Question: Attempts: 5 Keep the Highest: 5/10 7. Problem 16.08 (Long-Term Financing Needed) eBook Problem Walk-Through At year-end 2019, total assets for Arrington Inc. were $1.8

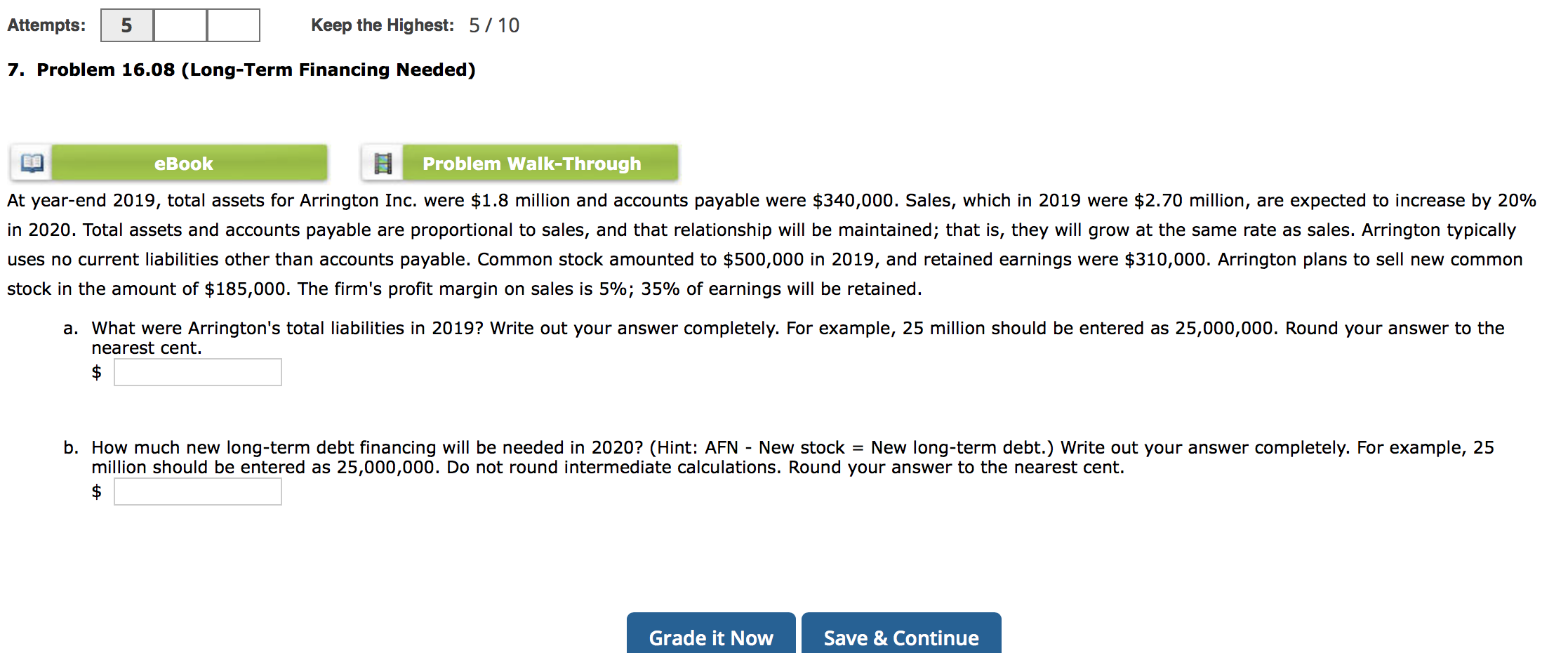

Attempts: 5 Keep the Highest: 5/10 7. Problem 16.08 (Long-Term Financing Needed) eBook Problem Walk-Through At year-end 2019, total assets for Arrington Inc. were $1.8 million and accounts payable were $340,000. Sales, which in 2019 were $2.70 million, are expected to increase 20% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to $500,000 in 2019, and retained earnings were $310,000. Arrington plans to sell new common stock in the amount of $185,000. The firm's profit margin on sales is 5%; 35% of earnings will be retained. a. What were Arrington's total liabilities in 2019? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest cent. b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.) Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts