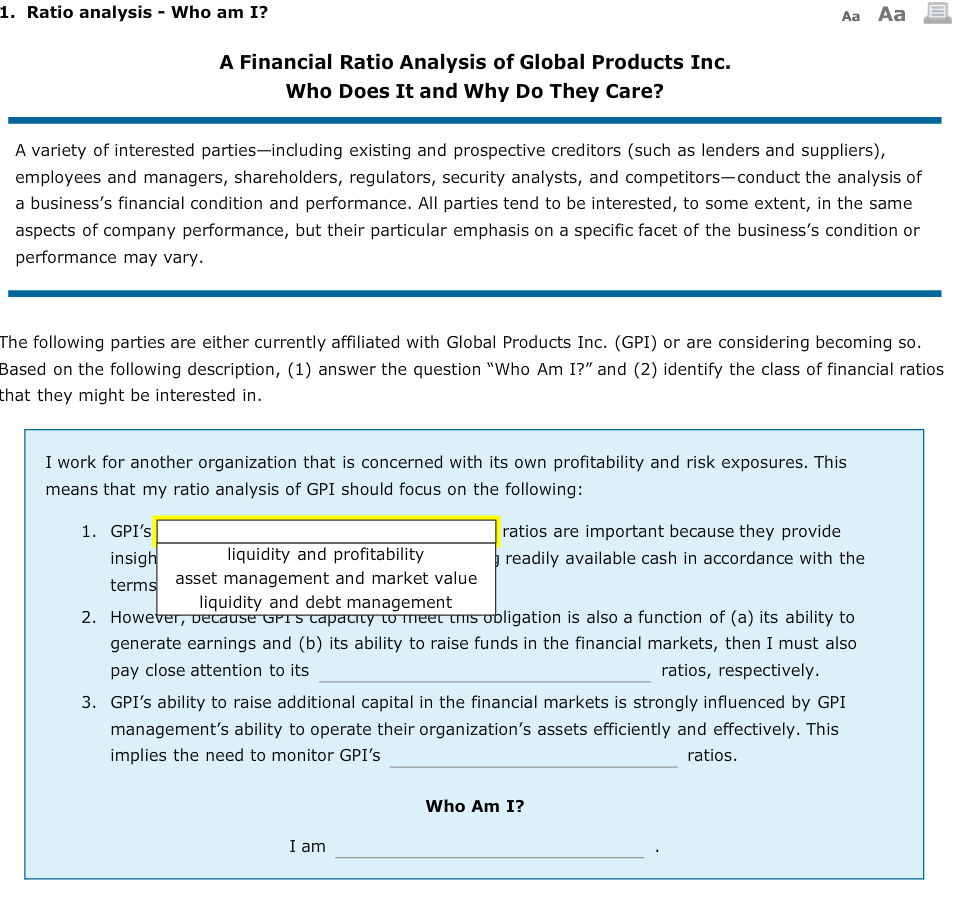

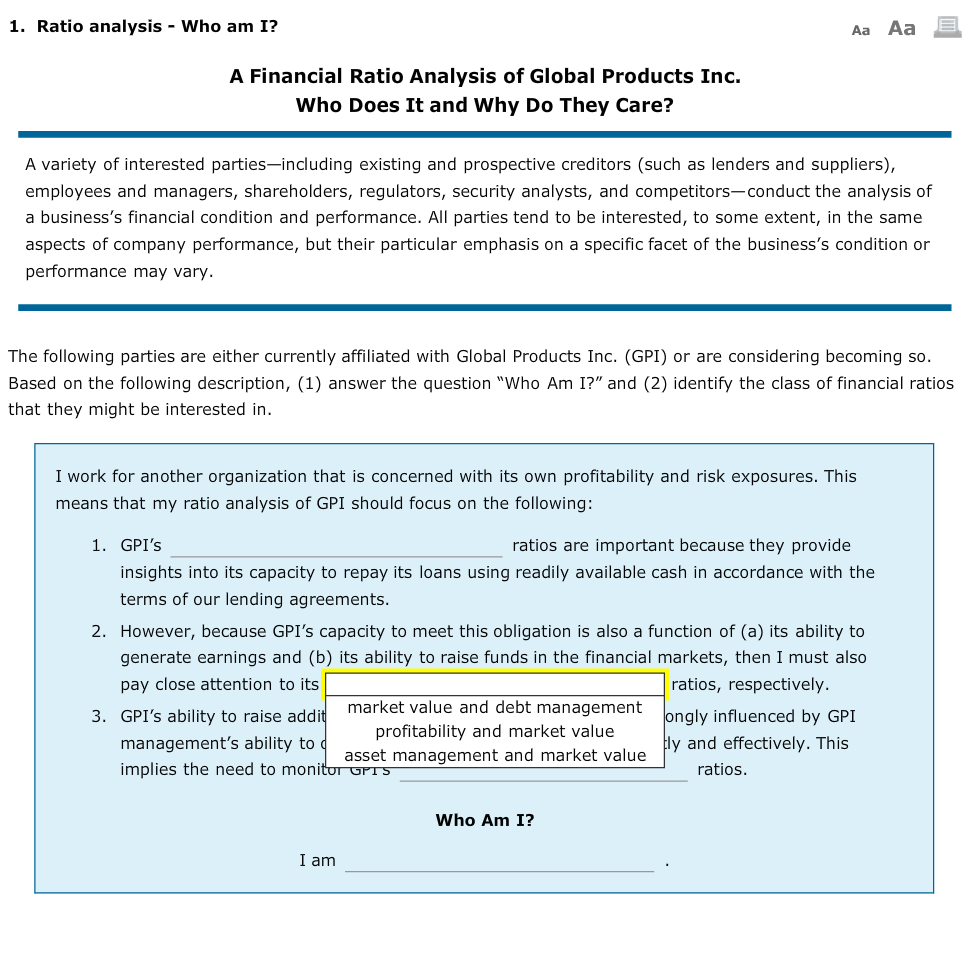

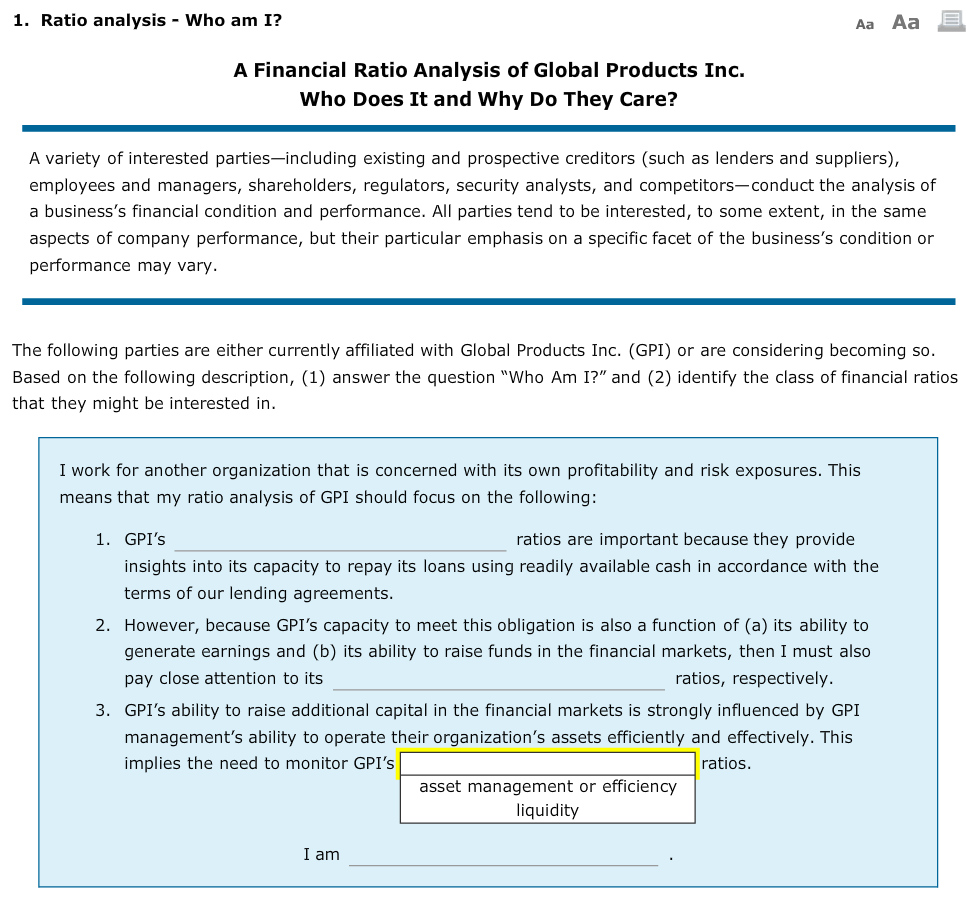

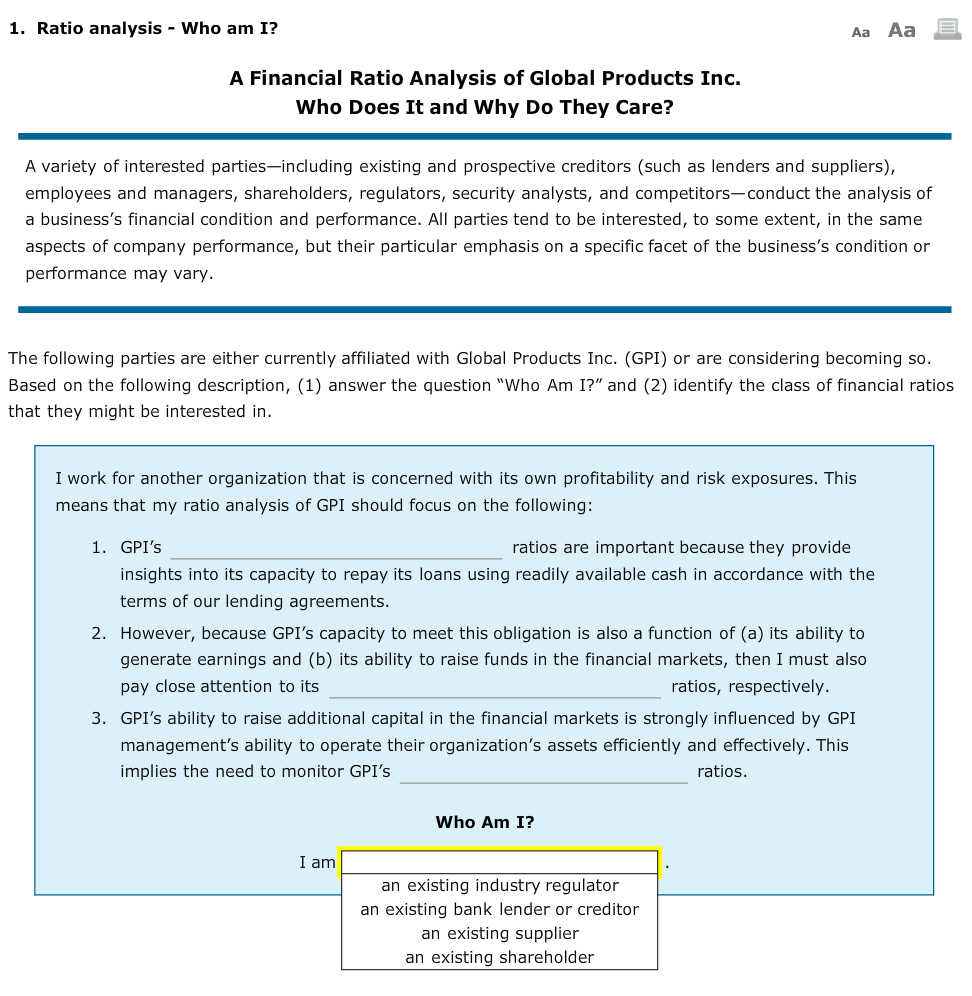

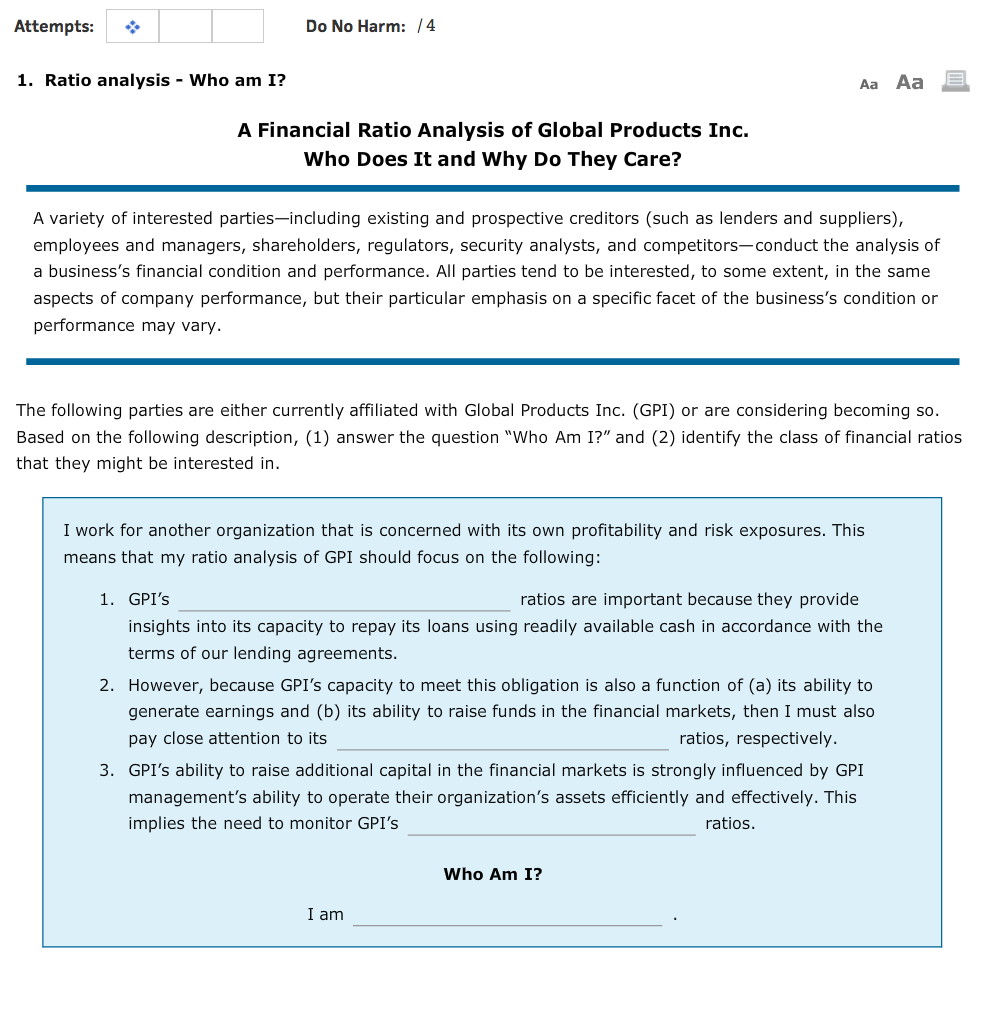

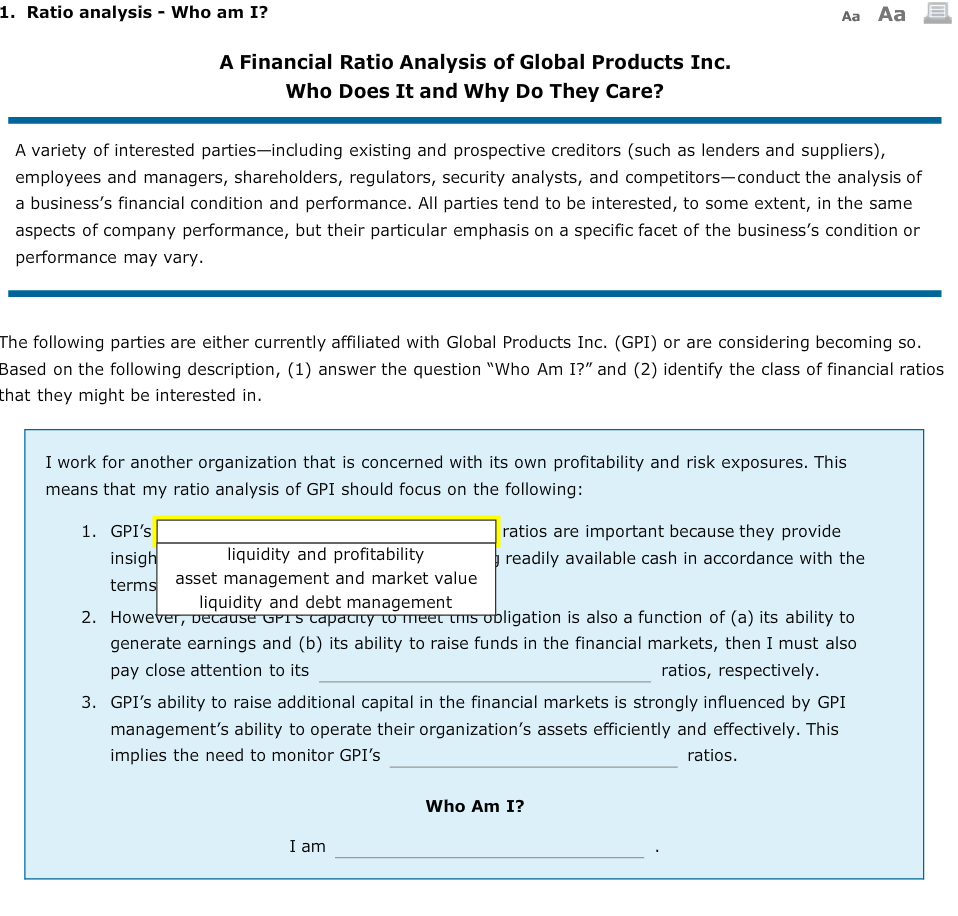

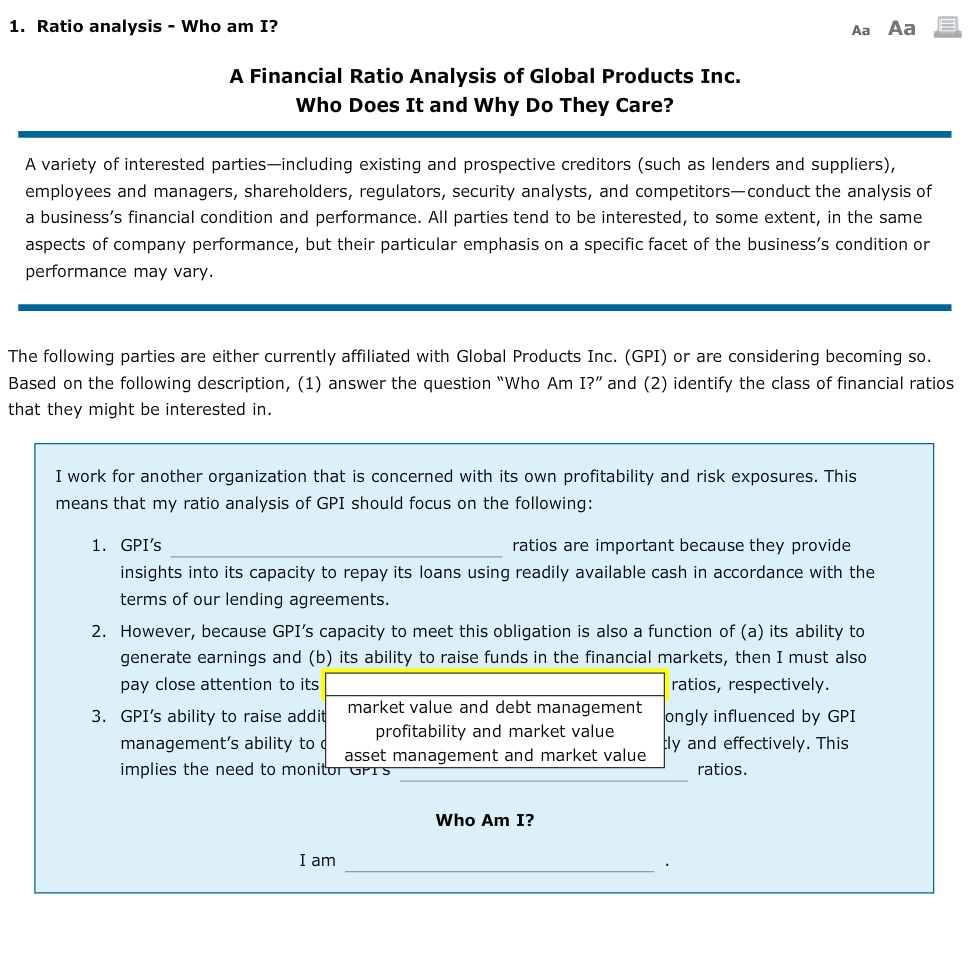

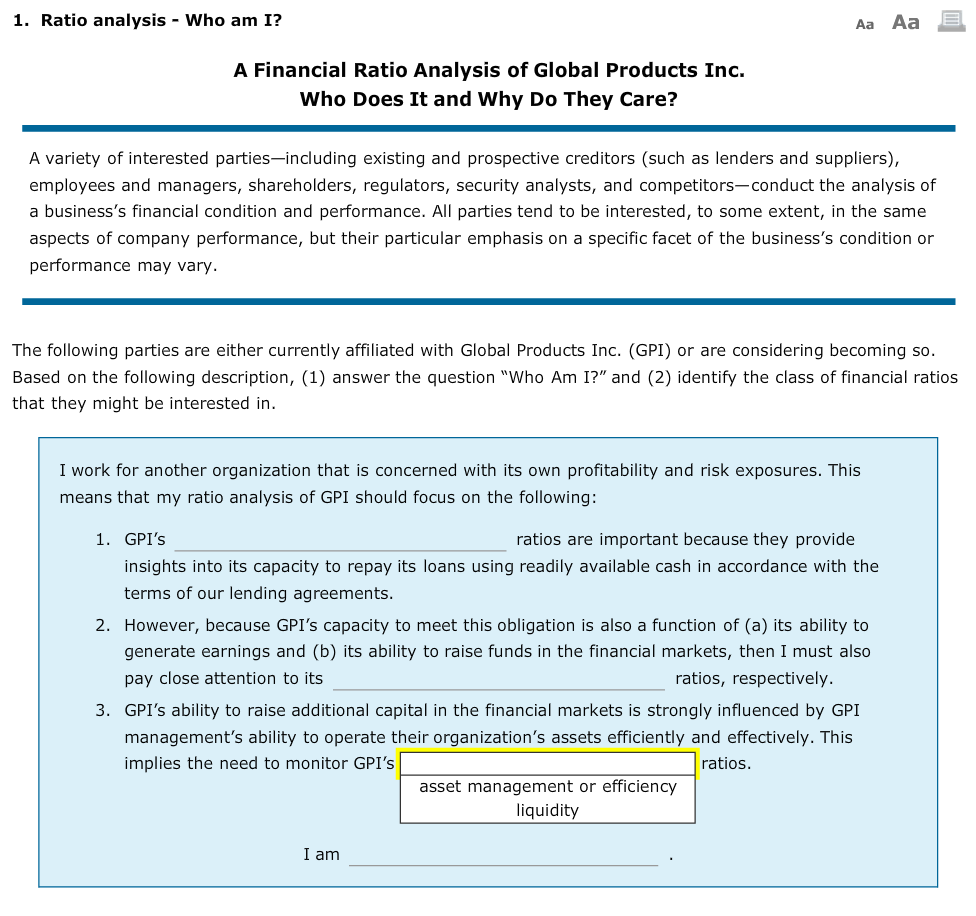

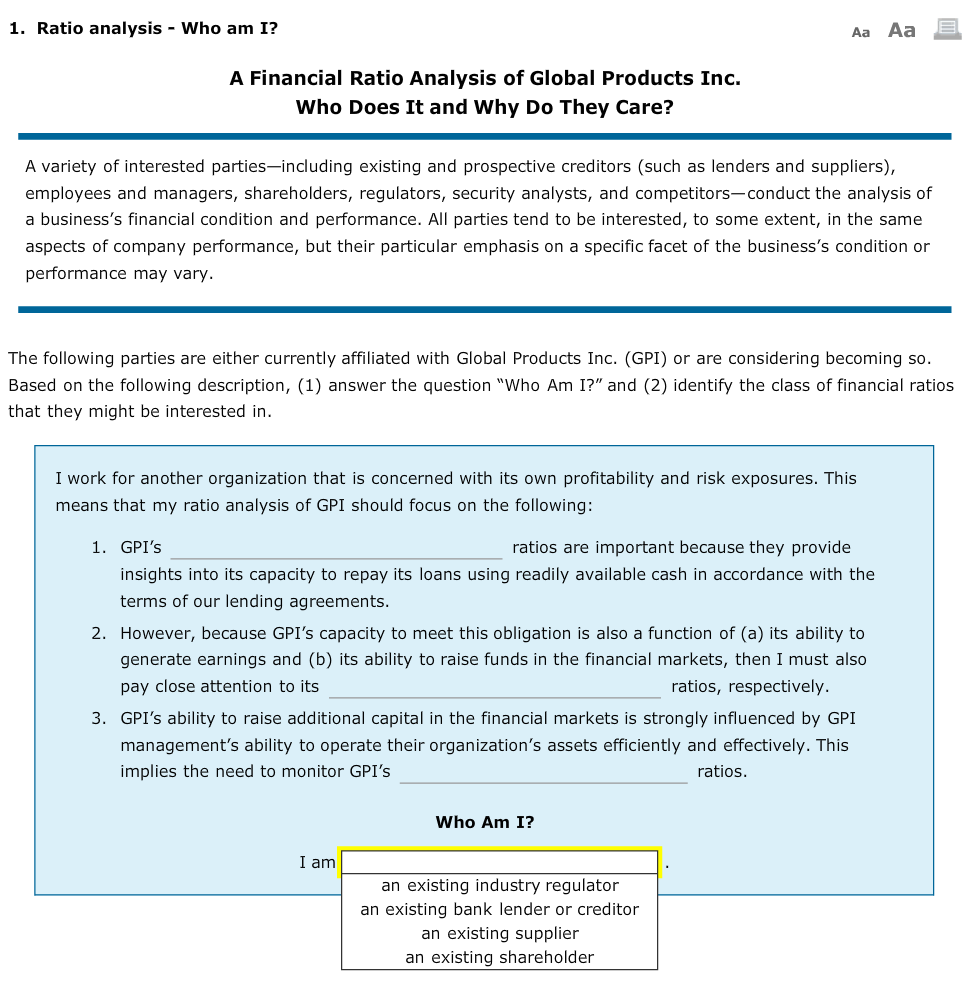

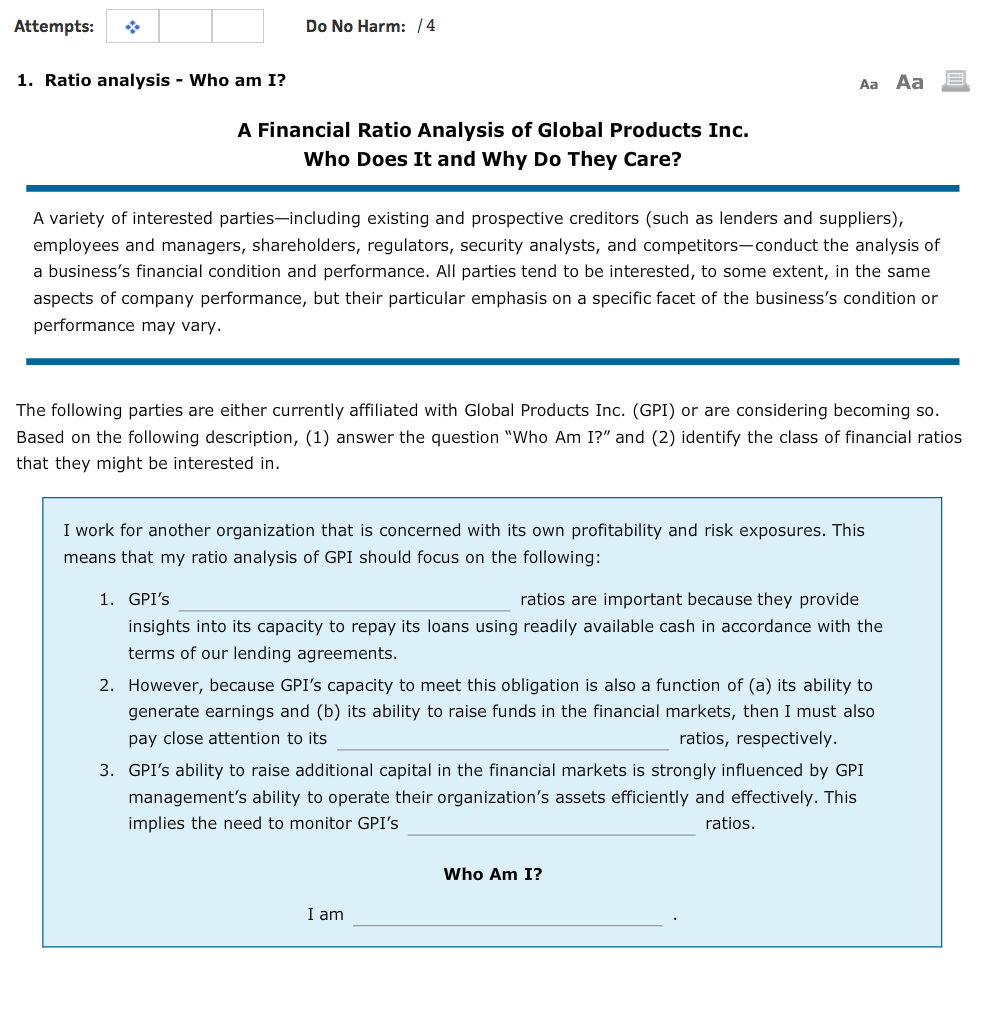

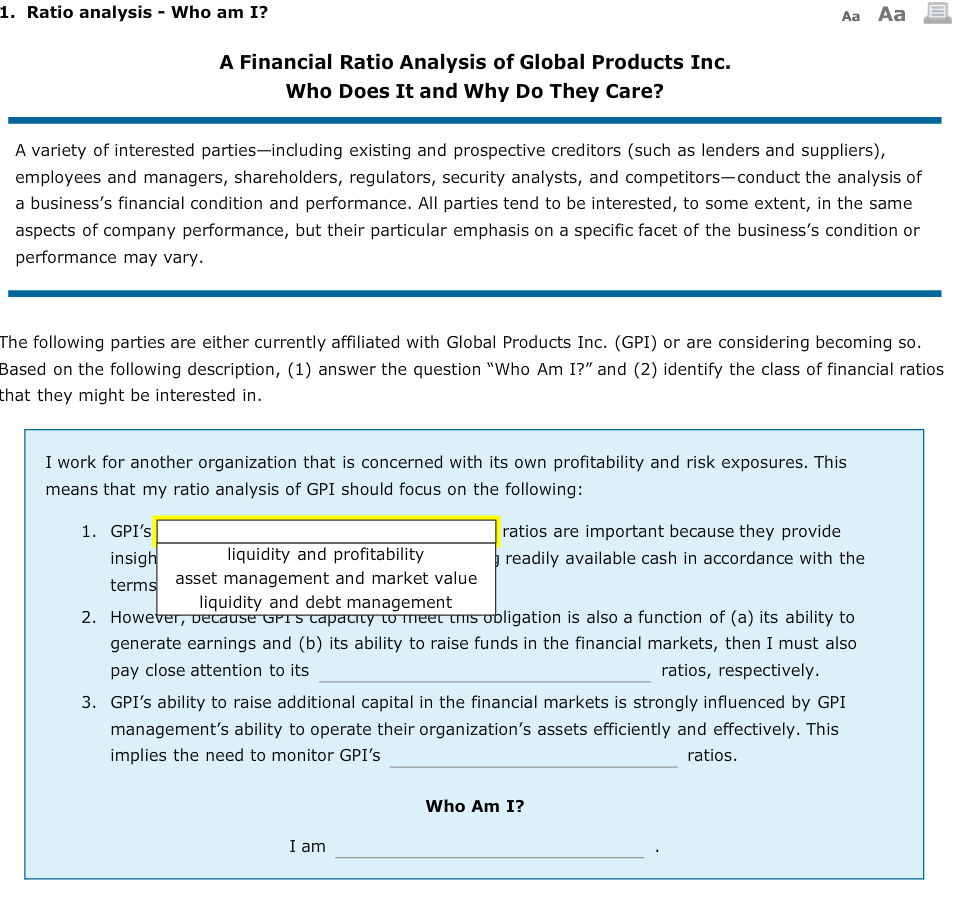

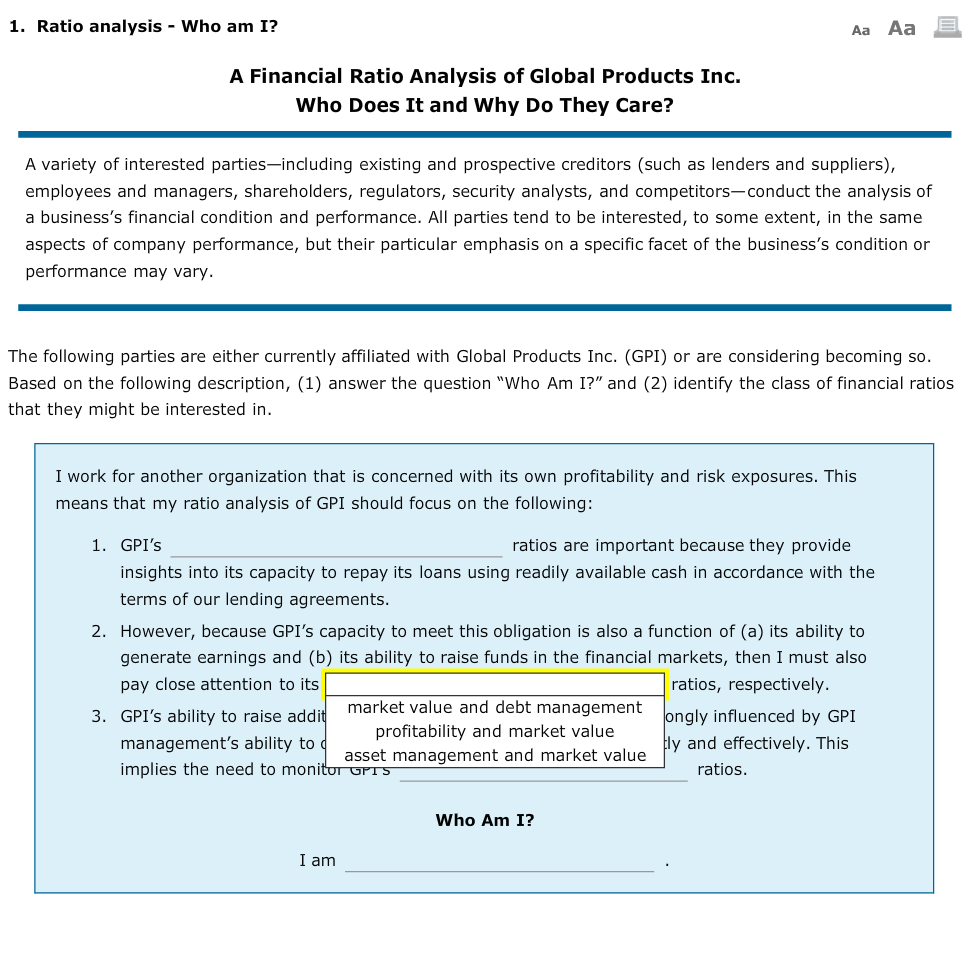

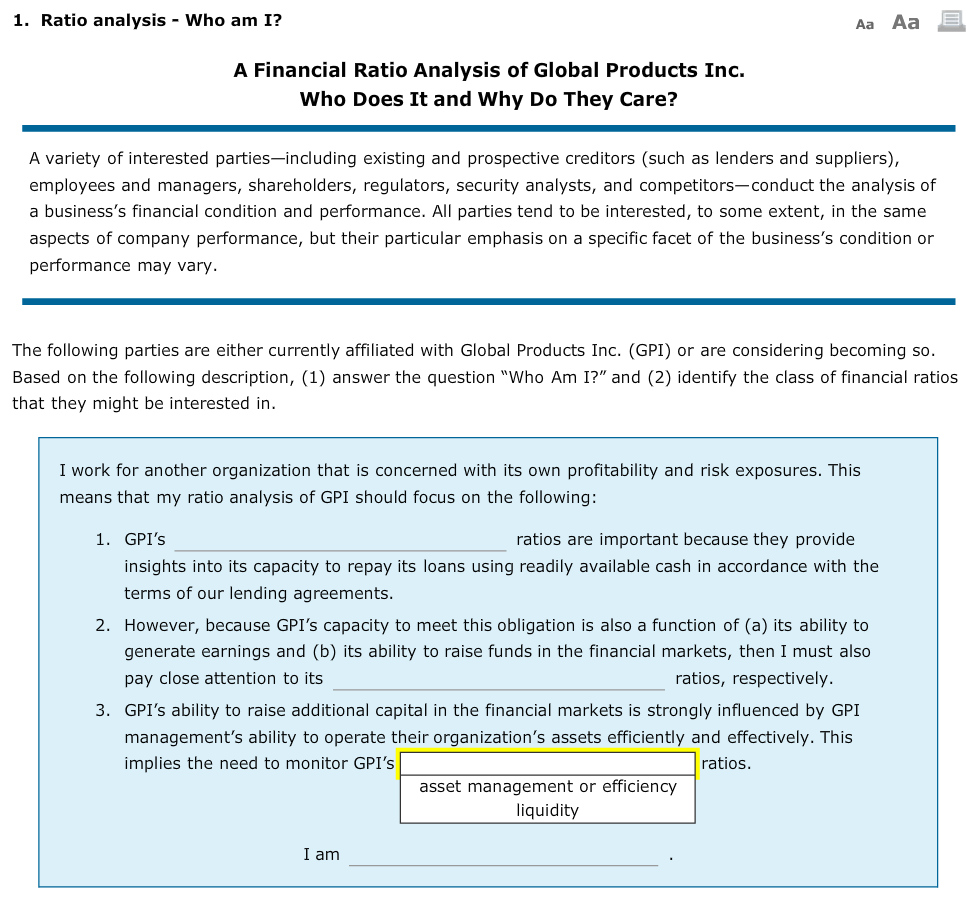

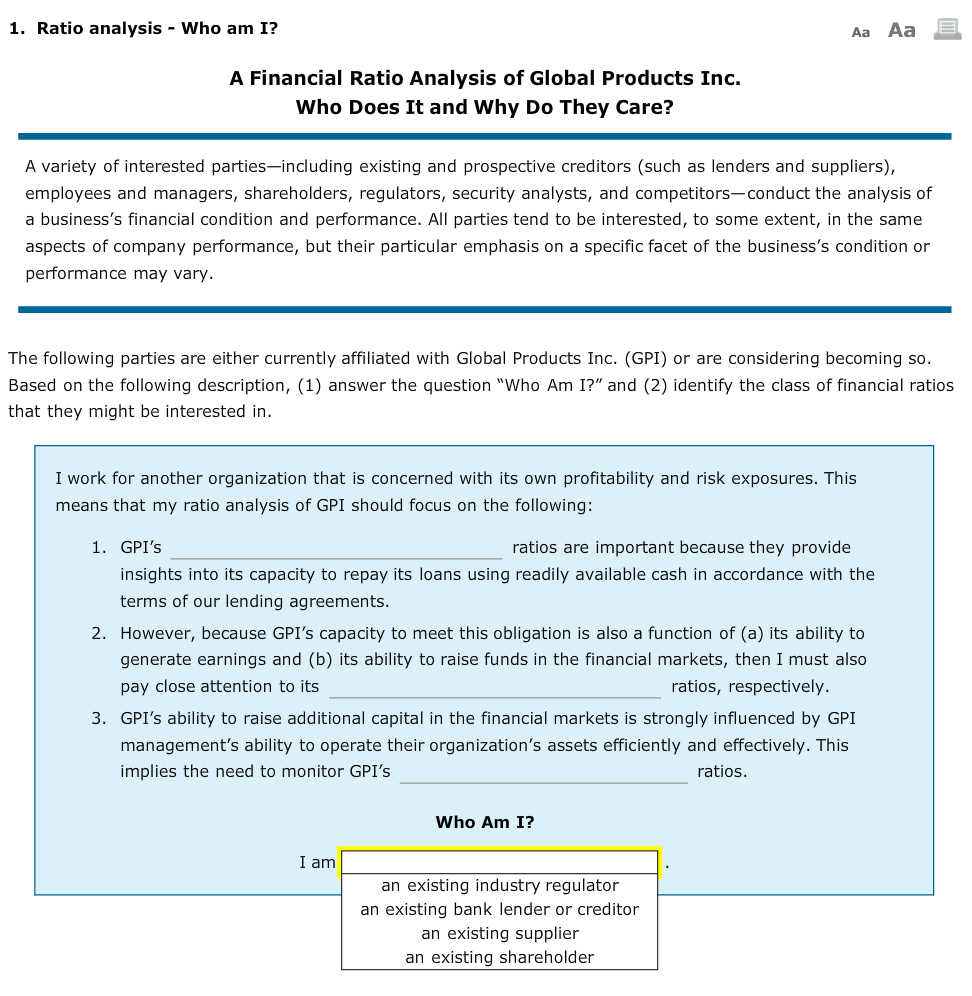

Attempts: do Do No Harm: {'4 1. Ratio analysis - Who am I? h Aa E. A Financial Ratio Analysis of Global Products Inc. Who Does It and Why Do They Care? A variety of interested partiesincluding existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitorsconduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specic facet of the business's condition or performance may vary. The following parties are either currently afliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, {1} answer the question \"Who Am I?" and {2} identify the class of financial ratios that they might be interested in. I work for another organization that is concerned with its own protability and risk exposures. This means that my ratio analysis of GP] should focus on the following: 1. GPI's ratios are important because they provide insights into its capacity to repay its loans using readily available cash in accordance with the terms of our lending agreements. 2. However, because GPI's capacity to meet this obligation is also a function of (a) its ability to generate earnings and (b) its ability to raise funds in the nancial markets, then I must also pay close attention to its ratios, respectively. 3. GPI's ability to raise additional capital in the nancial markets is strongly inuenced by GP] management's ability to operate their organization's assets efciently and effectively. This implies the need to monitor GPI's ratios. Who Am I? Iam 1. Ratio analysis - Who am I? A, A3 E A Financial Ratio Analysis of Global Products Inc. Who Does It and Why Do They Care? A variety of interested partiesincluding existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitorsconduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specic facet of the business's condition or performance may vary. The following parties are either currently afliated with Global Products Inc. {GPI} or are considering becoming so. Based on the following description, (1} answer the question \"Who Am I?" and (2} identify the class of financial ratios that they might be interested in. I work for another organization that is concerned with its own protability and risk exposures. This means that my ratio analysis of GP] should focus on the following: ratios are important because they provide insig \"ClUidltY and protability readily available cash in accordance with the asset management and market value management . . . uligation is also a function of (a) its ability to generate earnings and (b) its ability to raise funds in the nancial markets, then I must also pay close attention to its ratios, respectively. 3. GPI's ability to raise additional capital in the nancial markets is strongly inuenced by GP] management's ability to operate their organization's assets efciently and effectively. This implies the need to monitor GPI's ratios. Who Am I? Iam 1. Ratio analysis - Who am I? M Aa a A Financial Ratio Analysis of Global Products Inc. Who Does It and Why Do They Care? A variety of interested partiesincluding existing and prospective creditors {such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitorsconduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specic facet of the business's condition or performance may vary. The following parties are either currently afliated with Global Products Inc. {GPI} or are considering becoming so. Based on the following description, (1} answer the question \"Who Am I?" and (2} identify the class of financial ratios that they might be interested in. I work for another organization that is concerned with its own protability and risk exposures. This means that my ratio analysis of GP] should focus on the following: 1. GPI's ratios are important because they provide insights into its capacity to repay its loans using readily available cash in accordance with the terms of our lending agreements. 2. However, because GPI's capacity to meet this obligation is also a function of (a) its ability to generate earnings and (b) its ability to raise funds in the nancial markets, then I must also pay close attention to its 3. GPI's ability to raise addi management's ability to implies the need to moni ratios, respectively. market value and debt management ngly inuenced by GP] protability and market value I and effectivel .This asset management and market value y y ratios. IWho Am I? 1am 1. Ratio analysis - Who am I? M Aa E A Financial Ratio Analysis of Global Products Inc. Who Does It and Why Do They Care? A variety of interested partiesincluding existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitorsconduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specic facet of the business's condition or performance may vary. The following parties are either currently afliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, {1} answer the question \"Who Am I?" and (2} identify the class of financial ratios that they might be interested in. I work for another organization that is concerned with its own protability and risk exposures. This means that my ratio analysis of GP] should focus on the following: 1. GPI's ratios are important because they provide insights into its capacity to repay its loans using readily available cash in accordance with the terms of our lending agreements. 2. However, because GPI's capacity to meet this obligation is also a function of (a) its ability to generate earnings and (b) its ability to raise funds in the nancial markets, then 1 must also pay close attention to its ratios, respectively. 3. GPI's ability to raise additional capital in the nancial markets is strongly inuenced by GP] management's ability to operate their organization's assets efciently and effectively. This implies the need to monitor GPI's ratios. asset management or efficiency liquidity 1am 1. Ratio analysis - Who am I? A3 A3 E A Financial Ratio Analysis of Global Products Inc. Who Does It and Why Do They Care? A variety of interested partiesincluding existing and prospective creditors (such as lenders and suppliers), employees and managers, shareholders, regulators, security analysts, and competitorsconduct the analysis of a business's financial condition and performance. All parties tend to be interested, to some extent, in the same aspects of company performance, but their particular emphasis on a specic facet of the business's condition or performance may vary. The following parties are either currently afliated with Global Products Inc. (GPI) or are considering becoming so. Based on the following description, (1} answer the question \"Who Am I?\" and (2} identify the class of financial ratios that they might be interested in. I work for another organization that is concerned with its own protability and risk exposures. This means that my ratio analysis of GPI should focus on the following: 1. GPI's ratios are important because they provide insights into its capacity to repay its loans using readily available cash in accordance with the terms of our lending agreements. 2. However, because GPI's capacity to meet this obligation is also a function of (a) its ability to generate earnings and (b) its ability to raise funds in the nancial markets, then I must also pay close attention to its ratios, respectively. 3. GPI's ability to raise additional capital in the nancial markets is strongly inuenced by GP] management's ability to operate their organization's assets efciently and effectively. This implies the need to monitor GPI's ratios. Who Am I? 1am an existing industry regulator an existing bank lender or creditor an existing supplier an existing shareholder