Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attempts: Average: /4 3. Current asset financing policies Aa Aa Firms manage a variety of current assets. Permanent current assets are necessary for firms to

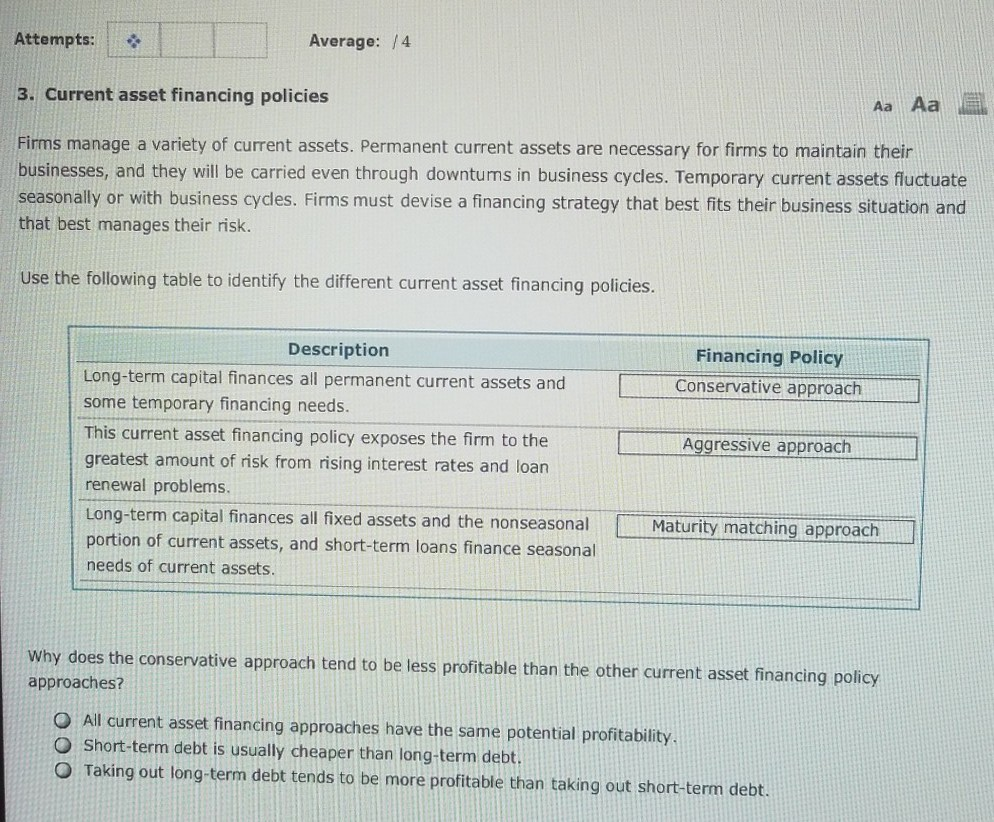

Attempts: Average: /4 3. Current asset financing policies Aa Aa Firms manage a variety of current assets. Permanent current assets are necessary for firms to maintain their businesses, and they will be carried even through downturns in business cycles. Temporary current assets fluctuate seasonally or with business cycles. Firms must devise a financing strategy that best fits their business situation and that best manages their risk. use the following table to identify the different current asset financing policies. Description Financing Policy Conservative approach Long-term capital finances all permanent current assets and some temporary financing needs. This current asset financing policy exposes the firm to the greatest amount of risk from rising interest rates and loan renewal problems. Long-term capital finances all fixed assets and the nonseasonal portion of current assets, and short-term loans finance seasonal needs of current assets. - .. . Aggressive approach Maturity matching approach-] Why does the conservative approach tend to be less profitable than the other current asset financing policy approaches? O All current asset financing approaches have the same potential profitability O Short-term debt is usually cheaper than long-term debt. O Taking out long-term debt tends to be more profitable than taking out short-term debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started