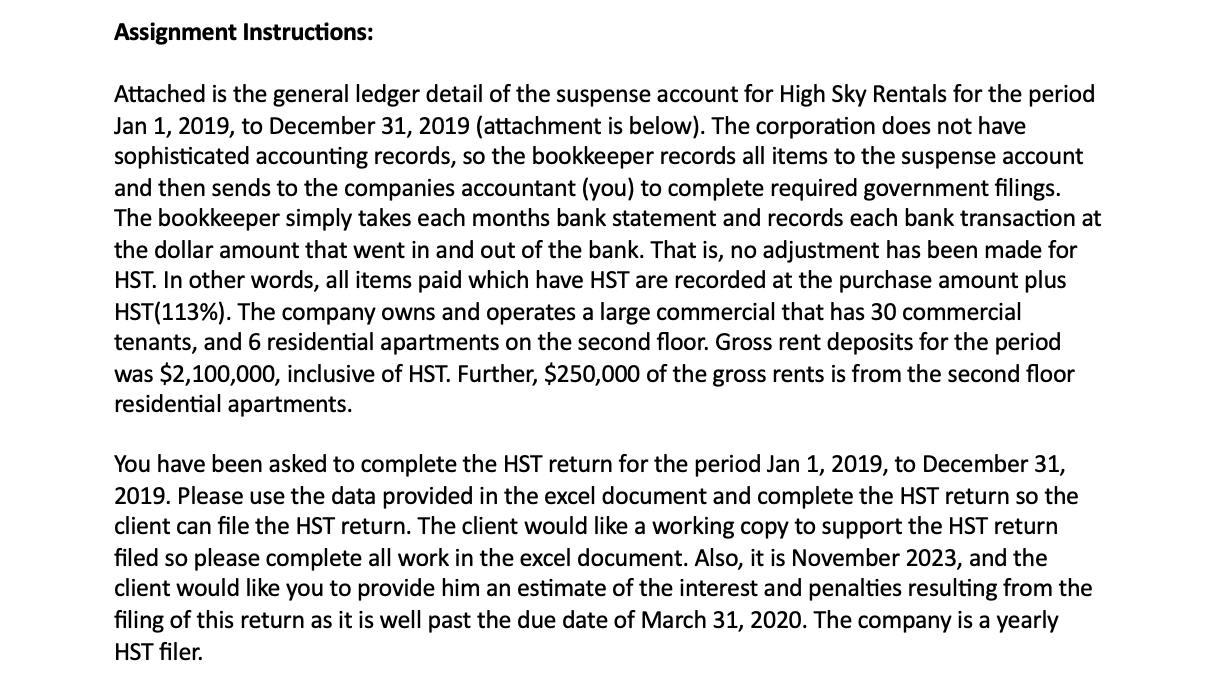

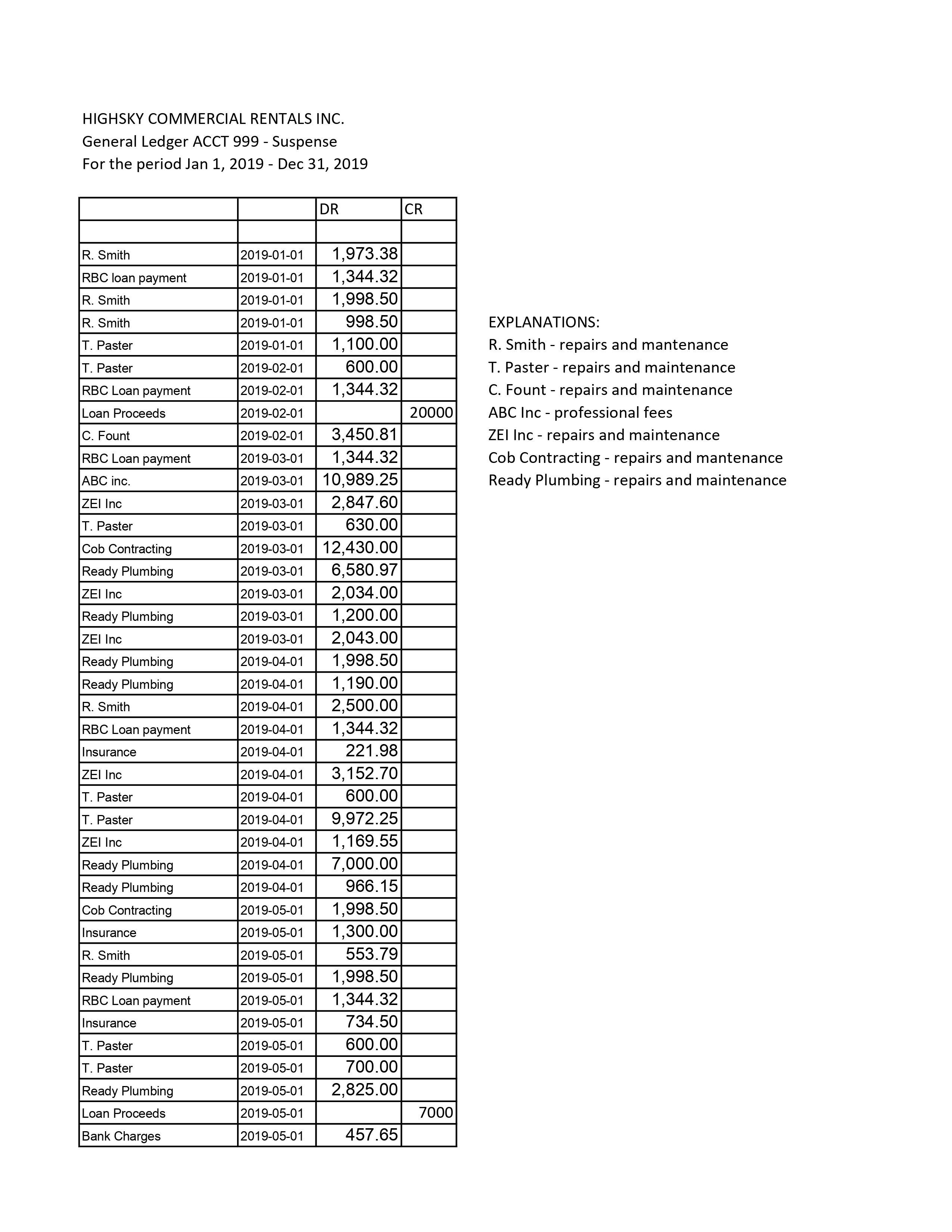

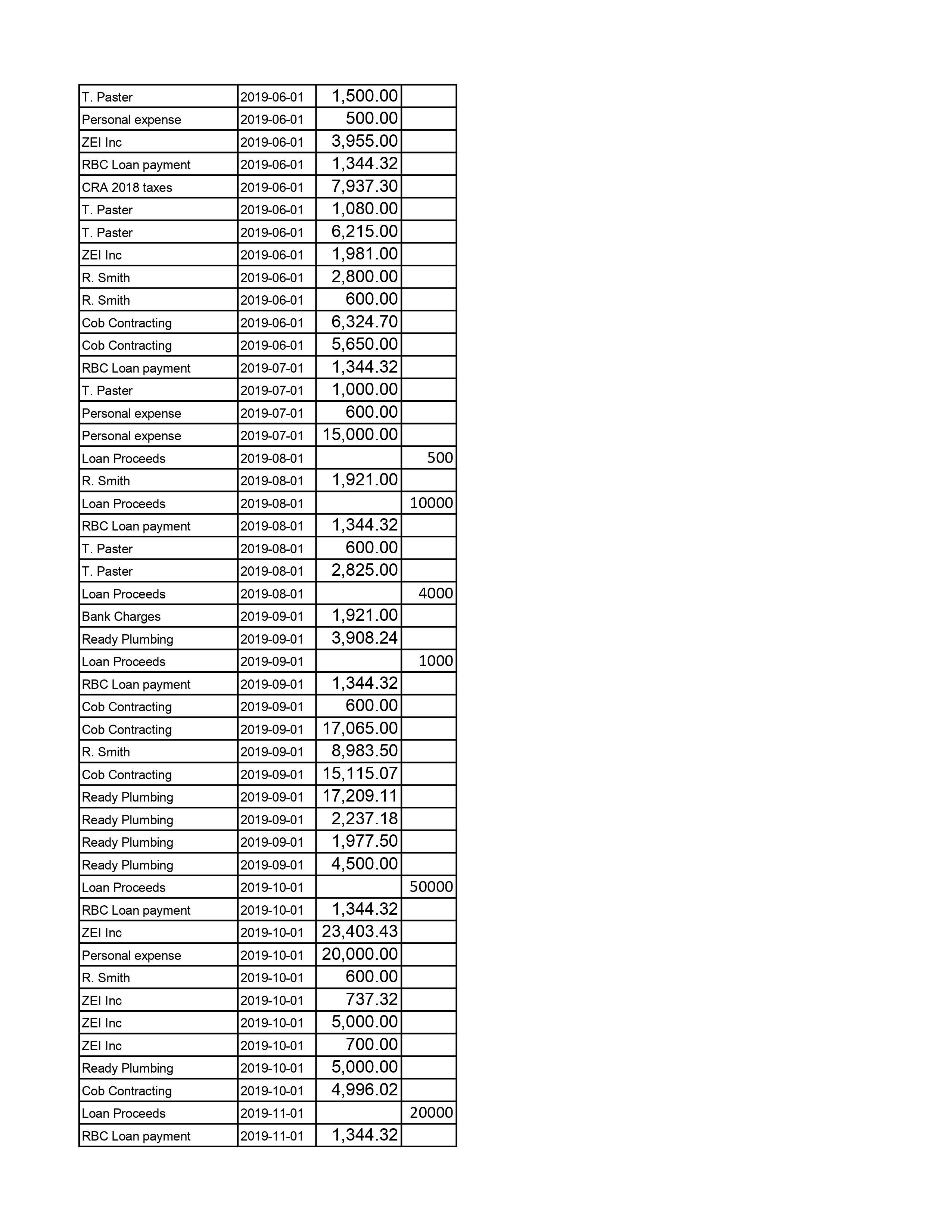

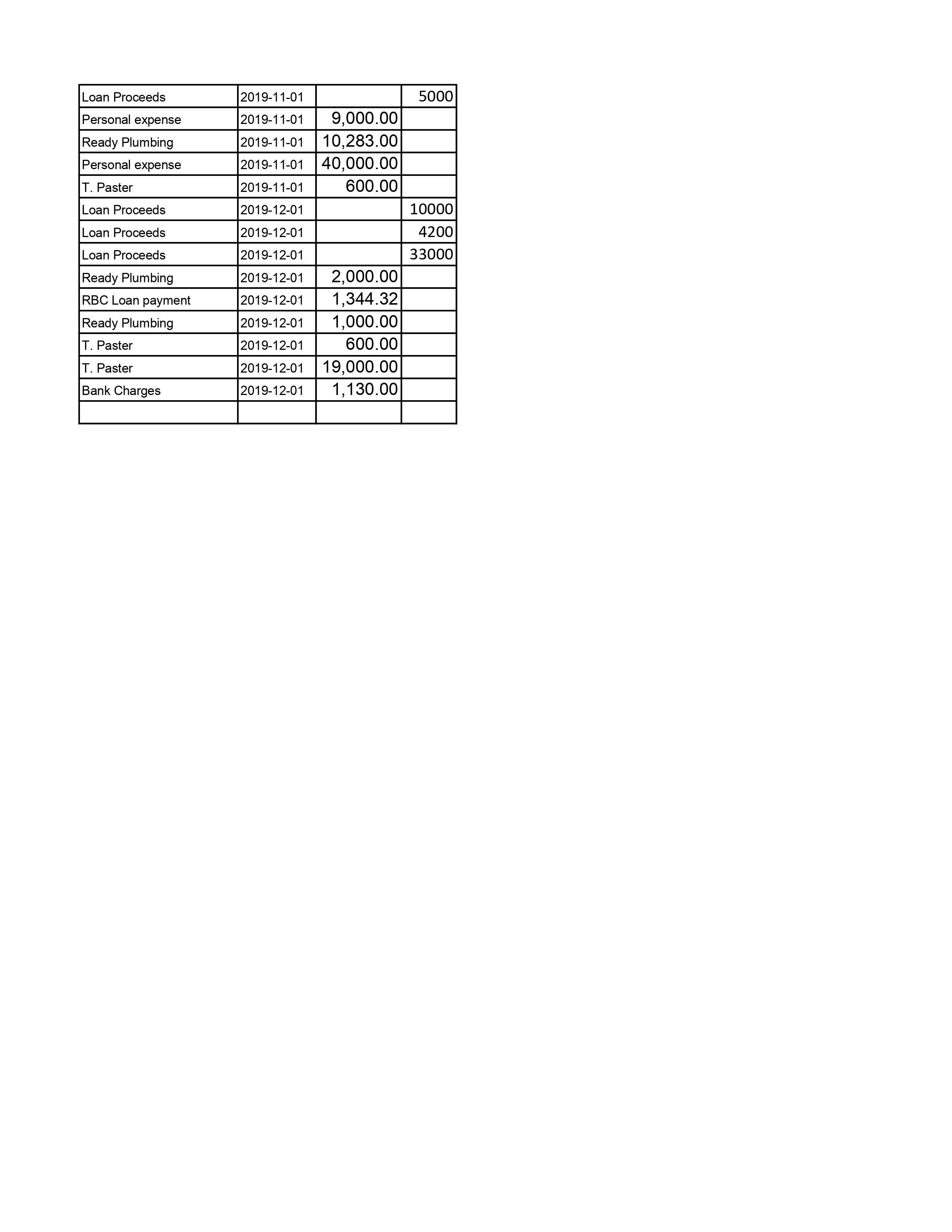

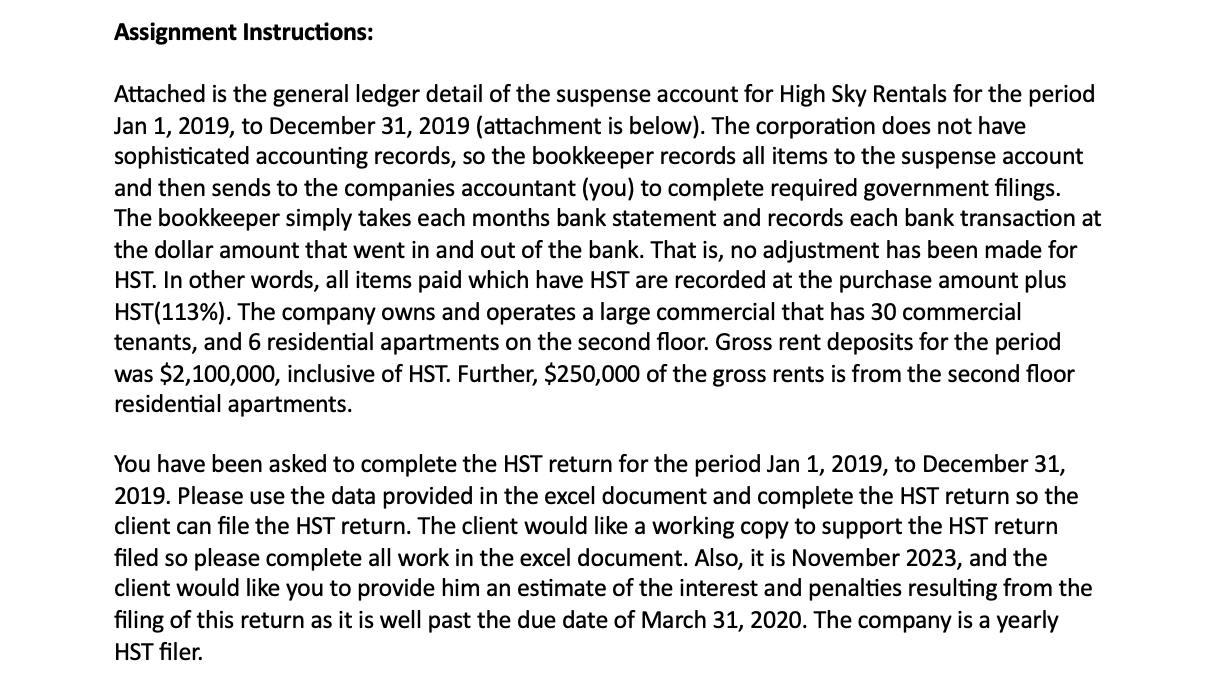

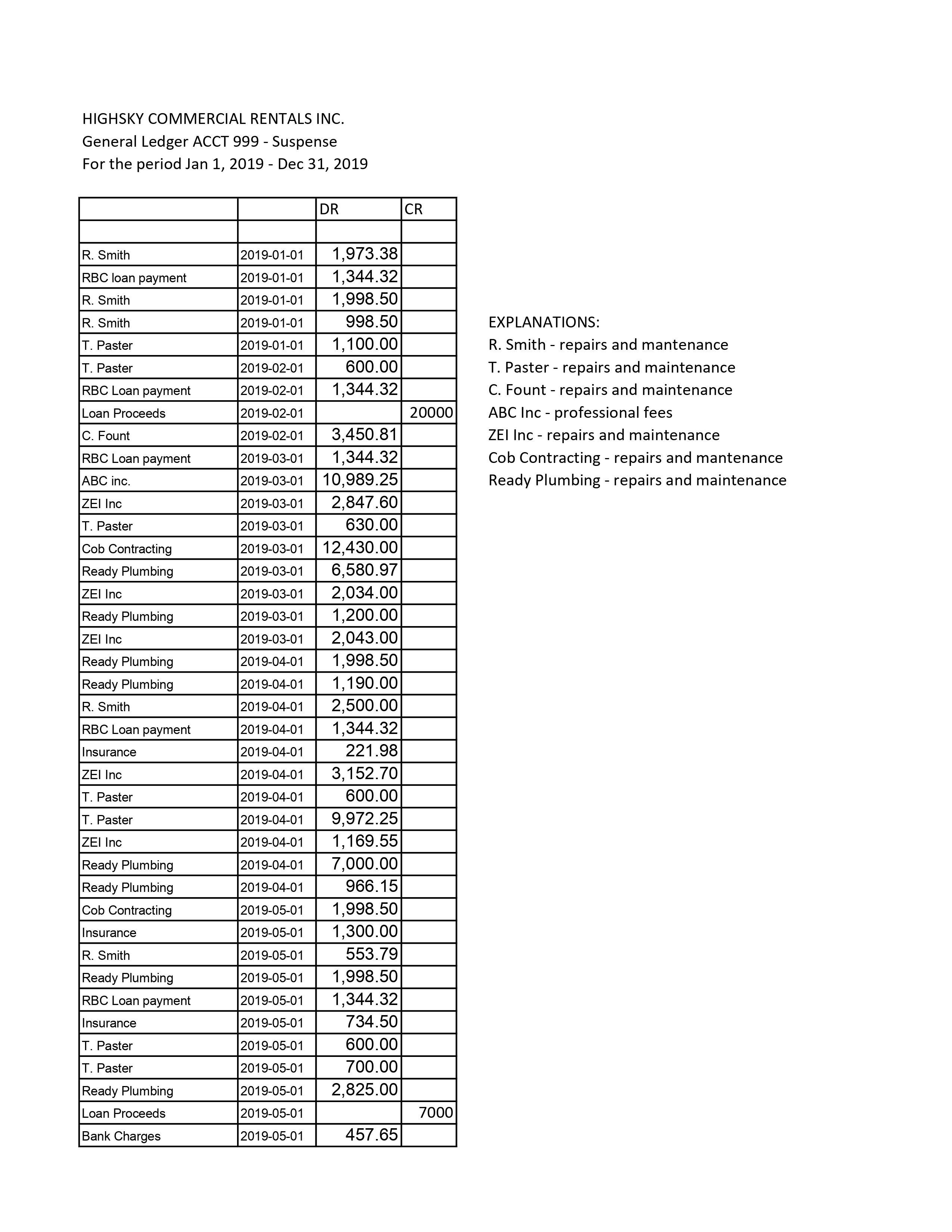

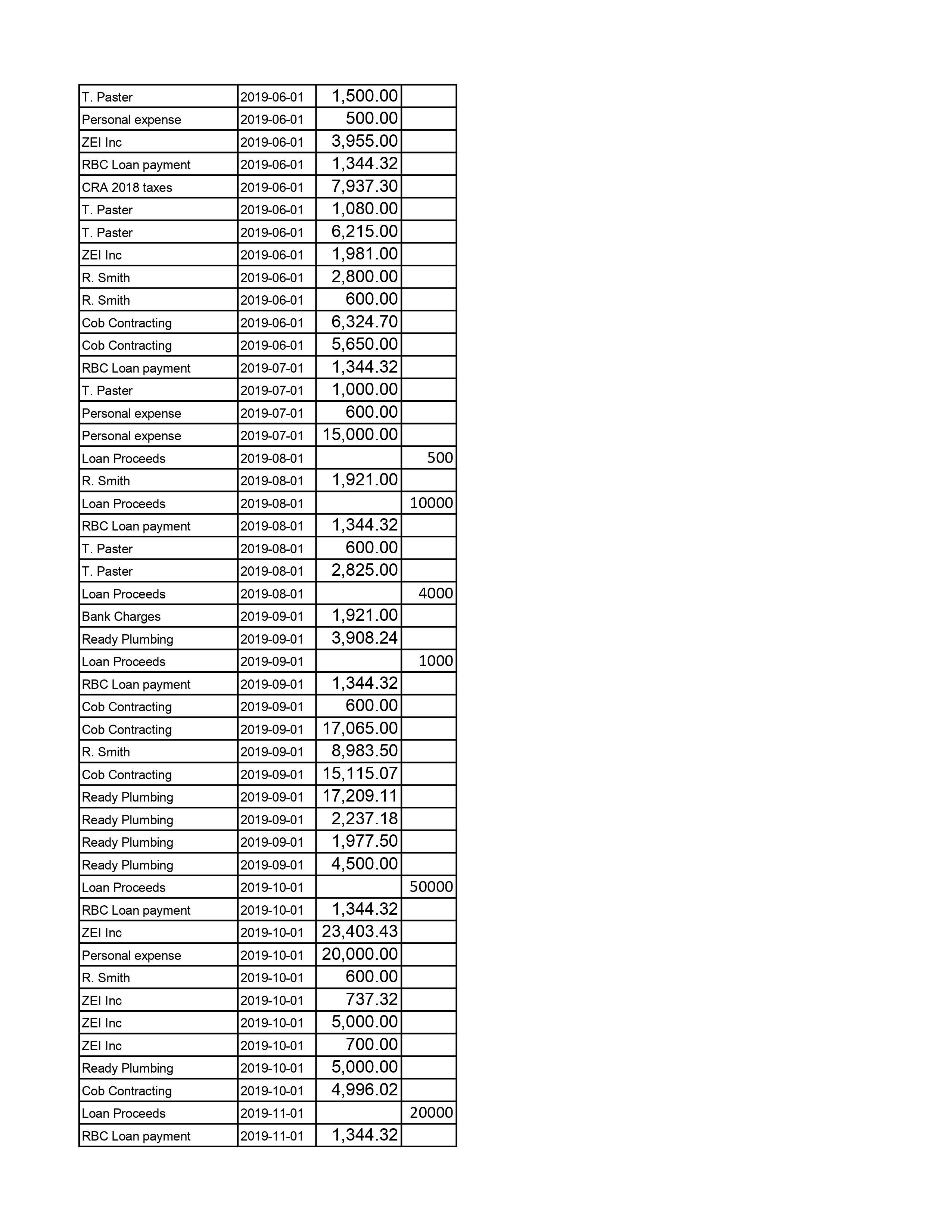

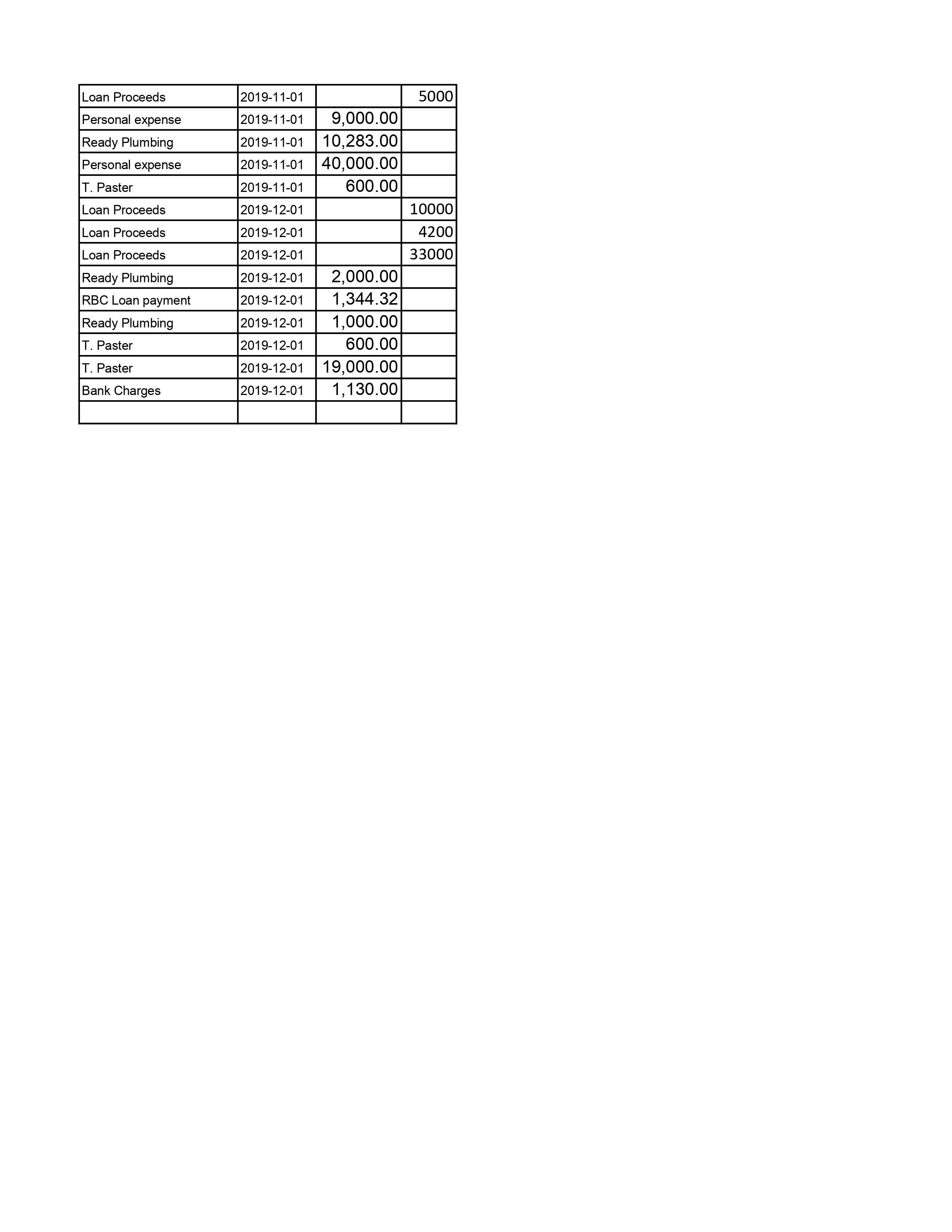

Attached is the general ledger detail of the suspense account for High Sky Rentals for the period Jan 1, 2019, to December 31, 2019 (attachment is below). The corporation does not have sophisticated accounting records, so the bookkeeper records all items to the suspense account and then sends to the companies accountant (you) to complete required government filings. The bookkeeper simply takes each months bank statement and records each bank transaction at the dollar amount that went in and out of the bank. That is, no adjustment has been made for HST. In other words, all items paid which have HST are recorded at the purchase amount plus HST(113\%). The company owns and operates a large commercial that has 30 commercial tenants, and 6 residential apartments on the second floor. Gross rent deposits for the period was $2,100,000, inclusive of HST. Further, $250,000 of the gross rents is from the second floor residential apartments. You have been asked to complete the HST return for the period Jan 1, 2019, to December 31, 2019. Please use the data provided in the excel document and complete the HST return so the client can file the HST return. The client would like a working copy to support the HST return filed so please complete all work in the excel document. Also, it is November 2023, and the client would like you to provide him an estimate of the interest and penalties resulting from the filing of this return as it is well past the due date of March 31, 2020. The company is a yearly HST filer. EXPLANATIONS: R. Smith - repairs and mantenance T. Paster - repairs and maintenance C. Fount - repairs and maintenance ABC Inc - professional fees ZEI Inc - repairs and maintenance Cob Contracting - repairs and mantenance Ready Plumbing - repairs and maintenance \begin{tabular}{|c|c|c|c|} \hline T. Paster & 2019-06-01 & 1,500.00 & \\ \hline Personal expense & 2019-06-01 & 500.00 & \\ \hline ZEI Inc & 2019-06-01 & 3,955.00 & \\ \hline RBC Loan payment & 2019-06-01 & 1,344.32 & \\ \hline CRA 2018 taxes & 2019-06-01 & 7,937.30 & \\ \hline T. Paster & 2019-06-01 & 1,080.00 & \\ \hline T. Paster & 2019-06-01 & 6,215.00 & \\ \hline ZEI Inc & 2019-06-01 & 1,981.00 & \\ \hline R. Smith & \begin{tabular}{|c|} 20190601 \\ \end{tabular} & 2,800.00 & \\ \hline R. Smith & 2019-06-01 & 600.00 & \\ \hline Cob Contracting & 2019-06-01 & 6,324.70 & \\ \hline Cob Contracting & 2019-06-01 & 5,650.00 & \\ \hline RBC Loan payment & 2019-07-01 & 1,344.32 & \\ \hline T. Paster & 2019-07-01 & 1,000.00 & \\ \hline Personal expense & 2019-07-01 & 600.00 & \\ \hline Personal expense & 2019-07-01 & 15,000.00 & \\ \hline Loan Proceeds & 2019-08-01 & & 500 \\ \hline R. Smith & 2019-08-01 & 1,921.00 & \\ \hline Loan Proceeds & 2019-08-01 & & 10000 \\ \hline RBC Loan payment & 2019-08-01 & 1,344.32 & \\ \hline T. Paster & 2019-08-01 & 600.00 & \\ \hline T. Paster & 2019-08-01 & 2,825.00 & \\ \hline Loan Proceeds & 2019-08-01 & & 4000 \\ \hline Bank Charges & 2019-09-01 & 1,921.00 & \\ \hline Ready Plumbing & 2019-09-01 & 3,908.24 & \\ \hline Loan Proceeds & 2019-09-01 & & 1000 \\ \hline RBC Loan payment & 2019-09-01 & 1,344.32 & \\ \hline Cob Contracting & 2019-09-01 & 600.00 & \\ \hline Cob Contracting & 2019-09-01 & 17,065.00 & \\ \hline R. Smith & 2019-09-01 & 8,983.50 & \\ \hline Cob Contracting & 2019-09-01 & 15,115.07 & \\ \hline Ready Plumbing & 2019-09-01 & 17,209.11 & \\ \hline Ready Plumbing & 2019-09-01 & 2,237.18 & \\ \hline Ready Plumbing & 2019-09-01 & 1,977.50 & \\ \hline Ready Plumbing & 2019-09-01 & 4,500.00 & \\ \hline Loan Proceeds & 2019-10-01 & & 50000 \\ \hline RBC Loan payment & 2019-10-01 & 1,344.32 & \\ \hline ZEI Inc & 2019-10-01 & 23,403.43 & \\ \hline Personal expense & 2019-10-01 & 20,000.00 & \\ \hline R. Smith & 2019-10-01 & 600.00 & \\ \hline ZEI Inc & 2019-10-01 & 737.32 & \\ \hline ZEI Inc & 20191001 & 5,000.00 & \\ \hline ZEI Inc & 2019-10-01 & 700.00 & \\ \hline Ready Plumbing & 20191001 & 5,000.00 & \\ \hline Cob Contracting & 2019-10-01 & 4,996.02 & \\ \hline Loan Proceeds & 2019-11-01 & & 20000 \\ \hline RBC Loan payment & 2019-11-01 & 1,344.32 & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Loan Proceeds & 20191101 & & 5000 \\ \hline Personal expense & 20191101 & 9,000.00 & \\ \hline Ready Plumbing & 20191101 & 10,283.00 & \\ \hline Personal expense & 20191101 & 40,000.00 & \\ \hline T. Paster & 20191101 & 600.00 & \\ \hline Loan Proceeds & 20191201 & & 10000 \\ \hline Loan Proceeds & 20191201 & & 4200 \\ \hline Loan Proceeds & 20191201 & & 33000 \\ \hline Ready Plumbing & 20191201 & 2,000.00 & \\ \hline RBC Loan payment & 20191201 & 1,344.32 & \\ \hline Ready Plumbing & 20191201 & 1,000.00 & \\ \hline T. Paster & 20191201 & 600.00 & \\ \hline T. Paster & 20191201 & 19,000.00 & \\ \hline Bank Charges & 20191201 & 1,130.00 & \\ \hline & & & \\ \hline \end{tabular}