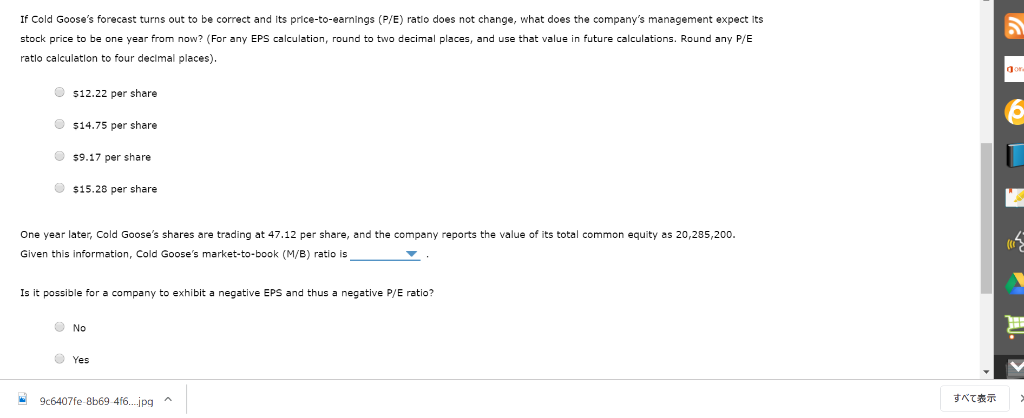

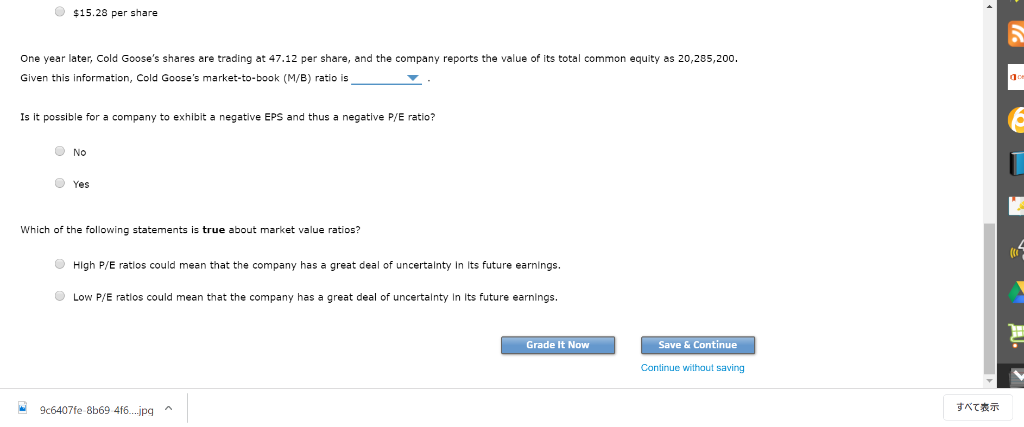

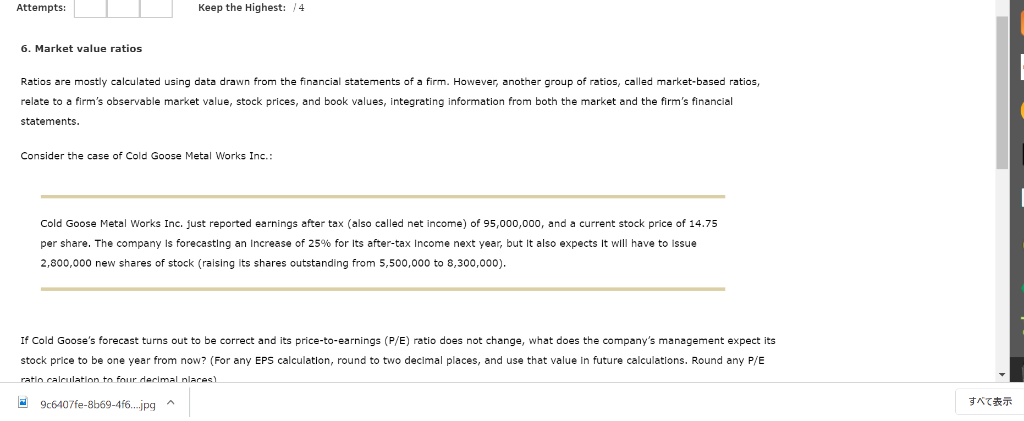

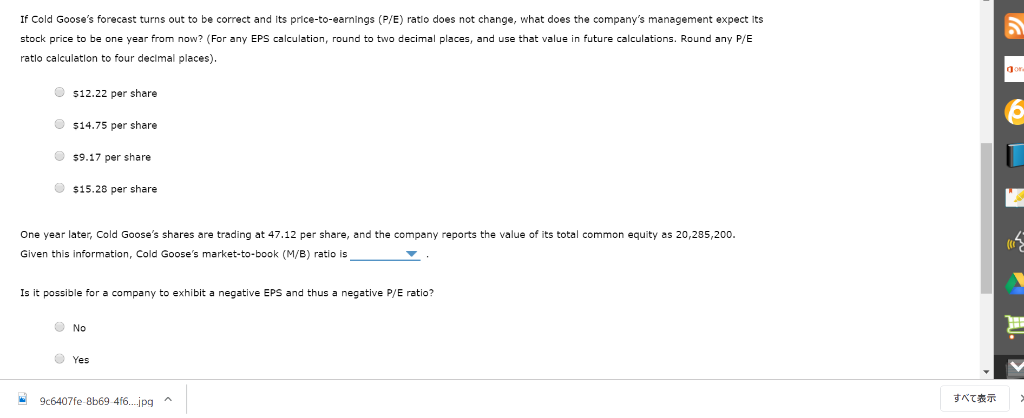

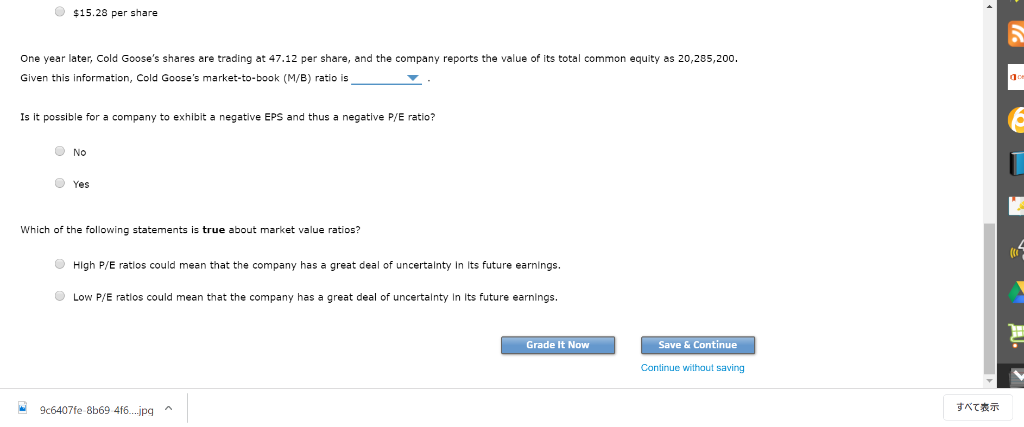

Attempts: Keep the Highest: 4 6. Market value ratios Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market-based ratios, a firm's observable market value, stock prices, and book values, integrating information from both the market and the firm's financial relate to statements. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. fust reported earnings after tax (also called net income) of 95,000,000, and a current stock price of 14.75 per share. The company Is forecasting an Increase of 25% for Its after-tax Income next year, but it also expects It will have to issue 2,800,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,300,000) If Cold Goose's forecast turns out o be correct and its price-to-earnings (P/E) ratio does not change, what does the company's management expect its be one year from now? (For any EPS calculation, round to two decimal places, and use that value in future calculations. Round any P/E stock price ratio calculation to four decimal nlaces) 9c6407fe-8b69-4f6. jpg If Cold Goose's forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does the company's management expect its stock price to be one year from now? (For any EPS calculation, round to two decimal places, and use that value in future calculations. Round any P/E ratlo calculatlon to four decimal places). gor S12.22 per share s14.75 per share $9.17 per share $15.28 per share One year later, Cold Goose's shares are trading at 47.12 per share, and the company reports the value of its total common equity as 20,285,200 Given this information, Cold Goose's market-to-book (M/B) ratio is possible for a company Ts o exhibit a negative EPS and thus a negative P/E ratio? No Yes 9c6407fe 8b69-416.ipa $15.28 per share One year later, Cold Goose's shares are trading at 47.12 per share, and the company reports the value of its total common equity as 20,285,200 Given this information, Cold Goose's market-to-book (M/B) ratio is possible for a company to exhibit Is negative EPS and thus a negative P/E ratio? No Yes Which of the following statements true about market value ratios? ( f uncertalnty In Its future earnings. High P/E ratlos could mean that the company has a great deal Low P/E ratios could mean that the company has a great deal of uncertalnty In Its future earnings. Save & Continue Grade It Now Continue without saving 9c6407fe 8b69 416 ing A