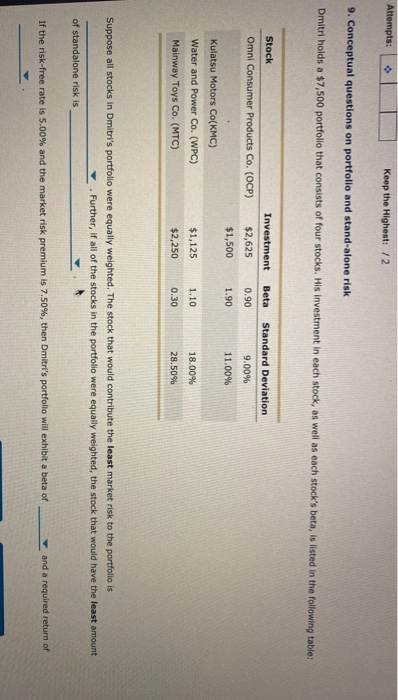

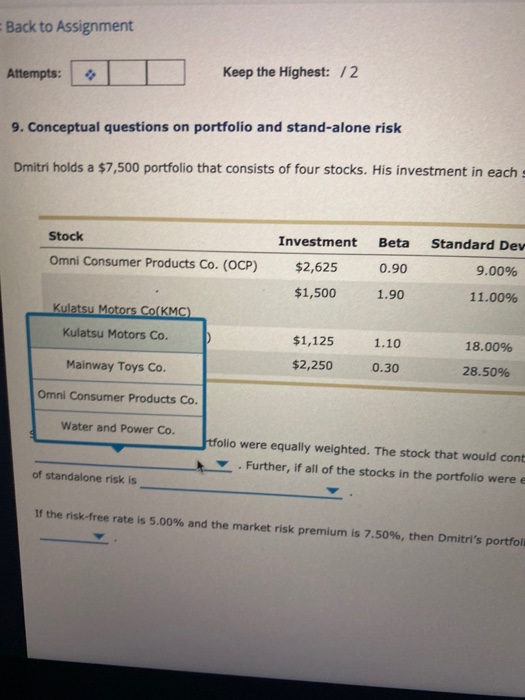

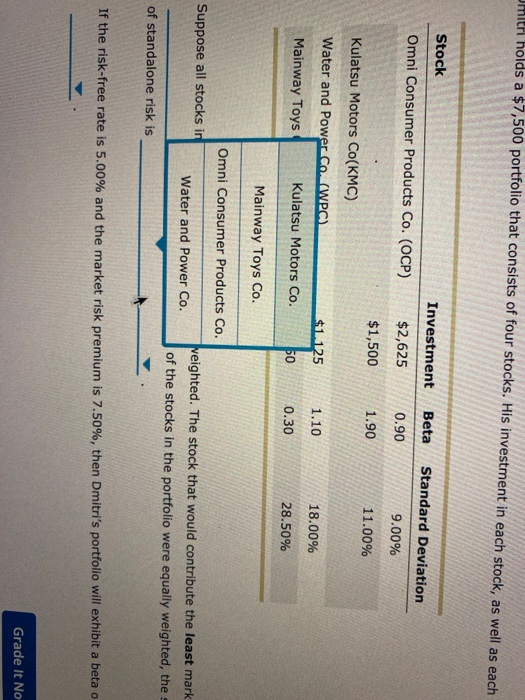

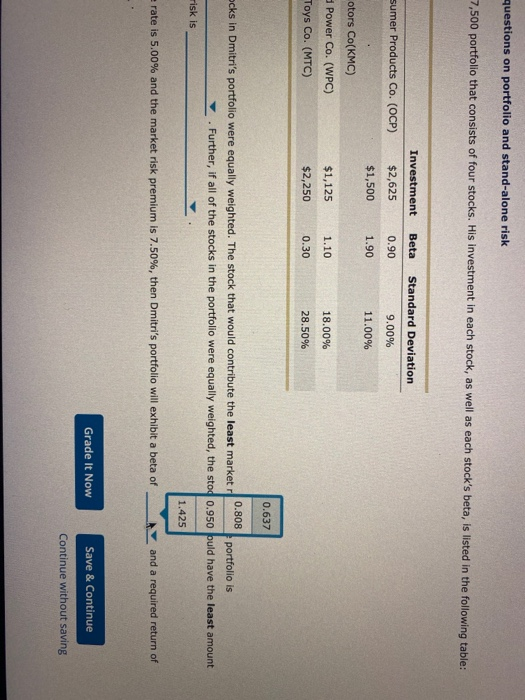

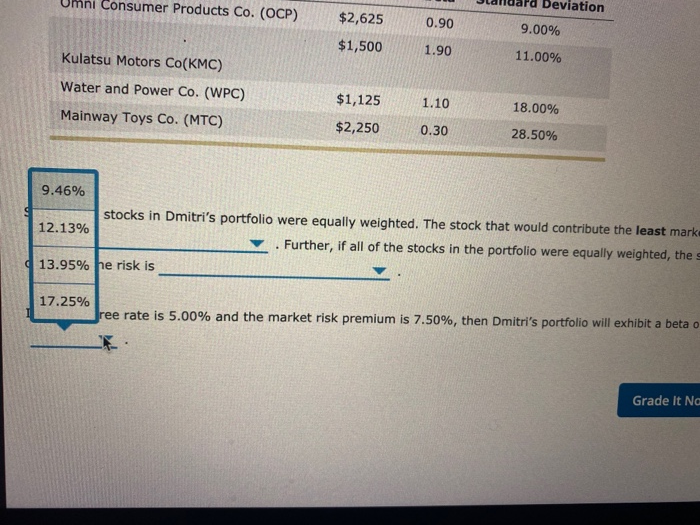

Attempts: Keep the Highest: 12 9. Conceptual questions on portfolio and stand-alone risk Dmitri holds a $7,500 portfolio that consists of four stocks. His investment in each stock, as well as each stock's beta, is listed in the following table: Investment Beta Stock Omni Consumer Products Co. (OCP) Standard Deviation $2,625 0.90 9.00% $1,500 1.90 11.00% Kulatsu Motors Co(KMC) Water and Power Co. (WPC) Mainway Toys Co. (MTC) $1,125 1.10 18.00% $2,250 0.30 28.50% Suppose all stocks in Dmitri's portfolio were equally weighted. The stock that would contribute the least market risk to the portfolio is Further, if all of the stocks in the portfolio were equally weighted, the stock that would have the least amount of standalone risk is If the risk-free rate is 5.00% and the market risk premium is 7.50%, then Dmitri's portfolio will exhibit a beta of and a required return of Back to Assignment Attempts: Keep the Highest: /2 9. Conceptual questions on portfolio and stand-alone risk Dmitri holds a $7,500 portfolio that consists of four stocks. His investment in each Stock Investment Beta Standard Dev Omni Consumer Products Co. (OCP) $2,625 0.90 9.00% $1,500 1.90 11.00% Kulatsu Motors Co(KMC) Kulatsu Motors Co. 1.10 18.00% $1,125 $2,250 Mainway Toys Co. 0.30 28.50% Omni Consumer Products Co. Water and Power Co. tfolio were equally weighted. The stock that would cont Further, if all of the stocks in the portfolio were e of standalone risk is If the risk-free rate is 5.00% and the market risk premium is 7.50%, then Dmitri's portfoli Jmler holds a $7,500 portfolio that consists of four stocks. His investment in each stock, as well as each Stock Investment Beta Standard Deviation Omni Consumer Products Co. (OCP) 0.90 9.00% $2,625 $1,500 1.90 11.00% Kulatsu Motors Co(KMC) Water and Power Co. (WPC) $1.125 1.10 18.00% Mainway Toys Kulatsu Motors Co. 50 0.30 28.50% Mainway Toys Co. Suppose all stocks in Omni Consumer Products Co. veighted. The stock that would contribute the least mark Water and Power Co. of the stocks in the portfolio were equally weighted, the of standalone risk is If the risk-free rate is 5.00% and the market risk premium is 7.50%, then Dmitri's portfolio will exhibit a beta o Grade It No questions on portfolio and stand-alone risk 7,500 portfolio that consists of four stocks. His investment in each stock, as well as each stock's beta, is listed in the following table: Investment Beta Standard Deviation sumer Products Co. (OCP) $2,625 0.90 9.00% $1,500 1.90 11.00% otors Co(KMC) Power Co. (WPC) Toys Co. (MTC) $1,125 1.10 18.00% $2,250 0.30 28.50% 0.637 0.808 ocks in Dmitri's portfolio were equally weighted. The stock that would contribute the least r portfolio is Further, if all of the stocks in the portfolio were equally weighted, the stod 0.950 puld have the least amount risk is 1.425 rate is 5.00% and the market risk premium is 7.50%, then Dmitri's portfolio will exhibit a beta of and a required return of Grade It Now Save & Continue Continue without saving ni Consumer Products Co. (OCP) Deviation $2,625 0.90 9.00% $1,500 1.90 11.00% Kulatsu Motors Co(KMC) Water and Power Co. (WPC) Mainway Toys Co. (MTC) $1,125 1.10 18.00% $2,250 0.30 28.50% 9.46% stocks in Dmitri's portfolio were equally weighted. The stock that would contribute the least mark 12.13% Further, if all of the stocks in the portfolio were equally weighted, the 13.95% he risk is 17.25% ree rate is 5.00% and the market risk premium is 7.50%, then Dmitri's portfolio will exhibit a beta o Grade It Na