Answered step by step

Verified Expert Solution

Question

1 Approved Answer

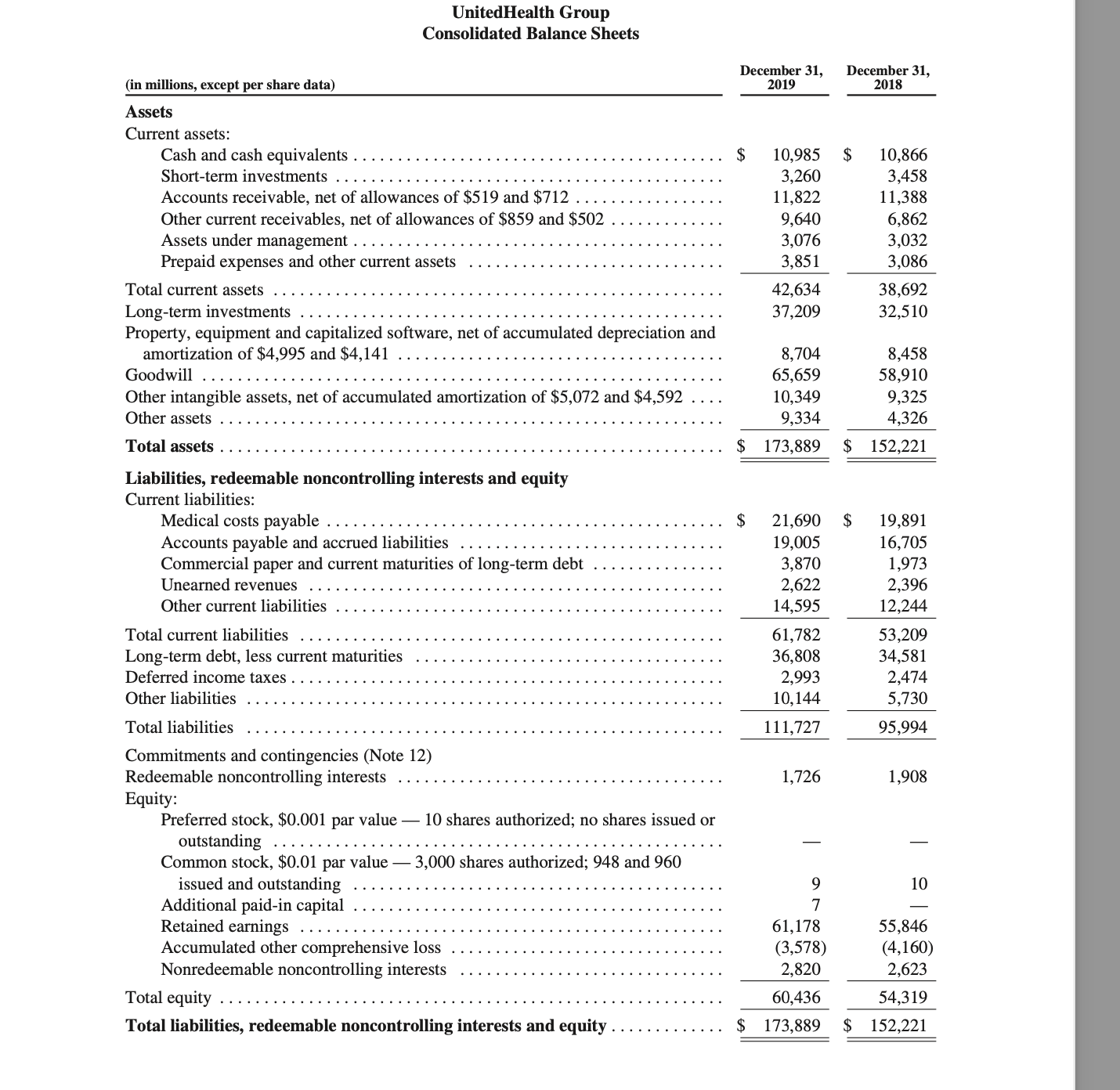

Attached are the Consolidated Balance Sheet, Consolidated Statement of Cash Flows, and selected footnotes from the 2 0 1 9 Annual Report of UnitedHealth Group.

Attached are the Consolidated Balance Sheet, Consolidated Statement of Cash Flows, and selected footnotes from the Annual Report of UnitedHealth Group. For a brief description of the companys business and organization, refer to Note What is the net book value of UnitedHealth Groups longterm debt on December How much of that do they expect to repay within the next months? Is the net book value of UnitedHealth Groups longterm debt on December higher than, lower than, or the same as its face value? By how much? Is the effective rate on the notes due December greater than, less than, or the same as the coupon rate? Explain your answer and reasoning. Did UnitedHealth Group recognize any interest expense pertaining to their notes due February during fiscal year If yes, how much? a What is the estimated fair value of longterm debt at the end of fiscal year b Is the estimated fair value of longterm debt greater than, smaller than, or the same as the net book value you identified in question above? What might explain the difference, if any? c As an analyst, do you think that the fair value or the book value is a better measure of UnitedHealths longterm debt? UnitedHealth had public debt that came due during fiscal year a How much cash did they actually pay in to retire this debt? b Was the amount they paid to retire that debt greater than, smaller than, or the same as its book value at the time of retirement? Explain. c Suppose that in fiscal UnitedHealth instead retired their notes due December early. How much cash would they have to pay in Would it generate a gain or a loss? Explain your answer. UnitedHealth Group

Consolidated Statements of Cash Flows Description of Business

UnitedHealth Group Incorporated individually and together with its subsidiaries, "UnitedHealth Group" and

"the Company" is a diversified health care company dedicated to helping people live healthier lives and helping

make the health system work better for everyone.

Through its diversified family of businesses, the Company leverages core competencies in data and health

information; advanced technology; and clinical expertise. These core competencies are deployed within two

distinct, but strategically aligned, business platforms: health benefits operating under UnitedHealthcare and

health services operating under Optum.The Company's longterm debt also included $ million and $ million of other financing

obligations.

Maturities of commercial paper and longterm debt for the years ending December are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started