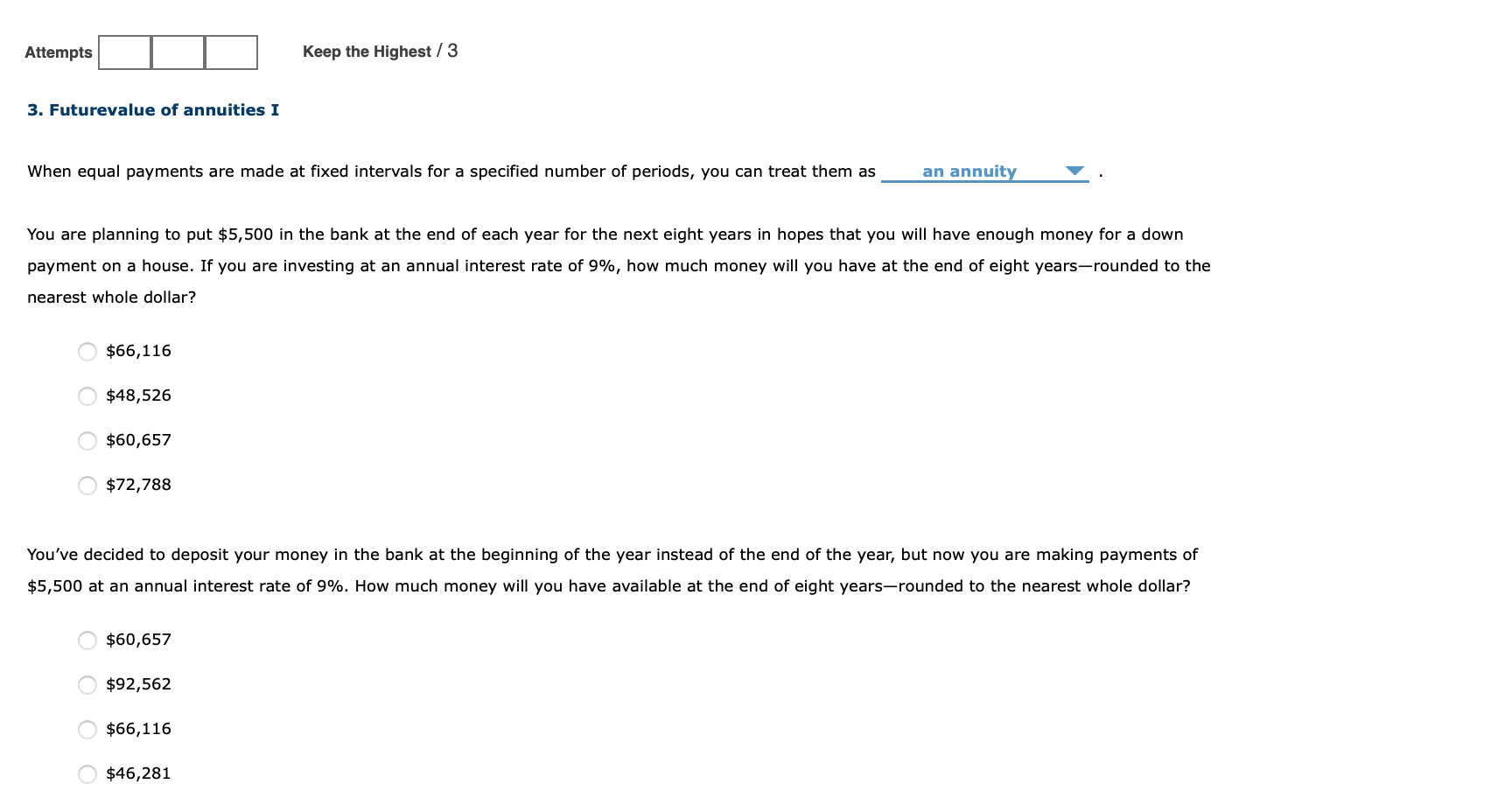

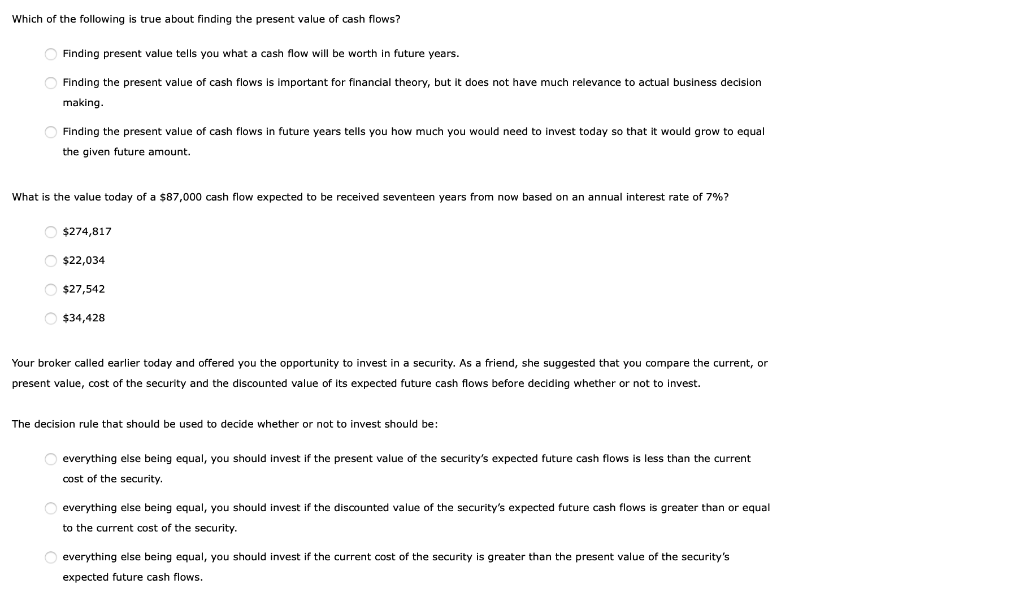

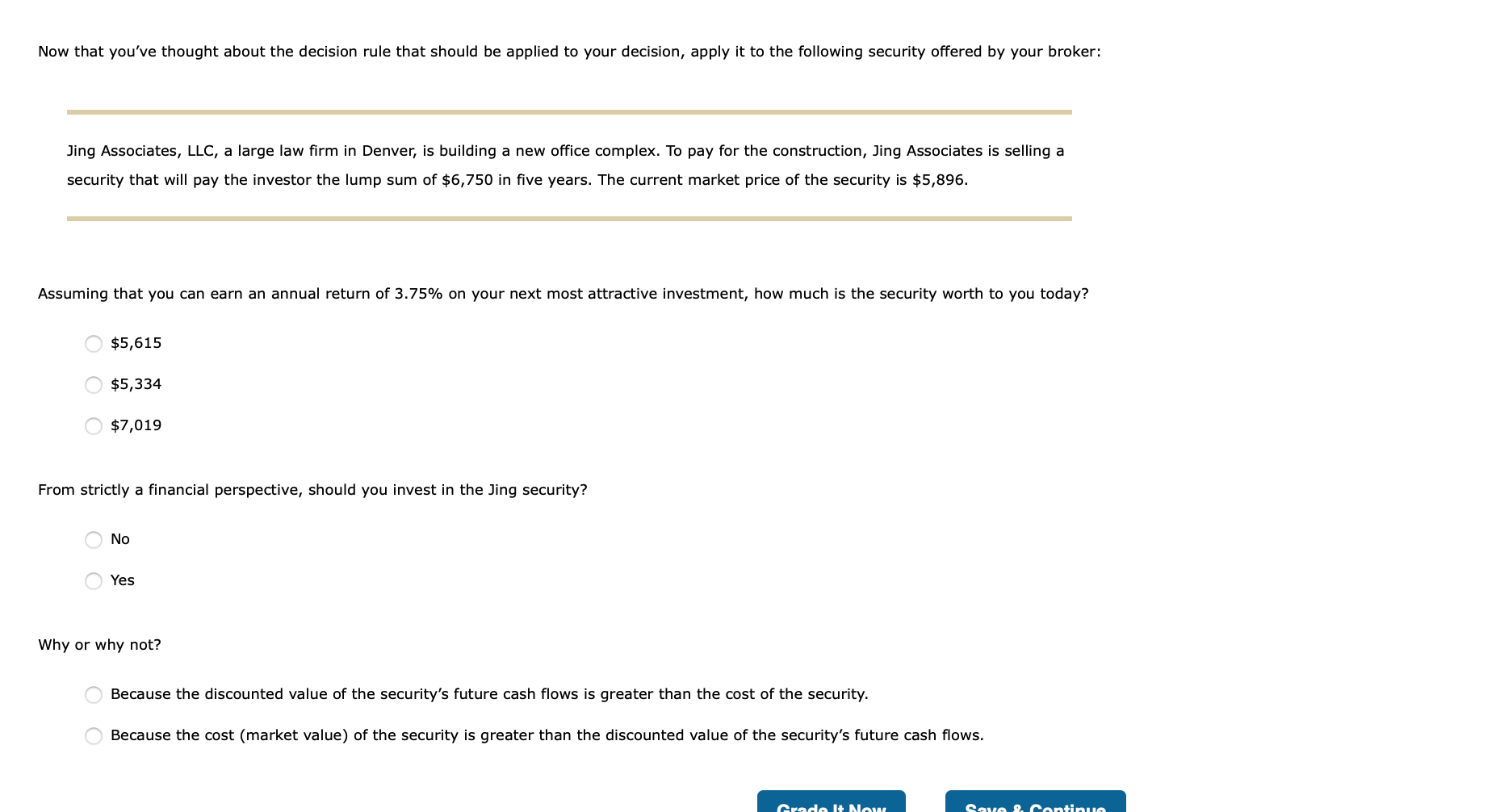

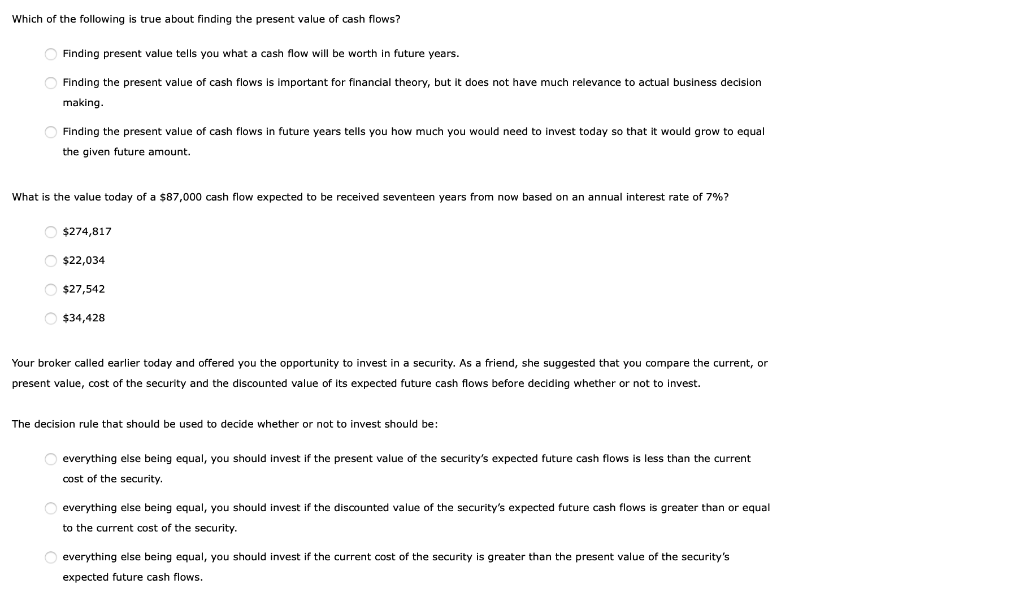

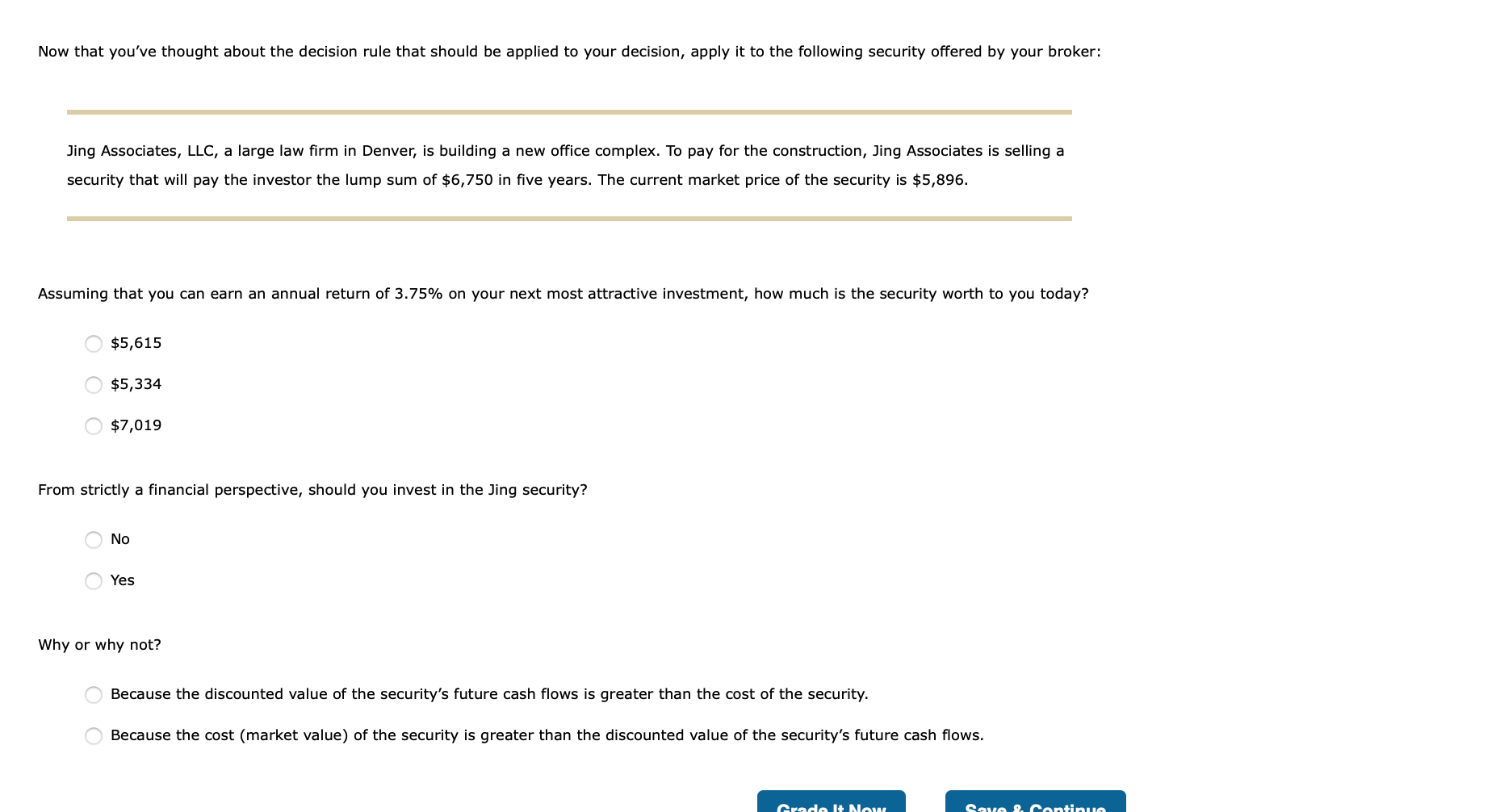

Attempts Keep the Highest / 3 3. Futurevalue of annuities I When equal payments are made at fixed intervals for a specified number of periods, you can treat them as an annuity You are planning to put $5,500 in the bank at the end of each year for the next eight years in hopes that you will have enough money for a down payment on a house. If you are investing at an annual interest rate of 9%, how much money will you have at the end of eight years-rounded to the nearest whole dollar? $66,116 $48,526 $60,657 $72,788 You've decided to deposit your money in the bank at the beginning of the year instead of the end of the year, but now you are making payments of $5,500 at an annual interest rate of 9%. How much money will you have available at the end of eight years-rounded to the nearest whole dollar? $60,657 $92,562 $66,116 $46,281 Which of the following is true about finding the present value of cash flows? Finding present value tells you what a cash flow will be worth in future years. Finding the present value f cash flows is important for financial theory, but it does not have much relevance to actual business decision making. Finding the present value f cash flows in future years tells you how much you would need to invest today so that it would grow to equal the given future amount. What is the value today of a $87,000 cash flow expected to be received seventeen years from now based on an annual interest rate of 7%? O $274,817 $22,034 O $27,542 O$34,428 Your broker called earlier today and offered you the opportunity to invest in a security. As a friend, she suggested that you compare the current, or present value, cost of the security and the discounted value of its expected future cash flows before deciding whether or not to invest. The decision rule that should be used to decide whether or not to invest should be: O everything else being equal, you should invest if the present value of the security's expected future cash flows is less than the current cost of the security. O everything else being equal, you should invest if the discounted value of the security's expected future cash flows greater than or equal to the current cost of the security. everything else being equal, you should invest if the current cost of the security is greater than the present value of the security's expected future cash flows. Now that you've thought about the decision rule that should be applied to your decision, apply it to the following security offered by your broker: Jing Associates, LLC, a large law firm in Denver, is building a new office complex. To pay for the construction, Jing Associates is selling a security that will pay the investor the lump sum of $6,750 in five years. The current market price of the security is $5,896. Assuming that you can earn an annual return of 3.75% on your next most attractive investment, how much is the security worth to you today? $5,615 $5,334 $7,019 From strictly a financial perspective, should you invest in the Jing security? No Yes Why or why not? Because the discounted value of the security's future cash flows is greater than the cost of the security. Because the cost (market value) of the security is greater than the discounted value of the security's future cash flows. Grade It Now Save & Continue