Answered step by step

Verified Expert Solution

Question

1 Approved Answer

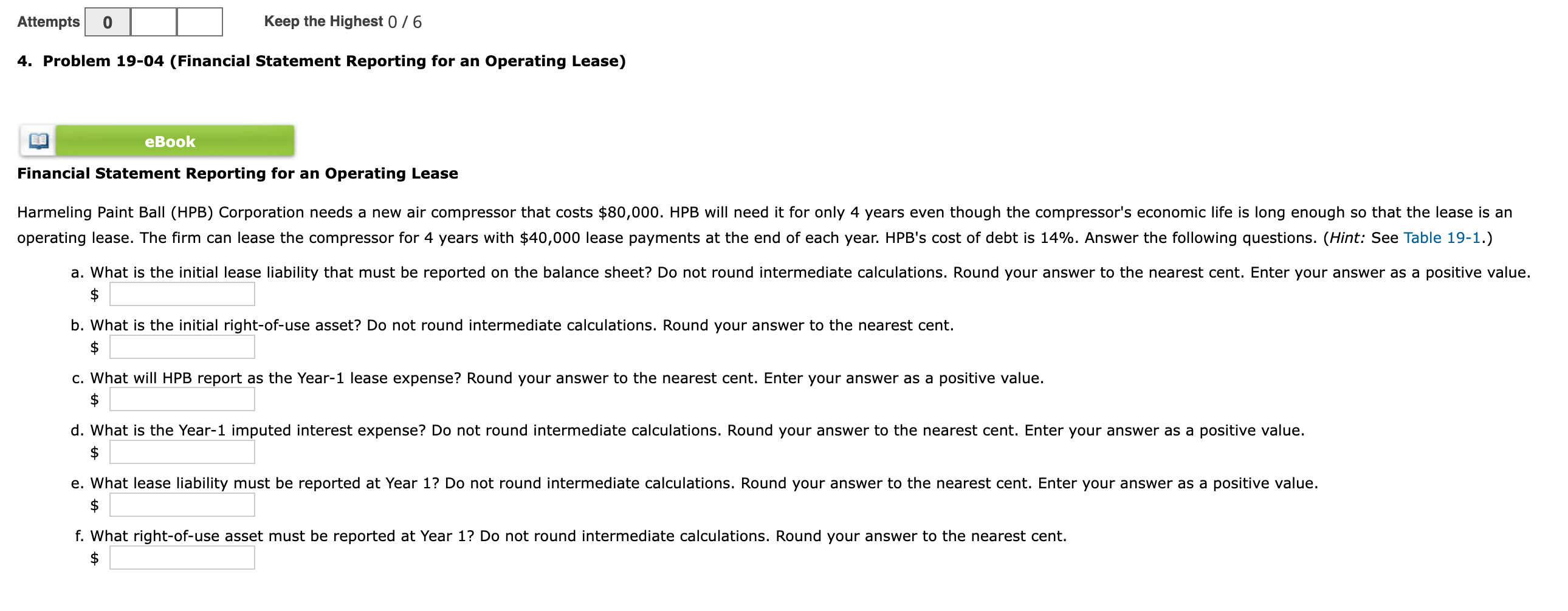

Attempts 0 Keep the Highest 0/6 4. Problem 19-04 (Financial Statement Reporting for an Operating Lease) eBook Financial Statement Reporting for an Operating Lease

Attempts 0 Keep the Highest 0/6 4. Problem 19-04 (Financial Statement Reporting for an Operating Lease) eBook Financial Statement Reporting for an Operating Lease Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $80,000. HPB will need it for only 4 years even though the compressor's economic life is long enough so that the lease is an operating lease. The firm can lease the compressor for 4 years with $40,000 lease payments at the end of each year. HPB's cost of debt is 14%. Answer the following questions. (Hint: See Table 19-1.) a. What is the initial lease liability that must be reported on the balance sheet? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ b. What is the initial right-of-use asset? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What will HPB report as the Year-1 lease expense? Round your answer to the nearest cent. Enter your answer as a positive value. $ d. What is the Year-1 imputed interest expense? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ e. What lease liability must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ f. What right-of-use asset must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started