Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attempts Keep the Highest / 43 6. Problem 20-06 (Warrant-Convertible decisions) eBook Warrant/Convertible decisions The Bahbat Carpet Company has grown rapidly during the past

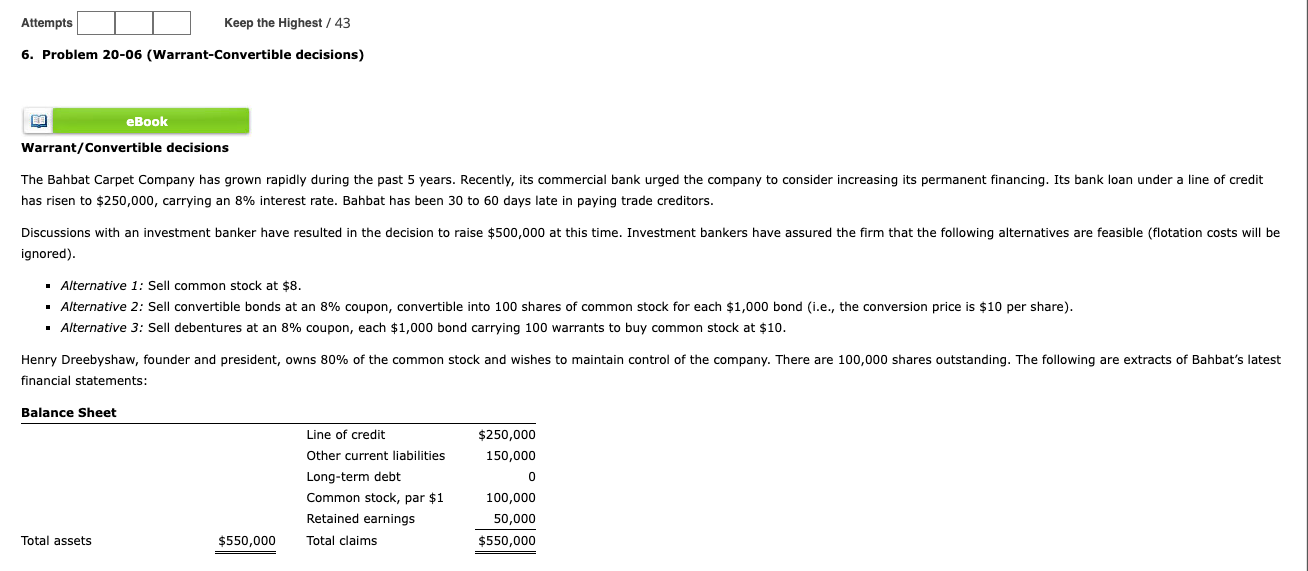

Attempts Keep the Highest / 43 6. Problem 20-06 (Warrant-Convertible decisions) eBook Warrant/Convertible decisions The Bahbat Carpet Company has grown rapidly during the past 5 years. Recently, its commercial bank urged the company to consider increasing its permanent financing. Its bank loan under a line of credit has risen to $250,000, carrying an 8% interest rate. Bahbat has been 30 to 60 days late in paying trade creditors. Discussions with an investment banker have resulted in the decision to raise $500,000 at this time. Investment bankers have assured the firm that the following alternatives are feasible (flotation costs will be ignored). Alternative 1: Sell common stock at $8. Alternative 2: Sell convertible bonds at an 8% coupon, convertible into 100 shares of common stock for each $1,000 bond (i.e., the conversion price is $10 per share). Alternative 3: Sell debentures at an 8% coupon, each $1,000 bond carrying 100 warrants to buy common stock at $10. Henry Dreebyshaw, founder and president, owns 80% of the common stock and wishes to maintain control of the company. There are 100,000 shares outstanding. The following are extracts of Bahbat's latest financial statements: Balance Sheet Line of credit $250,000 Other current liabilities Long-term debt 150,000 0 Common stock, par $1 100,000 Retained earnings 50,000 Total assets $550,000 Total claims $550,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started