financial statements in accordance with U.S.GAAP. Its inventory valuation

Attached are the condensed balance sheet, income statement and notes for CDX Company, COX prepares it financial statements in accordance with U.S.GAAP. Its inventory valuation method is LIFO. Assume all purchases and sales are on credit, and there were no disposals of fixed assets during 2014 (12/31/2014)

1. How much inventory did CDX purchase in 2014?

2. How much dividend did CDX pay in 2014?

3. Calculate Number of days of payables' of CDX in 2014. (To the first decimal place)

4. Calculate Cash conversion cycle' of CDX in 2014. (To the first decimal place)

5. Calculate "Cash flow from operating activities' of CDX in 2014.

6. Calculate 'Cash flow from investing activities' of CDX in 2014

7. Calculate 'Cash flow from financing activities' of CDX in 2014

8. What amount would CDX's cost of goods sold for 2014 be if it had used the FIFO method instead of the LIFO method

9. What is the cumulative amount of income tax savings that CDX has generated through 2014 by using the LIFO method instead of the FIFO method?

10. Calculate 'Inventory turnover ratio of place) CDX in 2014 under the FIFO method. (To the first decimal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started