Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attempted: 0/1 3. (a) Pansonec Enterprise (PSE) is an electrical equipment manufacturing enterprise with its main office in Semenyih town. It has been in

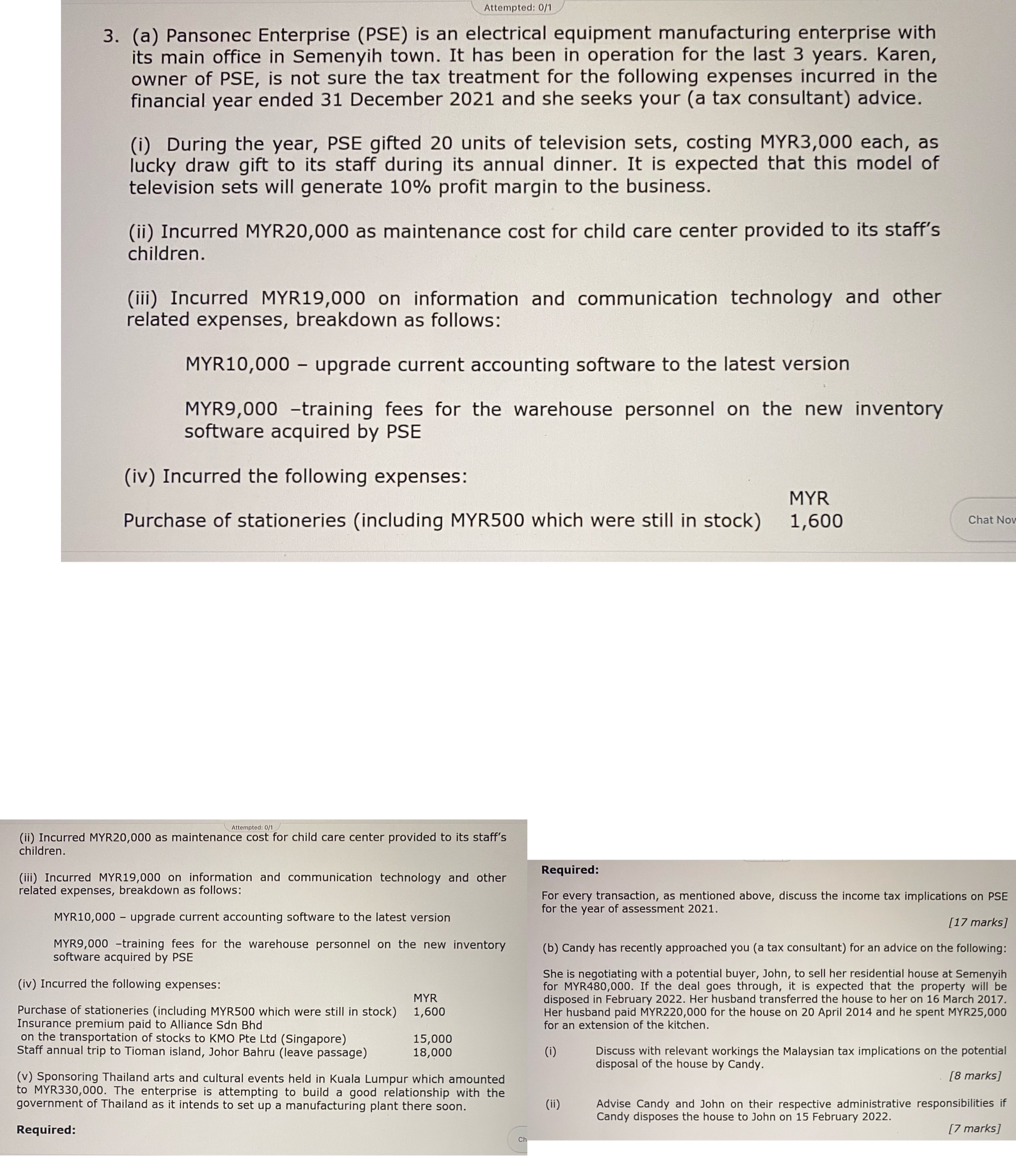

Attempted: 0/1 3. (a) Pansonec Enterprise (PSE) is an electrical equipment manufacturing enterprise with its main office in Semenyih town. It has been in operation for the last 3 years. Karen, owner of PSE, is not sure the tax treatment for the following expenses incurred in the financial year ended 31 December 2021 and she seeks your (a tax consultant) advice. (i) During the year, PSE gifted 20 units of television sets, costing MYR3,000 each, as lucky draw gift to its staff during its annual dinner. It is expected that this model of television sets will generate 10% profit margin to the business. (ii) Incurred MYR20,000 as maintenance cost for child care center provided to its staff's children. (iii) Incurred MYR19,000 on information and communication technology and other related expenses, breakdown as follows: MYR10,000 - upgrade current accounting software to the latest version MYR9,000 -training fees for the warehouse personnel on the new inventory software acquired by PSE (iv) Incurred the following expenses: MYR Purchase of stationeries (including MYR500 which were still in stock) 1,600 Attempted: 0/1 (ii) Incurred MYR20,000 as maintenance cost for child care center provided to its staff's children. (iii) Incurred MYR19,000 on information and communication technology and other related expenses, breakdown as follows: MYR10,000 - upgrade current accounting software to the latest version MYR9,000 -training fees for the warehouse personnel on the new inventory software acquired by PSE (iv) Incurred the following expenses: MYR Purchase of stationeries (including MYR500 which were still in stock) 1,600 Insurance premium paid to Alliance Sdn Bhd on the transportation of stocks to KMO Pte Ltd (Singapore) Staff annual trip to Tioman island, Johor Bahru (leave passage) 15,000 18,000 (v) Sponsoring Thailand arts and cultural events held in Kuala Lumpur which amounted to MYR330,000. The enterprise is attempting to build a good relationship with the government of Thailand as it intends to set up a manufacturing plant there soon. Required: Ch Chat Nov Required: For every transaction, as mentioned above, discuss the income tax implications on PSE for the year of assessment 2021. [17 marks] (b) Candy has recently approached you (a tax consultant) for an advice on the following: She is negotiating with a potential buyer, John, to sell her residential house at Semenyih for MYR480,000. If the deal goes through, it is expected that the property will be disposed in February 2022. Her husband transferred the house to her on 16 March 2017. Her husband paid MYR220,000 for the house on 20 April 2014 and he spent MYR25,000 for an extension of the kitchen. (i) (ii) Discuss with relevant workings the Malaysian tax implications on the potential disposal of the house by Candy. [8 marks] Advise Candy and John on their respective administrative responsibilities if Candy disposes the house to John on 15 February 2022. [7 marks]

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Income Tax Implications for PSE in the Year of Assessment 2021 i Gift of Television Sets to Staff The cost of the television sets amounting to MYR3000 each is not deductible as a business expense fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started